A loan deferment program and extensive central bank support have supported earnings at the United Arab Emirates' top banks, although net interest margins slid and impairments will likely increase as repayment holidays end.

In October, the IMF revised its UAE economic forecast, predicting real GDP would contract 6.6% in 2020, versus its earlier estimate of a 3.5% fall. Business conditions have also deteriorated despite the easing of lockdown restrictions, with IHS Markit's UAE purchase managers index slipping to 49.5 in October from 51.0 in September.

These troubles were reflected in banks' third-quarter earnings. First Abu Dhabi Bank PJSC, or FAB, the UAE's biggest bank and the Middle East and Africa's second-largest bank by assets, reported a 19.3% year-over-year drop in quarterly profit to 2.51 billion dirhams, according to S&P Global Market Intelligence data.

Third-quarter profit at Emirates NBD Bank PJSC, or ENBD, and Abu Dhabi Commercial Bank PJSC, or ADCB, the UAE's second- and third-largest banks, fell 68.8% and 3.5%, respectively. ENBD's prior-year earnings were boosted by a one-off gain of 2.3 billion dirhams.

Quarterly operating income at the UAE's 10 largest banks totaled 19.9 billion dirhams down from 22.0 billion dirhams in the prior-year period, according to a report by consultants Alvarez & Marsal.

"Results were reasonably in line with market expectations," said Asad Ahmed, Alvarez & Marsal's managing director and head of Middle East financial services.

Government boost

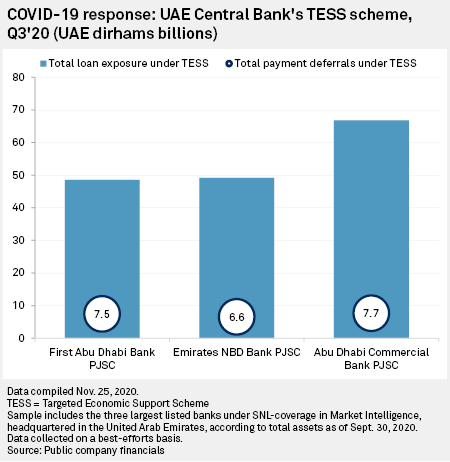

Yet profit declines would have been more substantial were it not for the Central Bank of the United Arab Emirates' 256 billion dirham economic stimulus program. Under the central bank's Targeted Economic Support Scheme, or TESS, banks were instructed to allow borrowers to defer repayment of both interest and the principal due on loans.

Under TESS, banks could obtain interest-free funds from the central bank. As of Sept. 30, Emirates NBD was using 6 billion dirhams of this cost-free funding. The regulator also reduced banks' minimum cash reserve ratio by half to 7% and eased other regulations.

"The main effect is that there's been continuing liquidity in the system, which is extremely important to come out of a crisis like this," said Ahmed. "TESS has been extremely helpful to the UAE economy."

In 2020 ENBD customers deferred 6.6 billion dirhams in loan payments up to Sept. 30. Of this, 5.2 billion dirhams was in corporate banking. In all, the deferrals are for loans totaling 49.1 billion dirhams.

On an analyst call, ENBD CEO Shayne Nelson revealed his bank had allowed about 100,000 customers to defer repayments.

"So far there has been a modest deterioration in credit quality, but it will take several more quarters before the true credit picture becomes evident," said Nelson.

ADCB delayed 7.7 billion dirhams of loan repayments on loans of 66.8 billion dirhams. FAB deferred 7.5 billion of loan repayments on loans totaling 48.6 billion dirhams, or 12% of its total loan book.

Nearly 40% of FAB's lending is to state-linked entities, with a further 6% short-term trading loans.

"[Our] loans and advances are to very safe assets and I think that will stand [us] in good stead versus our competitors in terms of cost of risk," FAB CEO James Burdett said during an analyst call, predicting government-backed companies would lead the UAE's economic rebound and so his bank would disproportionately benefit. Of ENBD's loans and receivables, 39% is to Dubai government entities.

Mixed credit quality

Yet impairments still soared. ENBD's nine-month net impairment losses more than doubled to 6.1 billion dirhams, while 12% of its gross loans are now in stage 2 or 3. Since the end of 2019, the bank's expected credit losses have increased 4.8 billion dirhams to 34 billion dirhams.

FAB's nine-month impairments rose 71% to 2.3 billion dirhams. ADCB's more than doubled to 3.1 billion dirhams.

"Banks such as Emirates NBD and ADCB have taken significantly larger provisions as a percentage of their operating income than FAB," said Ahmed. That does not necessarily mean FAB has taken insufficient portfolios, he said, but is instead a reflection of the banks' differing loan portfolios. Banks' varying profit performance this year is partly due to their provisioning levels, Ahmed said.

"Credit quality and provisioning trends were mixed," said Malik. "Some smaller banks more focused to the SME sector reported higher provisions, but FAB and ENBD's provisioning levels were decent and nothing too alarming because they're more orientated to lending to government entities and large corporates."

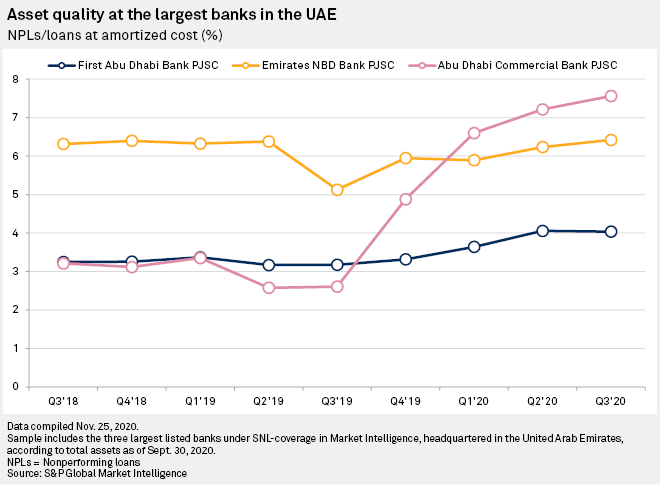

Nonperforming loan ratios are also increasing. ENBD's NPL ratio in the third quarter was 6.42%, up from 5.13% a year earlier, according to S&P Global Market Intelligence data. ADCB's NPL ratio increased to 7.56% from 2.61% year over year, while FAB posted a third-quarter NPL ratio of 4.04% from 3.18%.

"Some individuals and businesses who were facing cash-flow problems will be able to honor their loan obligations, which should mean NPLs and provisioning won't be as high as it would have been without these [deferment] measures," said Malik.

"I'd expect NPLs and provisions to be high over the next two to three quarters as these deferral programs come to an end. As customers return to the normal payment cycle, we'll get a better picture."

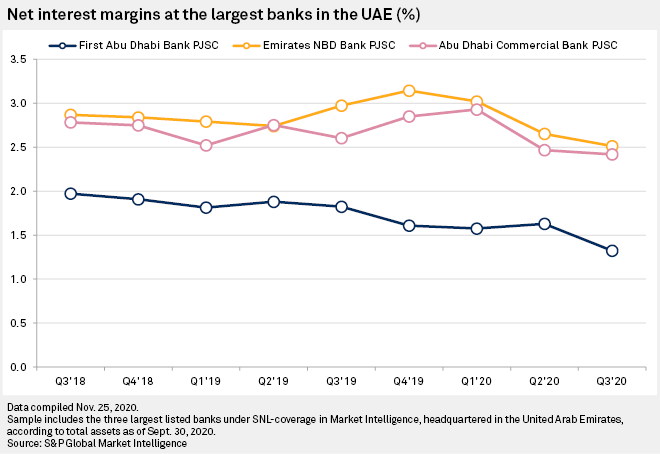

ENBD's third-quarter net interest margin fell as its declining loan yield outweighed falling deposit costs. Both FAB and ADCB posted year-over-year and quarter-over-quarter NIM drops.

"We think NIM has bottomed out," said FAB's Burdett. "We expect the cost of customer deposits to continue to fall."

Analysts remain more cautious. "Net interest margins will continue to be under pressure," said Ahmed.

As of Dec. 7, US$1 was equivalent to 3.67 United Arab Emirates dirhams.