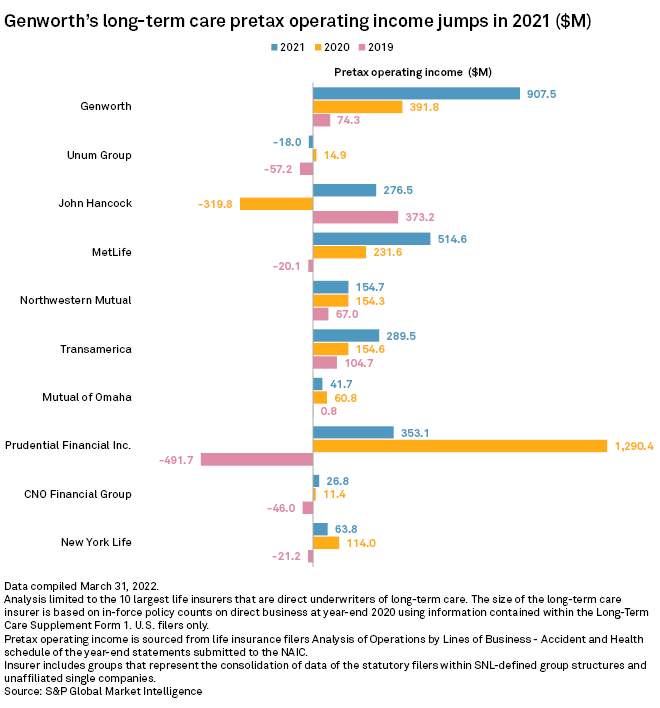

Pretax operating income soared in 2021 for a number of U.S. insurers that control the largest long-term care blocks in the country, according to a review of regulatory statements.

Genworth, MetLife see big gains

Pretax income within Genworth Financial Inc.'s long-term care, or LTC, business, including both group and individual policies, increased to $907.5 million in 2021 from $391.8 million in the prior year.

MetLife Inc.'s pretax income for its LTC business rose to $514.6 million in 2021, an increase of $283.0 million from its 2020 income total. That jump could mostly be attributed to higher net investment income. MetLife's overall net investment income climbed to $1.18 billion in 2021 from $880.2 million in the prior year.

Prudential Financial Inc. was third with pretax income in its LTC business, coming in at $353.1 million for the year, followed by Transamerica Life Insurance Co. and other U.S.-based affiliates of Aegon NV.

Within the group of insurers with the largest blocks of direct LTC business, Unum Group was the lone company to record a pretax loss in 2021. Unum lost $18.0 million in its LTC segment in 2021, compared to a pretax profit of $14.9 million during the prior year.

Net benefits paid decreased for many insurers

Seven out of the 10 largest direct LTC underwriters in the U.S. reported paying fewer benefits in 2021 than they did in 2020. The largest overall decline in LTC benefits paid was reported by Transamerica, which paid out $454.3 million in 2021, down from $634.0 million in 2020.

Across the industry, Genworth continues to pay the most LTC benefits on an annual basis. It recorded payments of $2.34 billion in 2021, which was down about $91 million from the prior year.

Affiliates of The Northwestern Mutual Life Insurance Co., MetLife and Unum all paid out more in LTC benefits in 2021 than they did a year earlier.