With the threat of a particularly active hurricane season on the horizon, the property and casualty insurance industry is preparing to alter its claims handling process to adapt to the conditions imposed by the global pandemic.

With the threat of a particularly active hurricane season on the horizon, the property and casualty insurance industry is preparing to alter its claims handling process to adapt to the conditions imposed by the global pandemic.

For many insurers, the focus will be on dealing with claims remotely, which they hope will alleviate policyholder discomfort around having guests in their homes and address the lack of property access that independent adjusters may face due to travel restrictions.

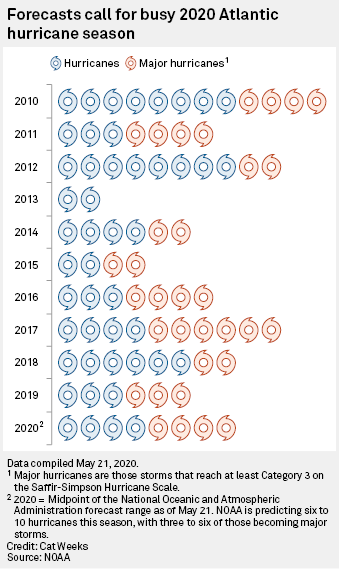

To add to the complications created by the pandemic, the National Oceanic and Atmospheric Administration is projecting above-average activity in the tropics, with an expected six to 10 hurricanes forming this season, and three to six of them becoming major, or Category 3 and above.

|

In Citizens Property Insurance Corp.'s 2020 catastrophe preparation release, the Florida-based company said it will allow its independent adjusters to work remotely. It said this would provide "additional options for resources" it has not had in the past, and will keep the adjusters engaged and ultimately reduce the typical amount of turnover.

"[The] solution also provides a benefit of not having to wait until the event has exited Florida to start the deployment of the resources and will improve the time to start handling claims," the release said.

Michael Peltier, a spokesperson for Citizens, said employees and management have shifted "smoothly" to remote working so far and have found that it has improved the work-life balance in many people's lives.

"I know we're going to take the lessons that we've learned from COVID, and if they're working for us then they can be a part of the culture going forward," Peltier said.

Chubb Ltd. is actively building out what it's calling a "digital adjusting team," said Tim Barziza, the company's head of property claims in North America.

"What's new with COVID is finding creative ways to take virtual concepts and apply them to even larger losses," Barziza said. He added that most of the claims filed since March, at least 1,000 to date, have been handled virtually.

Chubb also intends to use virtual methods even more in the future, and is looking to further enhance technology capabilities, such as tools that help give a better picture of the dimensions of a room from afar, Barziza said. Remote technology saves time and also adds capacity, which can help to address issues faced in 2017, when Hurricane Irma hit shortly after Hurricane Harvey and qualified adjusters were spread too thin, he added.

"You can't virtually adjust necessarily every claim, but that doesn't mean that you can't at least start down that process with a good amount of your claims," Barziza said. "The more you can do virtually, the better it is for the client."

Although much can be accomplished remotely, there will still be some claims that will have to be dealt with in person. Peltier mentioned that non-weather related water losses tend to involve claims that are more nuanced and technical, likely requiring someone to physically be there to evaluate it.

"Technology has its limits," Peltier said.

When Allstate Corp. employees have to be physically present to assess a claim, they are wearing masks and disposable gloves and maintaining social distancing, said Jerry Samson, regional claims leader for the insurer's national catastrophe team.

Samson said the company has a "long history" of using virtual technology, from drones to a "virtual assist application" that allows customers, adjusters and contractors to collaborate remotely. Allstate has already used these tools when tornadoes struck policyholder homes as the pandemic was already underway.

Anna Bryant, a spokesperson for State Farm Mutual Automobile Insurance Co., said in an email that many of the company's property claims may be settled with the help of virtual tools like video chat and photos, as well as a fleet of drones to assist with inspections on homes and roofs.

Bryant said State Farm is offering more claims handling options during this hurricane season but said it would be difficult to predict the percentage of claims that will be handled virtually or in-person this year since each hurricane claim is different.

"When possible, we'll leverage technology and offer virtual claim handling as appropriate," Bryant said.