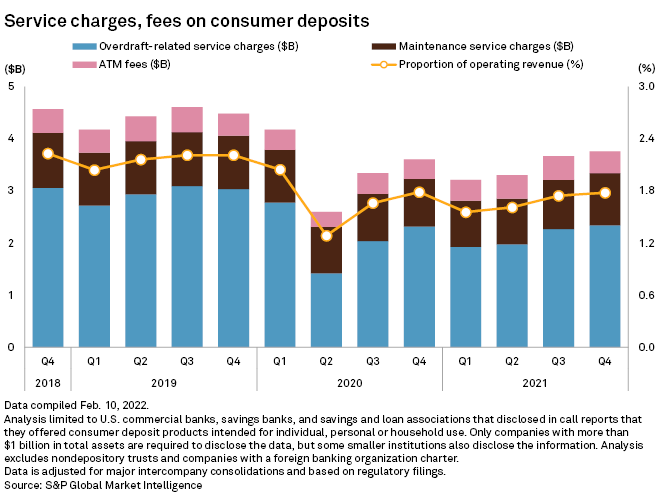

U.S. banks' total overdraft revenue steadily rose each quarter in 2021 even as banks began to increasingly move away from the practice.

Overdraft-related service charges stood at $2.34 billion for the industry during the last quarter of 2021, up from $2.27 billion in the linked quarter and $2.32 billion in the year-ago period, according to S&P Global Market Intelligence data. This rise occurred even as U.S. banks began to reduce and even eliminate overdraft fees in 2021. While U.S. banks' overdraft fees rose throughout the entire year, fourth-quarter 2021 earnings conference calls suggested the industry may buck that trend in 2022.

Banks talk overdraft

U.S. banks fourth-quarter 2021 earnings conference calls were chock-full of chatter about the culminating regulatory and competitive pressure surrounding overdraft. A number of the largest U.S. banks announced plans in January and February to eliminate or reduce nonsufficient funds and overdraft fees, including Wells Fargo & Co., Bank of America Corp., Truist Financial Corp., U.S. Bancorp, Regions Financial Corp. and M&T Bank Corp.

"We believe these changes are necessary to remain competitive in the current marketplace," said First Citizens BancShares Inc. Chairman and CEO Frank Holding Jr. on the company's fourth-quarter 2021 earnings call after announcing the company will nix nonsufficient funds fees and reduce its overdraft fee on consumer accounts to $10 from $36.

But staying competitive on overdraft fee practices comes with a price for many U.S. banks. First Citizens estimates the changes will reduce revenue by $35 million to $40 million annually.

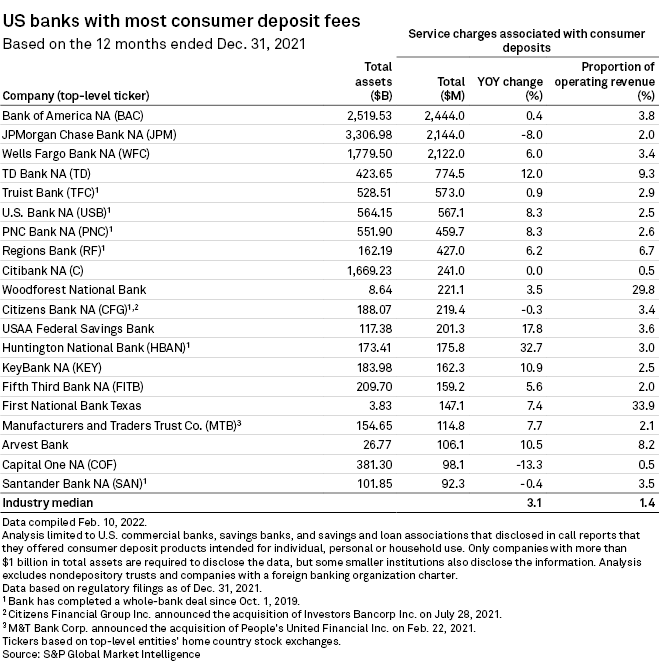

For the 12 months ended Dec. 31, 2021, Bank of America reported $2.44 billion in consumer deposit fees, the most of any U.S. bank. But the company expects its recent move to eliminate nonsufficient funds fees and reduce its overdraft fee charge to $10 from $35 to shrink overdraft fee income by 75%, Chairman, CEO and President Brian Moynihan said on the company's fourth-quarter 2021 earnings conference call.

Overdraft reliance

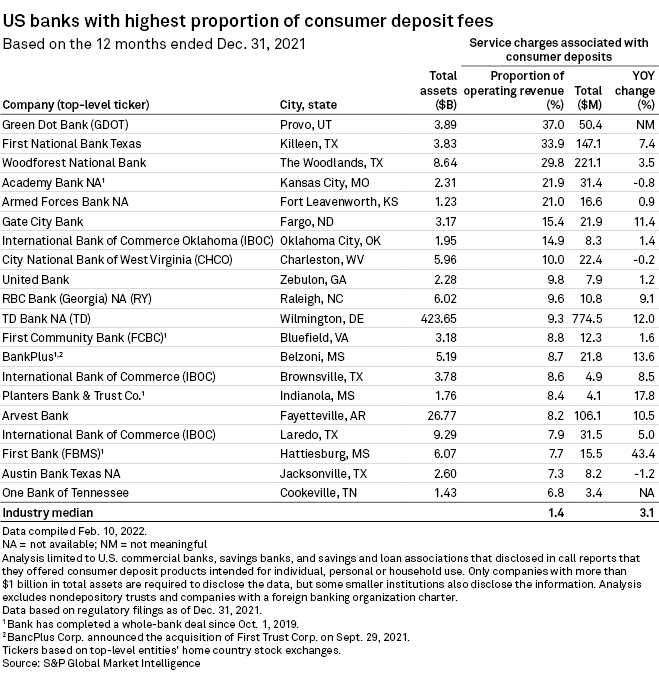

Service charges and fees on consumer deposits made up 1.78% of U.S. banks' operating revenue in the fourth quarter of 2021, but some rely on the fee income more than others.

Service charges on consumer accounts made up more than 10% of eight U.S. banks' operating revenue in the 12 months ended Dec. 31, 2021. Green Dot Corp., First National Bank Texas and Woodforest National Bank topped the list with 37.0%, 33.9% and 29.8%, respectively, compared to the industry median of 1.4%.

While many community banks have been reluctant to give up overdraft fee income, First National Bank Texas announced that it will give consumers the opportunity to refund overdraft fees from the previous banking day.

"Street Talk" is a podcast hosted by S&P Global Market Intelligence. In this episode, Lauren Seay explains why banks are reducing and eliminating overdraft and nonsufficient fund fees and discusses how the moves will impact earnings, the competitive landscape and even prompt more M&A activity.

Listen on SoundCloud