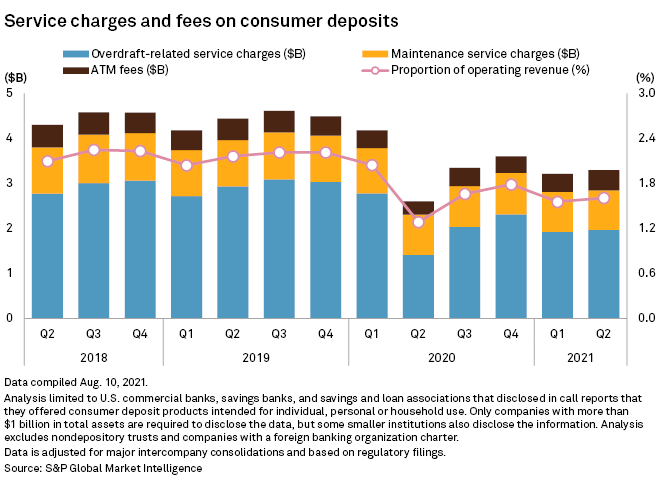

Overdraft fees are rebounding, but remain well below 2019 levels as competitive and political pressures have many banks offering low-fee accounts.

Banks booked $1.97 billion of overdraft fees in the second quarter, a 39.5% increase from the year-ago period. But fees are still 32.8% below the amount recorded in the 2019 second quarter.

Overdraft fees were cut in half over the first six months of 2020 as the pandemic forced business closures that curtailed consumer spending. While lockdowns have eased and economic growth has rebounded this year, banks are facing political and competitive pressure to move away from overdraft. Several banks have recently announced no-overdraft accounts or plans to unroll such accounts in the near term.

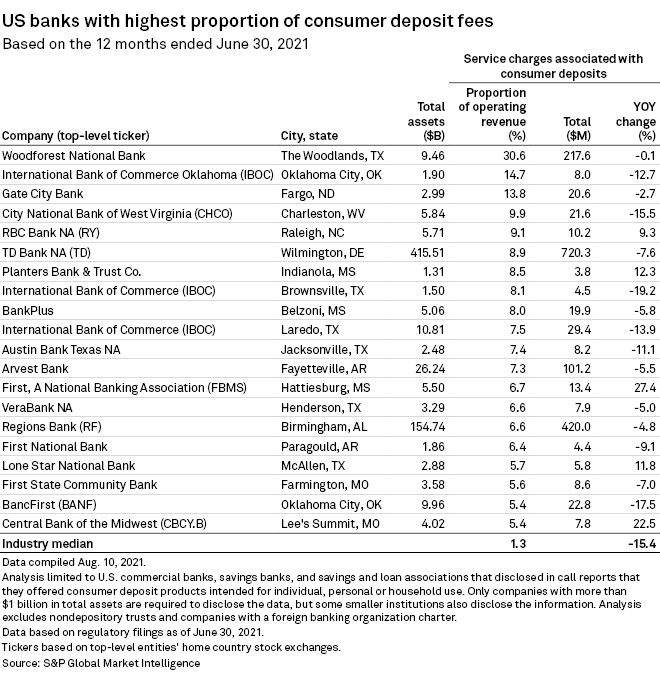

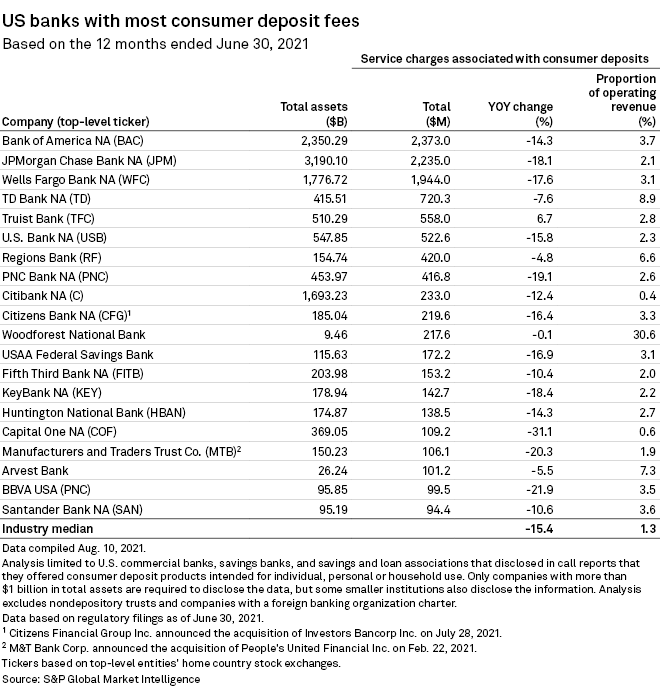

Regions Bank and TD Bank NA have been the banks most reliant on deposit service charges among companies with at least $100 billion in assets. Over the last 12 months through the second quarter, service charges represented 8.9% of TD Bank's operating revenue and 6.6% of Regions Bank's. The industrywide median is 1.3%.

Both banks are rolling out new products that will limit overdraft charges, and both companies project a decline in the revenue item.

TD Bank on June 24 announced a new deposit account, TD Essential Banking, a low-cost account that will not allow overdrafts and carries no minimum balance.

"Given the natural decline in fee revenue due to COVID-19 and the bank's accommodation to customers, we expect to see further fee revenue impact as we re-evaluate how to best serve our customers," Stephanie Cristino, a spokesperson for the bank, wrote in an email to S&P Global Market Intelligence.

Executives at Regions Financial Corp., the parent company of Regions Bank, also expect overdraft revenue to decline in the coming quarters. Management said they expect service charges to remain 10% to 15% below 2019 levels. At an Aug. 18 investor meeting, the company said it planned to launch a no-overdraft checking account in the third quarter.

Both TD Bank's and Regions' new checking accounts are certified as "Bank On" products, a set of standards for low-cost accounts to serve the underbanked developed by nonprofit Cities for Financial Empowerment Fund and endorsed by the American Bankers Association.

Banks are facing competitive pressure to offer checking accounts with limited or zero overdraft fees. Chime Financial Inc., a neobank, has amassed a significant retail client base with a slick mobile offering and consumer-friendly features such as no overdraft fees and early access to paychecks. The fintech recently raised $750 million at a $25 billion valuation.

"We'll continue to see the move in that trend to having more bank accounts that exclude overdraft charges, especially to the extent that it can be an offensive weapon," Jeff Harte, an analyst with Piper Sandler, said in an interview. At the same time, Harte said the product is unlikely to disappear completely as some consumers prefer to have overdraft protection.

Fees have also brought the banks unwelcome regulatory attention. TD Bank paid a $25 million civil penalty and offered $97 million in restitution as part of an August 2020 settlement with the Consumer Financial Protection Bureau. Regions Financial paid a $7.5 million penalty and returned more than $47 million to consumers in a 2015 settlement with the CFPB. In November 2020, Regions disclosed in a quarterly filing that it was cooperating with a CFPB investigation into the bank's overdraft practices, a notice that was still in the most recent quarterly report.

Overdraft practices came up at a congressional hearing earlier this year, and with Democrats in control of the White House and Congress, some policy analysts said they expect additional rulemaking on the practice.

Any regulatory pressure to eliminate overdraft revenue would likely affect some smaller banks the most. Among banks with at least $1 billion in assets, Woodforest National Bank, a $9.46 billion bank from Texas, is the most reliant on deposit account service charges, which constituted 30.6% of the bank's operating revenue over the last 12 months through the second quarter. The only other banks where consumer service charges accounted for more than 10% of operating revenues were Oklahoma City-based International Bank of Commerce Oklahoma and Fargo, N.D.-based Gate City Bank.