Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Dec, 2024

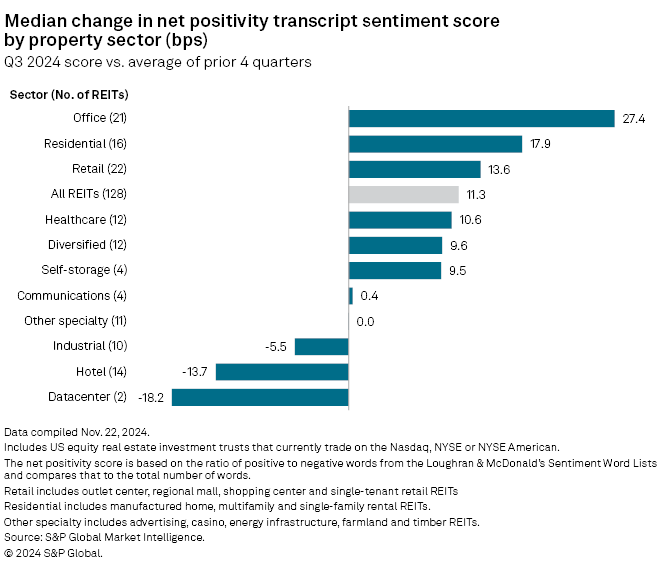

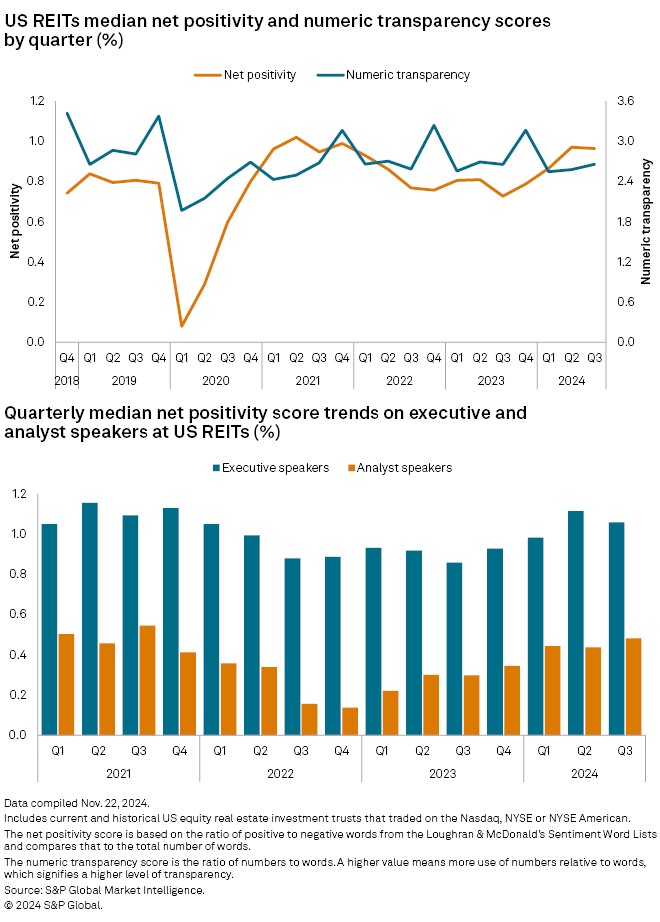

US equity real estate investment trusts conveyed a more upbeat vibe on their third-quarter earnings calls compared to the prior four quarters, according to an S&P Global Market Intelligence analysis of earnings call transcripts.

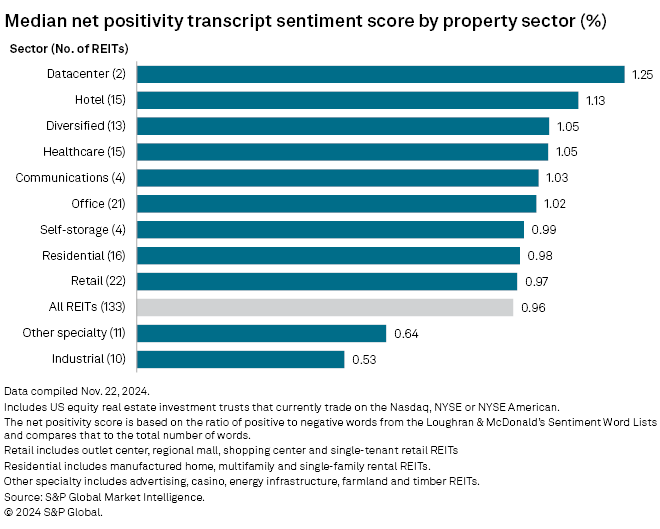

The median net positivity transcript sentiment score for all US REITs was 0.96% for the third quarter. The score represents a median increase of 11 basis points compared to the average score of the previous four quarters.

Among the sectors, the office segment saw the biggest median hike of 27 bps in net positivity transcript sentiment score compared to the prior four-quarter average. Its net positivity score was 1.02%, 6 bps higher than the REIT industry median.

Market Intelligence-calculated transcript sentiment scores use natural language processing to provide a way to look at earnings call transcripts quantitatively. Net positivity scores are based on the ratio of positive to negative words used in the transcript using the Loughran & McDonald's Sentiment Word Lists, compared to the total number of words in the transcript.

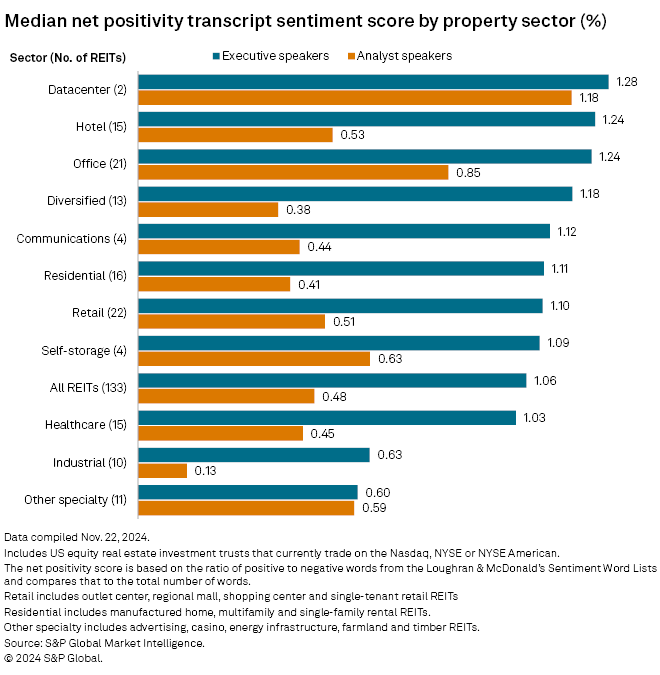

REIT executives speaking on third-quarter earnings calls used a larger ratio of positive to negative words compared to analysts on the calls.

Words spoken by executives at datacenter REITs ranked the highest, with a median net positivity transcript sentiment score of 1.28%. Words from executives at other specialty REITs — consisting of advertising, casino, energy infrastructure, farmland and timber REITs — ranked the lowest, scoring a median of 0.60%.

Looking at the words spoken by analysts on the earnings calls, the datacenter sector also ranked the highest, receiving a median net positivity transcript sentiment score of 1.18%. Words spoken by analysts covering industrial REITs got the lowest median score of 0.13%.

Sector net positivity transcript sentiment scores

Datacenter REITs' third-quarter earnings calls showed the most positivity among the sectors, with a median net positivity transcript sentiment score of 1.25%.

Within the sector, Equinix Inc.'s third-quarter earnings call transcript scored 1.47%, up by 14 bps from the REIT's prior four-quarter average of 1.33%. Digital Realty Trust Inc.'s earnings call transcript scored 1.02%, 50 bps lower than its average score of 1.52% for the previous four quarters.

The hotel segment obtained the second-highest median net positivity transcript sentiment score of 1.13%, followed by diversified REITs with 1.05%.

Among all US REITs, healthcare-focused Ventas Inc. had the highest score on its third-quarter earnings call transcript, at 2.36%, a slip of just 1 bps from its prior four-quarter average of 2.37%.

– Download the Excel file including individual company sentiment scores.

– Set up email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

Industrial REITs' earnings calls, on the other hand, showed the least positivity among the sectors, with a median net positivity transcript sentiment score of 0.53%. The earnings calls of other specialty REITs were a bit more positive, getting a median score of 0.64%.

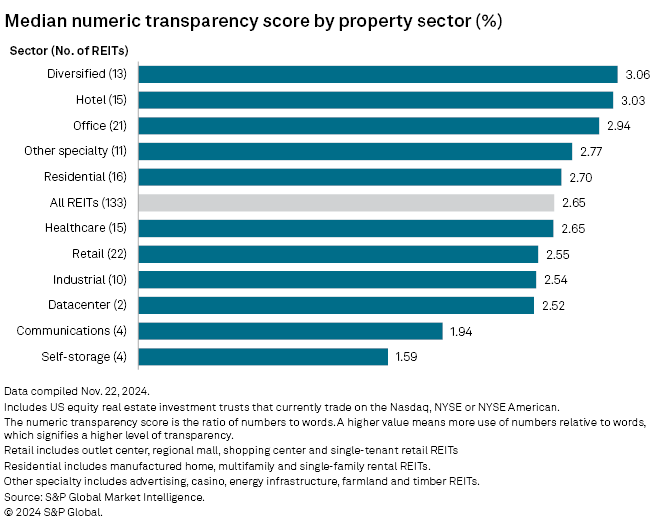

Sector numeric transparency scores

The US REIT industry's third-quarter median numeric transparency score, which measures the ratio of numbers to words, was 2.65%. The score was lower than the industry's median prior four-quarter average of 2.76%.

Diversified REITs used the most numbers relative to words during their third-quarter earnings calls, with a median numeric transparency score of 3.06%.

Within the sector, American Assets Trust Inc.'s recent earnings call transcript obtained the highest numeric transparency score of 4.66%, a hike of 71 bps from its prior four-quarter average of 3.95%.

Hotel REITs showed the highest numeric transparency on their third-quarter earnings call transcripts followed by the office sector, with median scores of 3.03% and 2.94%, respectively.

Multifamily-focused NexPoint Residential Trust Inc., with a score of 6.82% on its earnings call transcript, had the highest numeric transparency among US REITs.

In contrast, the self-storage sector had the lowest median numeric transparency score, at 1.59%. The communications sector ranked a bit higher in terms of numeric transparency, with a median score of 1.94%.