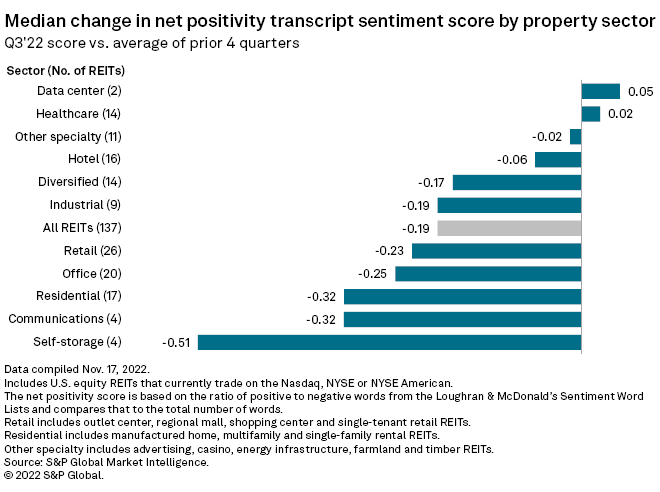

U.S. real estate investment trusts expressed less positivity on their third-quarter earnings calls compared to the prior four-quarter average, according to an S&P Global Market Intelligence analysis of earnings call transcripts.

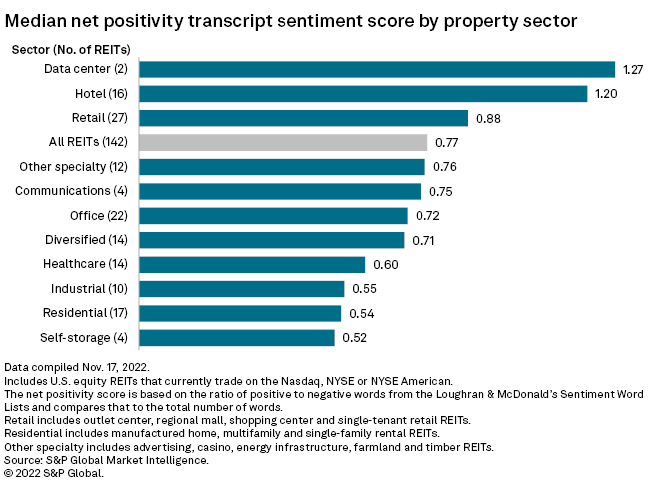

The median net positivity transcript sentiment score for all U.S. REITs was 0.77 for the third quarter, down 0.19 point compared to the average of the prior four quarters.

Market Intelligence-calculated transcript sentiment scores use natural language processing to provide a way to look at earnings call transcripts quantitatively. Net positivity scores are based on the ratio of positive to negative words used in the transcript using the Loughran & McDonald's Sentiment Word Lists, compared to the total number of words in the transcript.

Sector net positivity transcript sentiment scores

Data center REITs expressed the most positivity on their third-quarter earnings calls, with a median net positivity transcript sentiment score of 1.27 — a slight 0.05 point higher than the previous four-quarter average for the sector.

The hotel sector followed, with a median score of 1.20, followed by the retail sector at 0.88.

* Click here to download the Excel file including individual company sentiment scores.

* Click here to set up email alerts for future Data Dispatch articles.

Earnings call transcripts for self-storage REITs were scored the lowest of any property sector, at a median of 0.52, down 0.51 point compared to their previous four-quarter average.

Transcript sentiment scores for the communications and residential sectors were down 0.32 point each compared to their prior four-quarter averages, on a median basis.

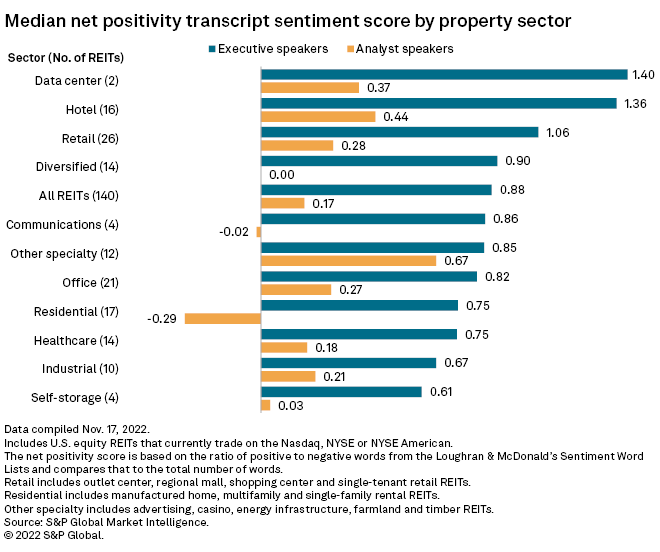

Executives speaking on the earnings calls continued to use a larger ratio of positive words as compared to analysts.

Words spoken by executives at data center and hotel REITs ranked the highest, at 1.40 and 1.36, respectively.

Analyzing words spoken by analysts on the earnings calls, the residential sector was scored at a median of negative 0.29, meaning more negative words were spoken by analysts than positive words.

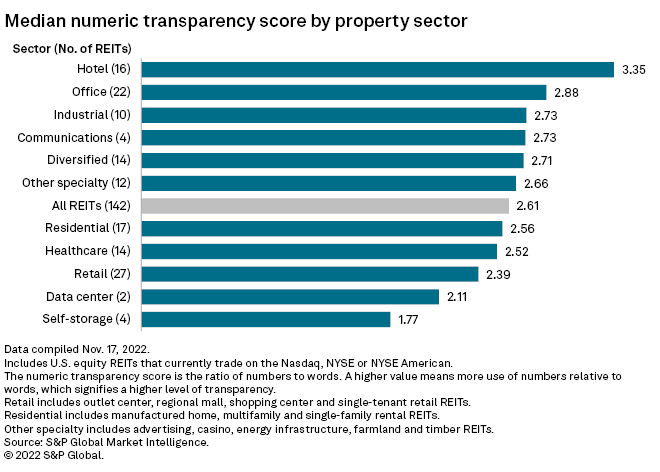

Sector numeric transparency scores

Third-quarter earnings call transcripts for hotel REITs scored the highest for numeric transparency, which is the ratio of numbers to words. A higher score means the REIT used more numbers relative to words during its earnings call and can signify a higher level of transparency.

The office and industrial sectors ranked second and third, respectively, while the self-storage sector used the least amount of numbers compared to total words on their earnings calls.