Germany's federal state banks, or landesbanken, are better prepared to weather the coronavirus crisis than they were to withstand the global financial crisis of 2008, but their commercial real estate and air finance portfolios could come under particular pressure, according to analysts.

With good asset quality and capital levels, lower risk appetite and Germany as their core market, landesbanken today are "materially different" from what they were in 2008, Roger Schneider, a director at the financial institutions group of Fitch Ratings, said in an interview. But given the concentration risk in their portfolios and low pre-provision profitability, their performance in 2020 and beyond is set to be rather weak, and this is reflected in Fitch's "negative" rating outlook.

Landesbanken may escape the COVID-19 crisis without rating downgrades, but there is constant pressure on them and the whole German banking system, Schneider said. They will still have to continue their "uphill battle" against low interest rates, compressed margins, and the need for high loan loss provisions and infrastructure investment.

In recent years, landesbanken have adopted a "back-to-roots" strategy to cope with the aftermath of the sector crash caused by the global financial crisis.

One large lender, WestLB, collapsed and several others had to be bailed out by the state, taken over by other landesbanken or even privatized, as in the case of Hamburg Commercial Bank AG. In 2007 there were 12 banks operating in the federal states, and now there are only six — Bayerische Landesbank AöR, Norddeutsche Landesbank Girozentrale, Landesbank Baden-Württemberg, Landesbank Hessen-Thüringen Girozentrale, Landesbank Saar and Landesbank Berlin Holding AG.

Risks remain

Foreign exposures and risky capital market bets got the landesbanken into trouble during the 2008 crisis. Since then, they have all significantly reduced their capital market risk and offloaded most of their toxic debt, Dierk Brandenburg, head of the financial institutions group at Scope Ratings, said in an interview.

They are therefore not seen as more vulnerable to the impact of COVID-19 than other German banks, but equally they are not immune to its negative effects, Brandenburg and Schneider said.

Concentration risk is a problem for landesbanken with high exposures to certain industries and corporates. In some cases the exposure to a single company can be up to €1 billion, according to Schneider. If these sectors and corporates were to run into trouble, the banks would be harder hit than more diversified institutions, he said, and they are especially vulnerable to such hits because of low profitability.

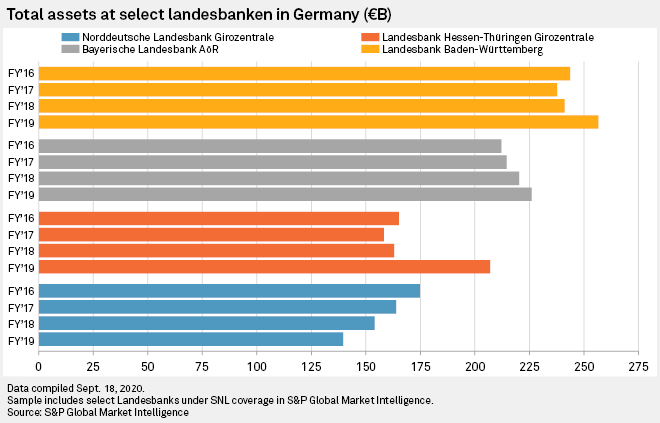

The four largest landesbanken — BayernLB, NordLB, LBBW and Helaba — would, if combined, make a credit institution with over €900 billion in total assets that effectively made no profit in the first half of this year, Schneider said. This is a key risk because it limits their ability to cover loan losses without losing capital, Brandenburg said.

Most of the landesbanken have modeled their risk provisioning not on effective rating deterioration in the loan book but on expected deterioration, Schneider said. Actual credit defaults in the banks' portfolios in the first half were few, and there is limited visibility on potential corporate defaults in the future, he said. So it remains to be seen whether their provisions will be enough.

Compared to peers in Germany and Austria, landesbanken reported some of the lowest first-half cost-of-risk ratios, which measure the annualized loan loss provisions as a percentage of consumer loans, rating agency Moody's said in a Sept. 14 report.

Germany provides ample COVID-19 support to small and medium-sized enterprises and given the general election in October 2021, it is unlikely the government will discontinue that support abruptly, Moody's said. Still, it is unclear how many companies will be able to stay solvent as the government backing peters out.

The wild card is to find out how effective the government measures, such as the short-time working allowance, have been and what happens when some of them end, Schneider said.

Weak spots

Certain areas in the landesbanken's corporate portfolios are likely to come under particular pressure due to the pandemic, including commercial real estate, aircraft finance and parts of the retail sector assets, according to the analysts.

NordLB's legacy shipping exposure, which triggered an emergency state-backed recapitalization of the bank in 2019, is not likely to cause more trouble given that it is backed by state guarantees. Around half of the bank's aircraft finance exposure is also guaranteed.

Commercial real estate underwriting has been reasonably good in recent years, so it is unlikely that the whole sector will be affected, Brandenburg said. However, certain areas, such as tourism, will take a harder blow from the crisis, he said. Some of the listed commercial real estate banks in Germany, such as Aareal and Depfa, have already sold off assets on the back of this, and landesbanken with similar exposures are also likely to take a hit, he added.

First-half CRE new business volume at NordLB's real estate arm, Deutsche Hyp, nearly halved year over year and the unit expects a moderate new business decline for full-year 2020. As of June 30, Deutsche Hyp's CRE exposure was €11.66 billion, of which €6.30 billion was in Germany.

LBBW and Helaba have high CRE exposures, but risks there are probably at the lower end of the spectrum as these banks are less exposed to higher-risk sectors, such as real estate developers, and to retail property, which is under higher pressure amid the COVID-19 crisis, Schneider said.

Although not pandemic-related, automotive finance could be a bigger risk to LBBW, which is by far the largest lender to the sector among the landesbanken, with an exposure of some €12 billion. BayernLB, the second-largest lender among the federal state banks, has less than half of that, at €5.5 billion.