Insurance stocks moved lower this week, along with the wider market, as worries related to the COVID-19 omicron variant weighed on equities globally.

The S&P 500 Insurance index fell almost 2.5% on Nov. 30 as the variant spread from South Africa to North America. The first confirmed omicron case in the U.S. was recorded in California the following day. Stocks also reacted negatively after Moderna Inc. CEO Stéphane Bancel in an interview with the Financial Times said he expects a "material drop" in vaccine effectiveness against the variant.

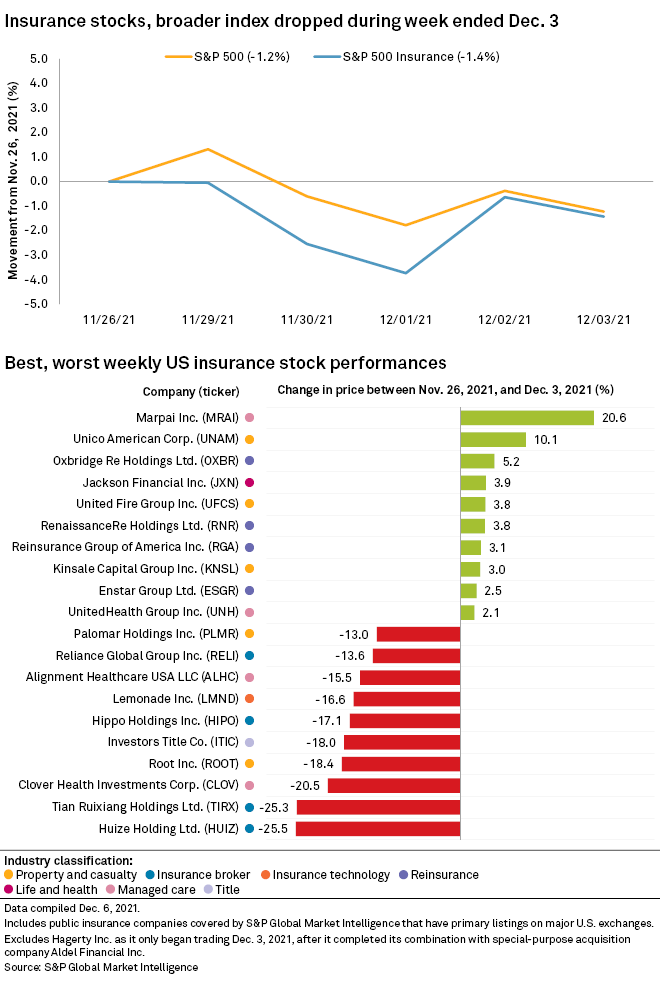

Equities would manage to limit some of their losses, but the S&P 500 finished the week ending Dec. 3 down 1.22% at 4,538.43, while the S&P 500 Insurance index closed down 1.43% at 524.20.

Ed Moya, a senior analyst for OANDA, said Federal Reserve Chairman Jerome Powell also influenced markets this week when he said he supported a faster tapering of the Fed's bond-buying program and that inflation was no longer "transitory." Powell added that the risk of increased inflation had heightened and that the end of the central bank's low interest-rate policies was near.

Supply chain issues could intensify in the first quarter of 2022, Moya said, which could exacerbate inflation and send the Fed into "an accelerated rate-hiking cycle," raising fears of a recession.

"It was part Omicron and also part resetting of Fed rate-hike expectations that put some equities on a rollercoaster ride," Moya said in an interview. "I think we're probably going to have to deal with a new heightened uncertainty in both the virus and on inflation over these next few months."

Pricing pressures are not likely to ease up in the near future, Moya said. While equities are likely to move higher in 2022, "it's not going to be an easy ride" the way it has been since governments worldwide started providing historic fiscal and economic support due to the pandemic, he added.

According to Greenspan, Travelers management also said personal auto frequency returned to pre-pandemic levels in the third quarter, while severity had risen by double digits.

Travelers finished the week down 2.93%, while The Allstate Corp., which announced it was selling its Northbrook, Ill., headquarters campus for $232 million, was down 5.91%. Lemonade Inc. tumbled 16.55%, and Erie Indemnity Company lost 12.37%.

The company expects 2021 net earnings of $17.80 to $17.95 per share and adjusted net earnings of $18.75 to $18.90 per share. For 2022, UnitedHealth anticipates net earnings of $20.20 to $20.70 per share and adjusted net earnings of $21.10 to $21.60 per share.

UnitedHealth was up 2.14% for the week. Major health insurers that finished in the red included Anthem Inc., down 4.94%, and Centene Corp., which lost 3.86%.