North American pipeline companies drove large-scale oil and gas M&A deal-making in February with several proposed transactions aimed at industry consolidation, according to S&P Global Market Intelligence data.

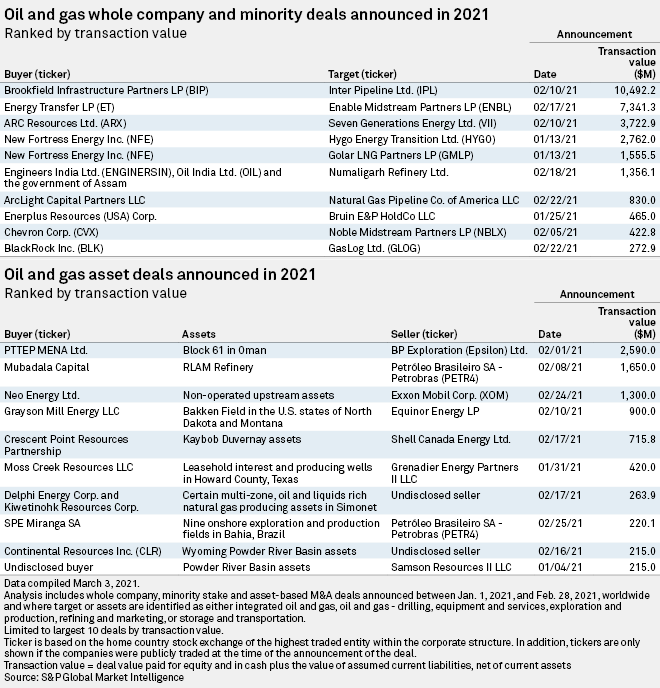

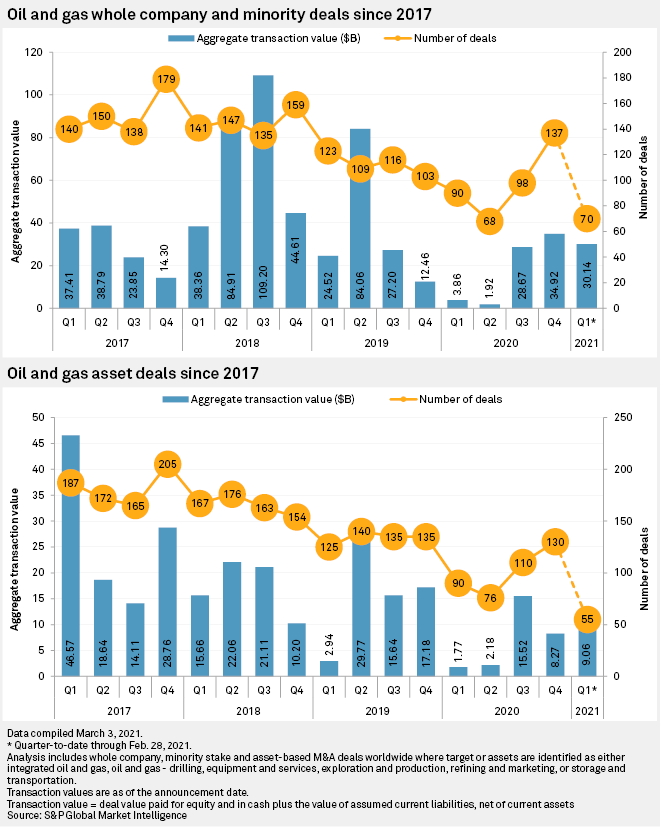

During the month, the sector announced 17 whole-company and minority-stake deals, compared to six in February 2020. The combined value of the February 2021 deals skyrocketed year over year from $43 million to nearly $25 billion.

The aggregate value of announced asset transactions rebounded significantly from $257 million to just over $8 billion as the number of deals rose from 11 to 17.

The biggest deal proposed during February was Brookfield Infrastructure Partners LP's bid to take Inter Pipeline Ltd. private for $10.5 billion. However, the Canadian pipeline company urged its shareholders to take no action on the offer as the company conducts a strategic review and looks to find a partner for the troubled Heartland Petrochemical Complex project.

Energy Transfer LP's agreement to buy Enable Midstream Partners for $7.3 billion from utility owners CenterPoint Energy Inc. and OGE Energy Corp. was the second-largest transaction announced for the month, while Chevron Corp. offered to roll up Noble Midstream Partners LP for $422.8 million after acquiring parent Noble Energy Inc. in 2020. On March 5, Chevron and Noble Midstream announced a formal merger agreement that, according to Credit Suisse, has an implied premium of about 17% to the initial bid.

The surge of midstream consolidation has arrived sooner than anticipated, but industry experts do not think that the proposed transactions so far are enough to shrink the pipeline sector to the size it needs to be.

When it came to oil and gas asset M&A, Exxon Mobil Corp.'s $1.3 billion agreement to divest its nonoperated upstream assets in the U.K. central and northern North Sea to a company funded by private equity firm HitecVision AS was the biggest transaction involving a North American company in February.

During the month, Equinor ASA also agreed to off-load its interests in the Bakken Shale in North Dakota and Montana to EnCap Investments LP-backed Grayson Mill Energy LLC for $900 million as the Norwegian state-controlled energy giant pivots away from oil and gas.