Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Sep, 2023

By Bill Holland

Large oil and gas companies' progress toward net-zero carbon emissions goals seems to have stalled or even backtracked, according to a study by a London think tank.

Only one of the world's 25 largest oil and gas companies has climate targets "potentially" aligned with the Paris Agreement on climate change's goal of limiting global warming to a 1.5-degree C rise by 2050, said the Carbon Tracker Initiative, a nonprofit think tank that studies the financial effects of the energy transition.

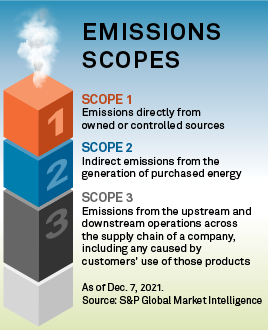

Almost no progress has been made since Carbon Tracker last ranked fossil fuel companies based on their climate targets in 2022, Carbon Tracker said. Two majors, Shell PLC and BP PLC, shifted strategies and increased their production guidance since Carbon Tracker's previous study. The largest contributing factor was the lack of goals to limit Scope 3 emissions, which are emissions from oil or gas end uses such as fuel for vehicles, power plants and homes.

|

At a Sept. 12 webinar covering the study of emissions reduction goals of the world's 25 largest oil and gas companies, Carbon Tracker said Italian oil company Eni SpA was the only company that had targets for reductions in emissions from all three scopes — operations, the supply chain and customer use. However, Carbon Tracker put an asterisk by Eni's first-place finish, cautioning that its net-zero plans rely on unproven carbon capture and storage technology and selling "dirty" carbon assets.

"Our analysis shows that the world's largest oil and gas companies are continuing to put investors at risk by failing to plan for production cuts in line with the 1.5-degree Paris goal," Mike Coffin, Carbon Tracker's head of oil, gas and mining research and co-author of the report, said in a statement. "Asset owners, asset managers, banks, insurers and other financial services firms should monitor whether the companies they fund or underwrite are adequately prepared for the inevitable change in the global energy system."

The largest oil producer, Saudi Arabia's national oil company, Saudi Arabian Oil Co., ranked at the bottom of the group for its climate program, according to Carbon Tracker.

"Aramco, in last place, is the only company to limit emissions reductions targets to assets that it wholly owns and operates," Carbon Tracker said. "It has set no baselines, pledging only to reduce emissions against amounts forecast under business-as-usual scenarios."

Criteria for study

To create its rankings, Carbon Tracker analyzed whether a company has net-zero goals for Scopes 1, 2 and 3 emissions by 2050 that include both operated and nonoperated assets. It then assigned each company to a tier based on how closely its goals conform to those ideals. The think tank did not include fully state-owned or Russian companies in its analysis since investors have little influence on national oil companies.

Carbon Tracker's rankings remained almost unchanged year over year, with only one company — Suncor Energy Inc. — moving into a higher tier.

"The general stagnation across the table suggests that the oil and gas industry is content with the level of announced ambitions," Carbon Tracker said, reasoning that high oil prices in 2022 tempted many producers to lean into fossil fuels, a shift aided by some public backlash against environmental, social and governance goals.

"Emissions are waste, and a management not committed to reducing Scope 1 and 2 is not focused on efficiency/profitability," Carbon Tracker said. "A management that does not target Scope 3 is not recognizing a key metric for structural changes in future demand. A company not setting interim targets is betting that this threat is a long way off. And a company that is using unrealistic offsetting targets is disrespecting our intelligence."

Performance of European firms

European companies ranked near the top of the list with consistently stronger targets than their North American rivals, Carbon Tracker said. The weakest commitments came from Exxon Mobil Corp.; Petróleo Brasileiro SA - Petrobras; and Chinese operators China Petroleum & Chemical Corp. (Sinopec), Petrochina Co. Ltd. and China National Offshore Oil Corp., Carbon Tracker said.

Most large North American oil and gas companies have not set Scope 3 goals, arguing that customers should be accountable for their own emissions. Exxon and independent ConocoPhillips were in the bottom tier of 16 companies because they lack a Scope 3 goal, Carbon Tracker said. Chevron Corp. has a Scope 3 reduction goal but has not committed to reducing Scope 3 emissions to net-zero by 2050, Carbon Tracker said.

Occidental Petroleum Corp. ranked the highest among North American oil and gas companies. It would have placed higher if it had interim emissions targets in addition to the 2050 goal, Carbon Tracker said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.