S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Office space available for sublease in the U.S. rose 3.6% in the first quarter to 159 million square feet, surpassing levels seen before the pandemic, The Wall Street Journal reported, citing CBRE Group Inc. data.

Landlords are already facing decreasing rents and rising vacancies due to low demand in office space and an elevated amount of lease expirations, the publication added. Markets with near-historic high sublease availability include New York, San Francisco and Washington, D.C. In Manhattan, N.Y., there was more than 20 million square feet of office space available for sublease in the first quarter, the publication reported, citing Savills.

Return to office is expected to take the rest of 2022 to take hold, and clear patterns of office usage will likely emerge in 2023, Julie Whelan, global head of occupier research at CBRE, said in a recent Nareit's REIT Report Podcast. Nareit is the U.S.-based trade association for real estate investment trusts and publicly traded real estate companies.

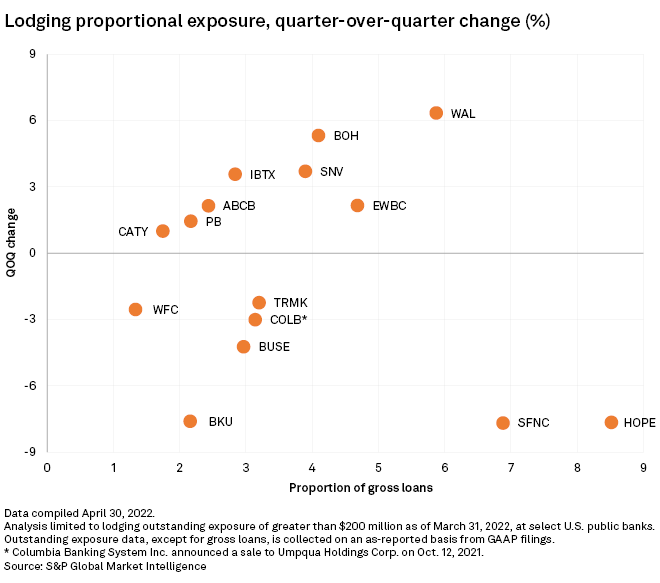

CHART OF THE WEEK: US banks report Q1 hotel exposure as economy opens amid inflationary risks

⮞

⮞

⮞

M&A

* Duke Realty Corp. rejected Prologis Inc.'s takeover offer, made May 10, saying the proposed all-stock deal worth roughly $23.7 billion is insufficient.

* Brookfield Asset Management Inc.-managed private real estate funds will acquire Watermark Lodging Trust in an all-cash transaction valued at $3.8 billion, including assumed debt and preferred equity. Watermark's board has unanimously approved the transaction, which could close in the fourth quarter.

Property deals

* Swiss private equity house Partners Group Holding AG will buy a U.S. rental homes portfolio worth more than $1 billion from Fortress Investment Group LLC, Bloomberg News reported, citing people with knowledge of the matter. The portfolio includes over 2,000 newly built houses operated by Kairos Living and some 1,000 homes in contract, according to the news outlet.

* Highwoods Properties Inc. is buying the 650 S. Tryon at Legacy Union office tower in Charlotte, N.C., for a total expected investment of $203 million. The 367,000-square-foot property is 78% leased and has LEED gold building certification.

* Pebblebrook Hotel Trust acquired the 119-room The Inn On Fifth luxury resort in Naples, Fla., for $156.0 million.

Data Dispatch: Banks took mixed approaches to CRE office exposure in Q1

8 US REITs announce dividend increases in April

AEW Capital Management trims back 22 REIT positions in Q1, exits 3