The appeal of bargain hunting, consumers' increased price sensitivity and the considerable insulation from e-commerce have all contributed to the continued growth of off-price retailers as large department stores continue to consolidate their physical footprint, according to analysts.

As department stores continue to shed stores, off-price merchants and discount retailers are in expansion mode, according to an analysis by S&P Global Market Intelligence.

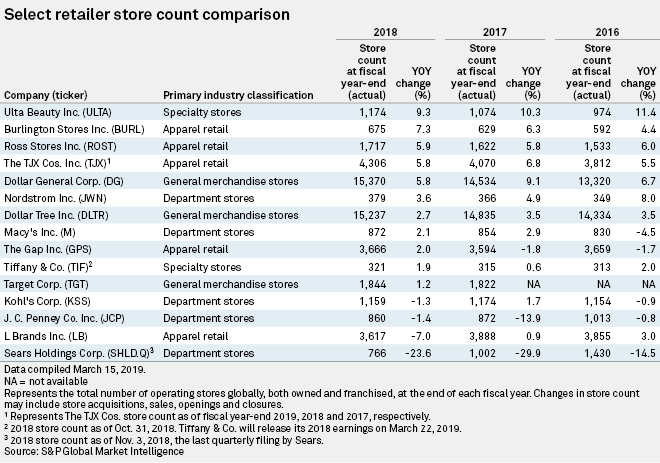

At the end of fiscal 2018, Burlington Stores Inc. grew its store count by 7.3%, while Ross Stores Inc. increased the number of its stores by 5.9% and Dollar General Corp. upped its store base by 5.8% compared with fiscal 2017.

On the other hand, L Brands Inc.'s store count was down 7% from fiscal 2017, while Kohl's Corp. and J.C. Penney Co. Inc. wrapped up fiscal 2018 with 1.3% and 1.4% fewer stores, respectively.

Part of the appeal of off-price retailers is the thrill customers get from hunting for the best deals and the knowledge that an item is not guaranteed to be available the next time the customer visits the store.

Zain Akbari, an equity analyst at Morningstar, said this is in contrast to large department stores such as Macy's whose inventory is pretty set and does not change as quickly because it has been purchased ahead of the season "and as a result, the customer doesn't have that incentive [to revisit the store]," he told S&P Global Market Intelligence.

The off-price and discount store model expansion will continue in 2019, according to forecasts made by executives in the most recent round of earnings. The TJX Cos. Inc. said it plans to open 230 stores in 2019, Ross Stores plans to open 100 stores and Burlington Stores plans to open 50 stores.

Meanwhile, Macy's Inc., J.C. Penney and The Gap Inc. are among the slew of department stores and apparel retailers that announced plans to close several stores in 2019, continuing what has become a trend in the last several years.

Effectively sourcing the right inventory at the right price is an essential part of the off-price model. Industry experts said off-price retailers are well-positioned to obtain branded products at lower prices and continue to play a significant role in the retail industry, according to analysts.

"Apparel inventory availability has been very good for these retailers extending back several years and that has come even as manufacturers have gotten more sophisticated with the systems that they use to forecast demand and ensure that their production runs are accurate," Akbari said. He added that off-price retailers "offer fast payment and they offer [manufacturers] a chance to at least somewhat monetize that surplus set of goods."

Manufacturers certainly prefer to sell their goods through full-price channels, though the off-price channel does provide a tangible source of sales, and fully eliminating them can be likened to leaving money on the table, analysts said.

"These apparel manufacturers are also publicly traded companies and as far as I'm aware, they don't want to make any less," said Tim Vierengel, a senior research analyst at Northcoast Research, in an interview.

Although some brands such as Ralph Lauren Corp. have reduced their inventory distribution through off-price channels, the scale of brand partnerships off-price retailers are involved in creates a safety net from the actions of a few brands.

"When you are the 800-pound gorilla in off-price like TJX ... and you're dealing with 17,000 brands around the world and new ones coming in all the time, availability of brands is not a concern," John Morris, a senior analyst at D.A. Davidson said in an interview.

New opportunities for brand partnerships

As department stores such as Macy's continue to consolidate their operations and restructure their inventory management, off-price retailers have the opportunity to expand their brand partnerships. Vendors who supply department stores are already seeking out partnerships with off-price retailers such as TJX, thereby causing an "influx of even more brands and more availability," according to TJX President and CEO Ernie Herrman.

"All those vendors that are serving any of those retailers, they want to call us when they know that they're not going to have those outlets," Herrman said on a Feb. 27 call discussing the company's fourth-quarter and fiscal 2019 results.

According to Alex Arnold, an equity research analyst at Odeon Capital Group LLC, consumers have also become more promotion-driven and price-sensitive in the aftermath of the great recession in the late 2000s.

Arnold told S&P Global Market Intelligence that "promotions are increasingly sort of resonating with the consumer, and as that psyche shift happens, which has been a multiyear process, you're seeing tailwinds that are ongoing for the off-price [retailers]."

Remodeling retail spaces

Even with the persisting growth, analysts said off-price retailers are not big enough to become anchor tenants in big shopping malls previously occupied by larger department stores. However, remodeling the space into stores with smaller square footage is an option analysts say could work.

"To the extent that those spaces that are vacated by a larger department store could be subdivided then yes perhaps but ... strip malls and strip centers … those are the most likely areas for these retailers going forward for their continued expansion plans," Akbari said.

In an effort to reduce their store footprint, large department store retailers are converting their larger stores to smaller format stores. Kohl's said March 5 that it will close four underperforming stores in April and open four new smaller format stores later in the year.

Moody's analysts expect department store square footage to decrease by 4% in 2019 compared to the estimated 13% drop in 2018, primarily driven by Sears Holdings Corp. store closures, according to a March 11 note.

"Companies continue to look at their store bases with a critical eye," the Moody's analysts said. They also noted that the store closures have provided opportunities for "healthy retailers" to gain market share.

According to Morris, "not only can [off-price retailers] go in and pick up that real estate, but they can also potentially pick up that market share that's also been given up or forfeited by the full-price companies that are consolidating."

It is worth noting, analysts said, that off-price retailers have a lower exposure to the rise of e-commerce compared to that of department stores.

"This off-price model creates something of a treasure hunt that has historically been difficult for online-only retailers to replicate, and so as a result of that they're able to incentivize people to keep coming into the stores and not deal as directly with the digitization component," Akbari said.

In addition to the challenge of offsetting shipping costs without losing the ability to offer lower prices, keeping up with the ever-changing assortment can be considerably difficult from a technology standpoint, according to analysts.

"It would take so much time, money and energy in regards to what you need to do on the IT end ... to be able to turn around really quick," Northcoast Research's Vierengel said.