Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

By Michael O'Connor and Chris Hudgins

U.S. shoppers spent more than expected in October.

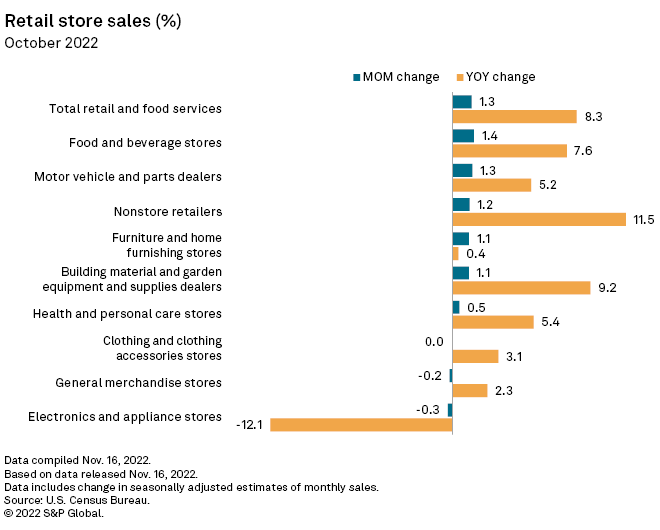

Retail and food services grew 1.3%, according to U.S. Census Bureau data released Nov. 16. Economists expected the figure to rise 1%, according to a consensus estimate compiled by Econoday.

Retail sales

U.S. retail and food services sales reached $694.5 billion in October, according to the seasonally adjusted Census Bureau preliminary estimate. The increase comes after flat sales in September.

Sales at food and beverage stores rose 1.4%, the highest monthly increase among retail categories excluding gas stations, bars and restaurants. Nonstore retailers — e-commerce, mail-order shops, vending machine operators and other direct sellers — had the biggest annual increase among the same group at 11.5%.

Electronics and appliance stores posted a 0.3% sales decline in October and had the only annual decline at 12.1%.

The sales figures are not adjusted for inflation. The consumer price index rose 0.4% in October from the previous month and 7.7% over the last 12 months.

Bloated retail inventories and high inflation will challenge retailers during the important holiday shopping season this year. Third-quarter earnings for big retail names have so far been mixed, with Amazon.com Inc. and Target Corp. warning of fourth-quarter sales weakness, while Walmart Inc. raised its full-year sales guidance on the heels of stronger-than-expected results.

Default risk

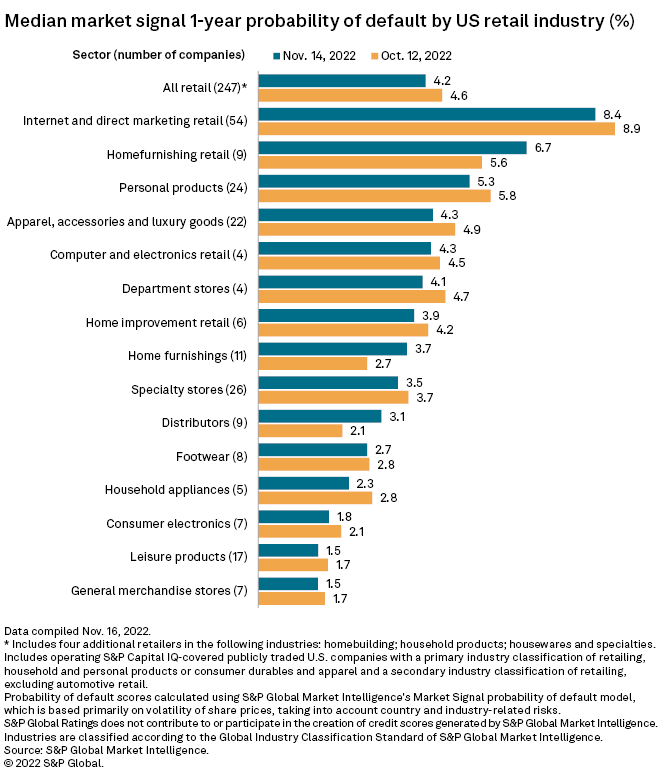

The median probability of default score for all publicly traded U.S. retailers as of Nov. 14 was 4.2%, down slightly from 4.6% as of Oct. 12.

Internet and direct marketing retailers again had the highest median market signal one-year probability of default of any sector, at 8.4%, according to S&P Global Market Intelligence data. The score, which represents the odds of default within a year, is based mainly on the volatility of share prices for public companies and accounts for country- and industry-related risks.

Bankruptcies

There had been 15 retail bankruptcy filings in 2022 as of Nov. 15, according to Market Intelligence data, the fewest number of filings in comparable periods since at least 2010.