Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Nov, 2024

By Sean Longoria and Umer Khan

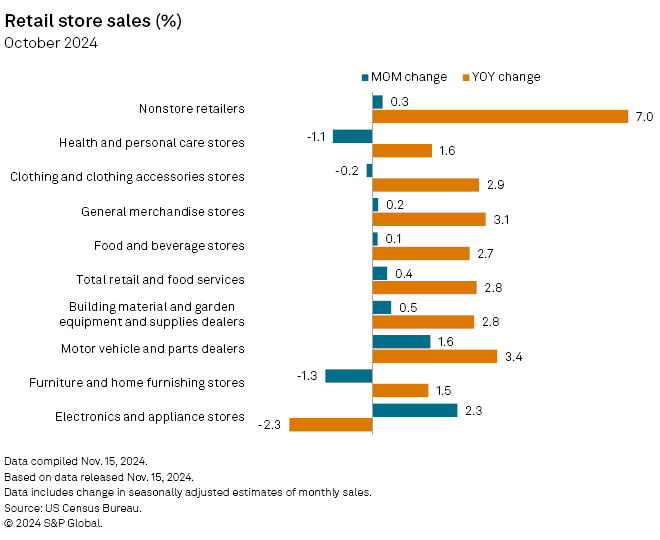

US consumers spent more at retailers in October than economists expected, signaling a positive start to the crucial end-of-year shopping period.

Total retail and food services sales rose 0.4% month over month in October, according to US Census Bureau data. Consensus estimates compiled by Econoday showed an expectation of a 0.3% increase. September sales, meanwhile, rose more than initial government estimates, with a revised 0.8% gain from August.

"October's increase proved to be slightly better than projections and was likely boosted by lower fuel prices," Chip West, a retail and consumer behavior expert with marketing, packaging and supply chain company RRD, said in a Nov. 15 note. "As inflation slowed for a number of months, prices in several categories have stabilized, with some even showing declines, offering further relief to consumers."

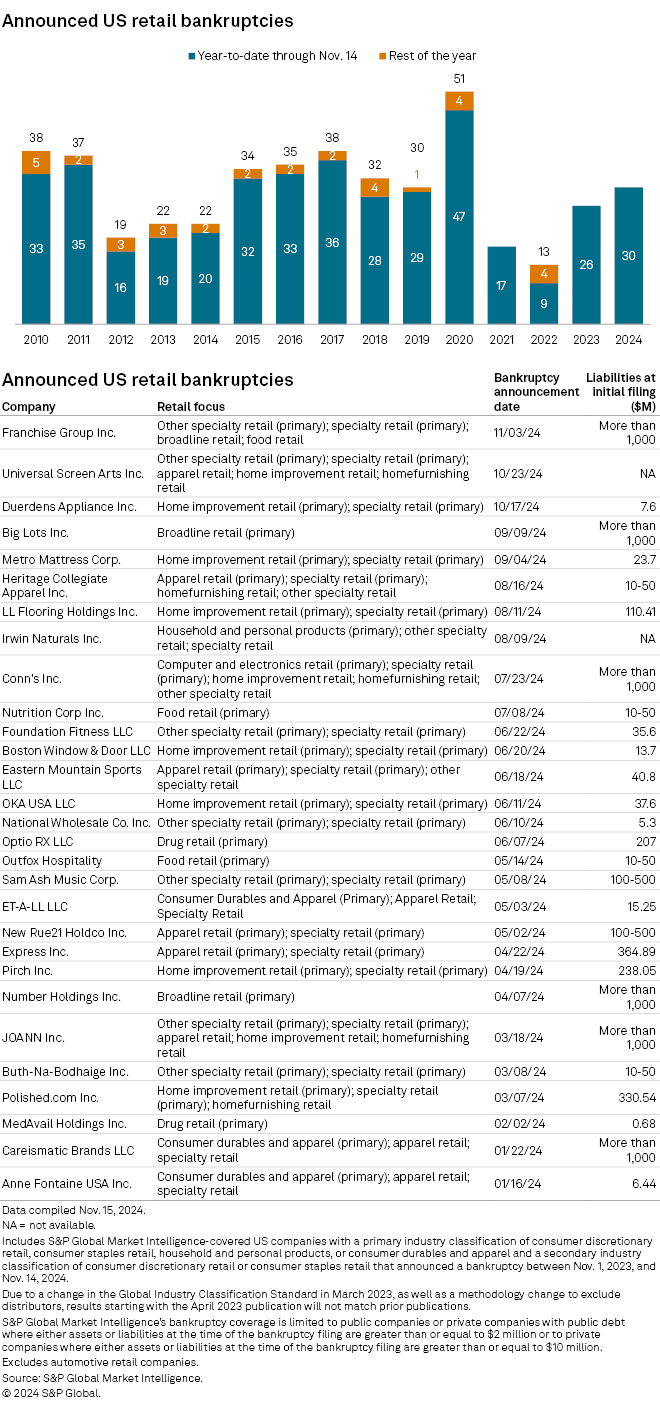

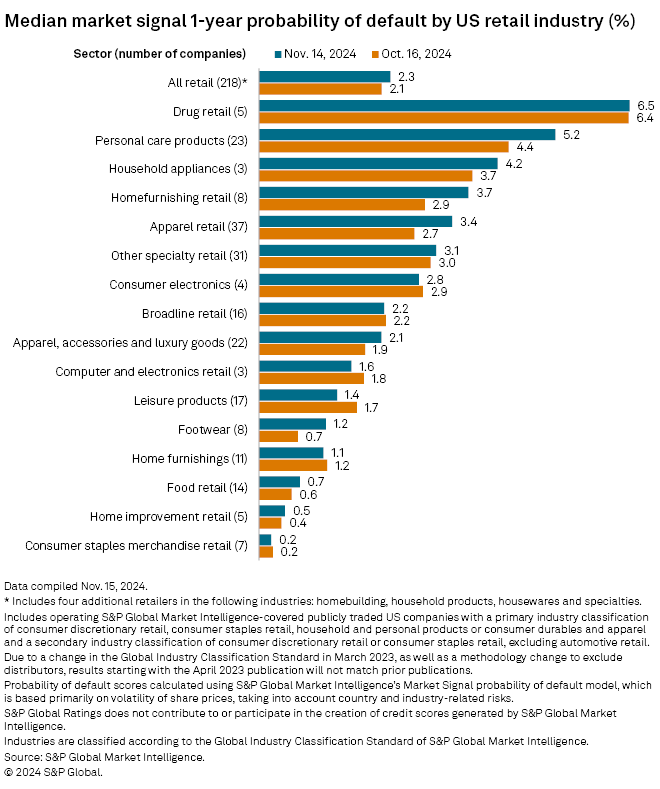

Also, S&P Global Market Intelligence recorded three new retail bankruptcy filings in the month through Nov. 15. Default risk for publicly traded retails slightly rose during the same period.

Sales

Retail and food services sales hit a combined $718.87 billion in October, according to seasonally adjusted advance estimates by the Census Bureau. Through the first 10 months of the year, consumers have spent a little more than $7 trillion, up 2.8% against the same period in 2023.

Within retail categories, electronics and appliance stores recorded the highest monthly sales increase at 2.3%. Motor vehicle and parts dealers recorded the second-highest rise at 1.6%.

– Set email alerts for future Data Dispatch articles.

– For more bankruptcy analysis, check out the monthly bankruptcy series.

"Sales of automobiles and parts were the main driver of overall sales in October, most likely driven by the spike in car sales during and after Hurricane Milton," Tuan Nguyen, an economist at RSM US LLP, wrote in a Nov. 15 blog post.

The largest monthly drop was the 1.6% fall in the miscellaneous store retailers category, which includes specialty shops and auctions. Furniture and home furnishing stores recorded the next-largest drop at 1.3%.

Bankruptcies

Franchise Group Inc., which owns The Vitamin Shoppe and other specialty retail franchises, was one of three bankruptcy filings during the month through Nov. 15, according to Market Intelligence data. The company listed more than $1 billion in liabilities in its Nov. 3 bankruptcy filing and is seeking to reorganize.

Kitchen and home appliance retailer Duerdens Appliance Inc., meanwhile, sought to liquidate its business in its Oct. 17 filing.

Creditors for Universal Screen Arts, Inc. filed a bankruptcy petition Oct. 23 seeking to liquidate the online gift retailers' assets to satisfy the company's debts. A bankruptcy trustee was appointed Nov. 15 to oversee the liquidation process and a meeting of creditors is set for December, according to court documents.

Market Intelligence has recorded 30 bankruptcy filings of public and certain private companies in 2024 through Nov. 15. The total is higher than comparable figures in eight of the prior 14 years.

Default risk

The odds of default for publicly traded retailers ticked higher in mid-November from a month earlier. Among all retail categories, median default risk was 2.3% on Nov. 14, up from 2.1% on Oct. 16, according to Market Intelligence's Market Signals Probability of Default model.

The scores represent the median odds of default on debt within a year and are based primarily on the volatility of share prices for public companies on major US exchanges, accounting for country- and industry-related risks and other macroeconomic factors.

Median probability of default scores rose across nine of 16 retail industries. Personal care products and home furnishing companies recorded the highest increases in default risk scores during the month, with 0.8 percentage point upticks in each industry.