After rising in the last two quarters of 2018, the number of U.S. banks and thrifts concentrated in commercial real estate loans fell to 450 at the end of the first quarter, down from 459 at year-end 2018 and 462 in the year-ago quarter.

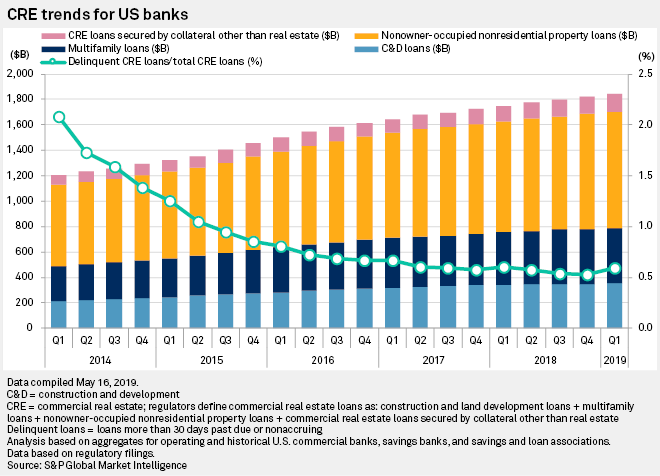

Total CRE loans continued to grow in the first quarter, rising 1.05% quarter over quarter and 5.35% year over year. Delinquent CRE loans as a percentage of total CRE loans rose to 0.59% at March 31, up 6 basis points from the end of 2018, but down 1 basis point since March 31, 2018.

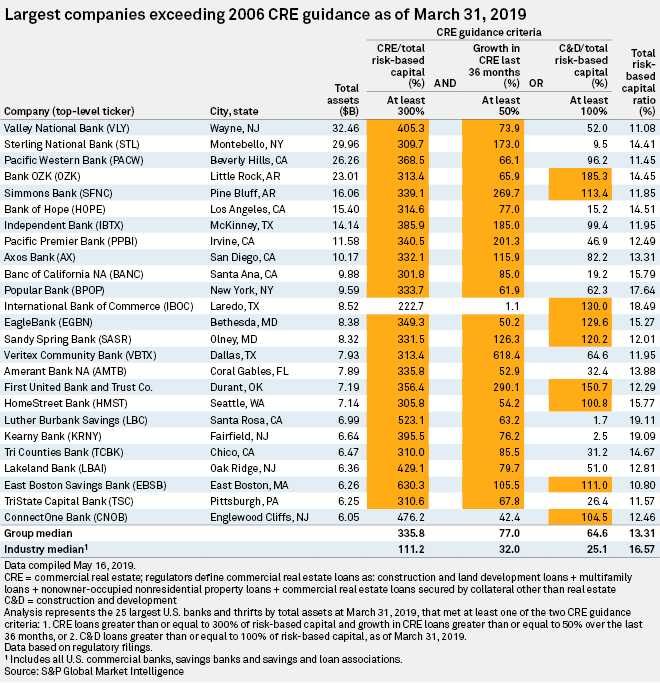

Since 2006, U.S. banking regulators have advised that CRE loan concentrations above a certain threshold could lead to increased regulatory scrutiny. In 2015, they reissued that guidance in light of substantial CRE loan growth.

The guidance states that banks may be considered concentrated in CRE loans if they meet at least one of two thresholds: first, if CRE loans are greater than 300% of risk-based capital and CRE loans have grown by more than 50% over the last three years; or second, if construction and land development loans are more than 100% of risk-based capital.

The regulatory definition of CRE includes four categories: construction and land development loans; multifamily loans; loans secured by nonowner-occupied commercial properties; and loans used to finance CRE or construction and development activities not secured by real estate.

Montebello, N.Y.-based Sterling National Bank was the largest bank by assets to become "concentrated" in CRE in the first quarter. Its concentration ratio jumped to 309.7% as of March 31 from 294.1% at the end of 2018, and its 36-month CRE growth rate was 173.0%.

New York-based Signature Bank, which was the largest bank concentrated in CRE at the end of 2018, fell below the regulatory threshold in the first quarter after its 36-month CRE growth rate fell below 50%.

Note: Figures reported in this article may not match figures reported in prior articles due to company restatements.

Click here to set alerts for future Data Dispatches. Click here to access an Excel spreadsheet that lists companies concentrated in CRE as of March 31, 2019. |