As the owner of two Ohio nuclear plants is pressed to open its books on the profitability of the units, the timing of subsidies at the center of a federal criminal investigation may be a larger issue.

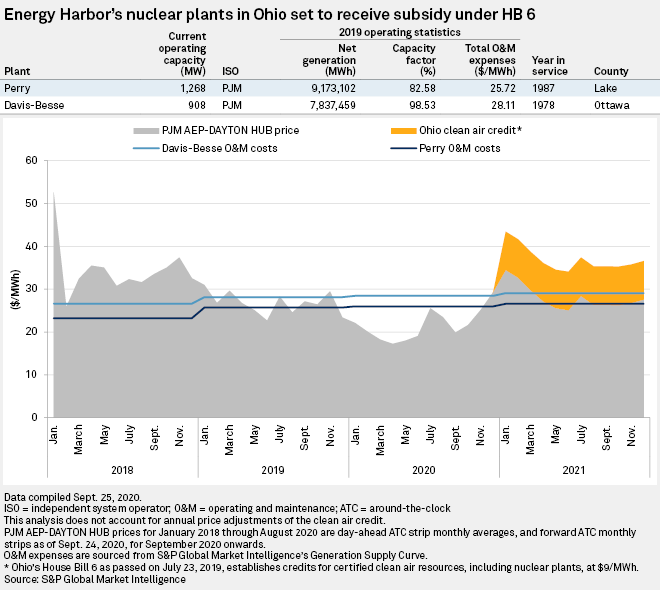

An S&P Global Market Intelligence analysis shows Energy Harbor Corp.'s 908-MW Davis-Besse and 1,268-MW Perry nuclear plants, both in northern Ohio, have operating costs higher than wholesale electricity prices. A mid-2019 analysis showed the plants with operating costs running below wholesale electricity prices.

The most recent analysis shows wholesale prices in the PJM Interconnection rising through the end of 2020 and into 2021, which is when Ohio's clean air credit for nuclear plants kicks in.

House Bill 6, which establishes a $9/MWh credit for clean air resources, provides $150 million in annual financial support for the Davis-Besse and Perry nuclear units beginning Jan. 1, 2021, through Dec. 31, 2027.

A comparison of wholesale electricity prices and plant operation and maintenance, or O&M, costs modeled from Market Intelligence's Generation Supply Curve suggests that both plants were operating at below wholesale electricity prices through the end of 2018. Davis-Besse's O&M costs were at or above PJM wholesale prices for most of 2019, while Perry generally operated below market prices.

In 2019, O&M expenses averaged $25.72/MWh for Perry and $28.11/MWh for Davis-Besse, with the monthly average spot power price in the mid- to high $20s/MWh at the PJM AEP-Dayton hub for the same year. For 2020, modeled O&M costs for both plants hold in the mid- to high $20s/MWh, but the margin against wholesale power prices narrows.

PJM AEP-Dayton hub pricing averages approximately $20/MWh in the first nine months of this year, brought down in spring in part because of reduced demand for power due to the coronavirus pandemic. Forwards assessments run in the high $20s/MWh for the remainder of 2020 and throughout 2021. The margins for both plants increase when the proposed clean air credits are included in the analysis.

For 2021, Davis-Besse's O&M costs are expected to average $29.07/MWh, with Perry's O&M costs forecast at $26.57/MWh. Forwards assessments top out at $34.43/MWh in January 2021 and average $28/MWh for the year excluding the $9/MWh subsidy.

Ohio Attorney General Dave Yost has reportedly told state lawmakers to bring Energy Harbor and FirstEnergy Corp. officials before legislative committees to disclose whether the nuclear plants need the subsidies.

In addition, Yost on Sept. 23 filed a civil lawsuit to halt the collection of ratepayer-backed subsidies for the state's nuclear plants.

The lawsuit and legislative hearings come after federal prosecutors in July filed bribery charges against former Ohio House Speaker Larry Householder and four associates. They have been indicted and accused of using "more than $59 million" through a "slush fund" to steer H.B. 6 through the Ohio Legislature. An affidavit filed by an FBI special agent implies that FirstEnergy and affiliated entities, though not mentioned by name, wired funds through a 501(c)(4) nonprofit group called Generation Now to support H.B. 6 and combat a statewide referendum to repeal the law.

Former FirstEnergy subsidiary FirstEnergy Solutions Corp. emerged from bankruptcy in late February as Energy Harbor.