Markets awash in liquidity and a booming pace of deal-making are helping companies avoid bankruptcy, but the Federal Reserve's shifting policy on rising inflation suggests 2022 will be more challenging for distressed companies.

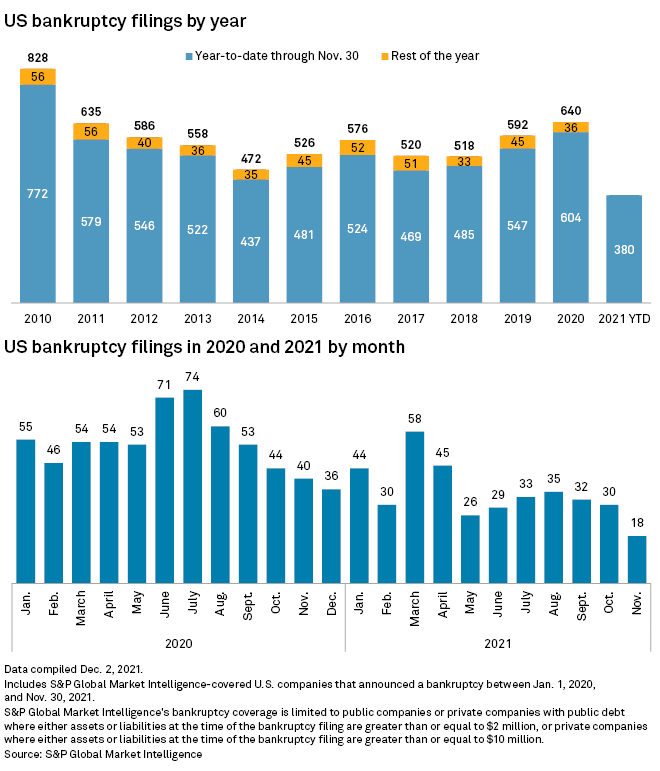

In November, 18 companies entered bankruptcy proceedings, a drop from 30 in October, according to S&P Global Market Intelligence data, which excludes the smallest business filings. In the first 11 months of the year, 380 corporate bankruptcy cases were filed, lower than any of the previous 11 years.

The unprecedented amount of capital and government support that went into the economy in response to the pandemic upended predictions that bankruptcies would spike. Instead, ample liquidity across markets and the heightened pace of deal-making is helping distressed companies avoid bankruptcy.

The November lull is a continuation of the business bankruptcy slowdown that began in late 2020, when filings dropped as companies took advantage of the enormous amount of liquidity injected into the U.S. banking system, according to Andrew Behlmann, a partner in Lowenstein Sandler LLP's bankruptcy and restructuring department. With open capital markets, many distressed companies have been able to refinance troublesome debt.

"There are obviously a lot of stressed and potentially distressed companies being kept afloat by lenders and bond purchasers chasing yield in an ultra-low interest rate environment," Behlmann wrote in an email.

Still, restructuring professionals said there are plenty of risks heading into the new year. Shifting Fed policy, surging inflation, supply chain challenges, labor shortages and the long-term shifts in behavior caused by the ongoing pandemic will challenge companies in 2022, according to Melissa Kibler, senior managing director at Mackinac Partners, a financial advisory and restructuring firm.

"The availability of capital and leverage has enabled some companies to temporarily defer their problems by adding more debt," Kibler said in an interview. "We all know that we're going to be in a rising interest rate environment, and when you've now just added debt and you are more leveraged, you are even more vulnerable."

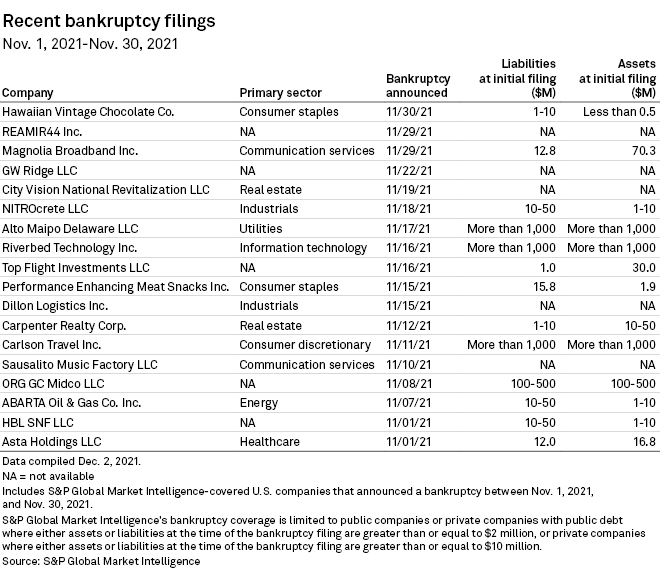

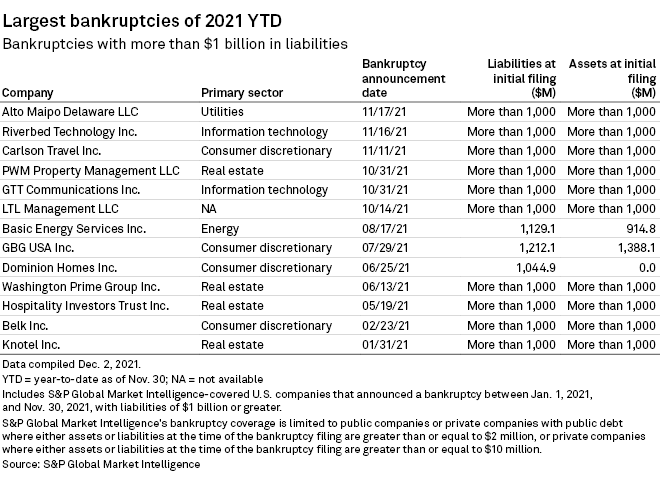

Three companies that entered bankruptcy proceedings in November listed more than $1 billion in liabilities at the time of filing, according to Market Intelligence data. The volume of cases with $1 billion or more in liabilities in 2021 is fairly consistent with the pre-COVID era, Behlmann said.

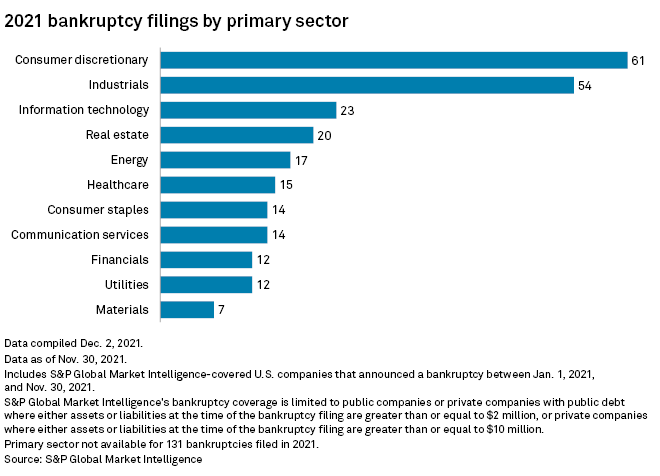

Consumer discretionary companies have had the most bankruptcies so far this year. The sector consists of a broad range of industries including retailers, restaurants, homebuilders and auto parts companies.

Within the consumer discretionary sector, the hotels, resorts and cruise lines industry has had the most bankruptcies with 14. Occupancy at U.S. hotels remains below pre-pandemic levels.

Consumer discretionary companies have been a popular target for short sellers in 2021. However, short interest across the market is at historic lows, depriving markets of a corrective that can push companies into bankruptcy, according to Derek Horstmeyer, a finance professor at George Mason University. Hedge funds that typically short stocks were spooked by short squeezes during the meme stock phenomenon earlier this year. If hedge funds started shorting again, it would fuel "substantial corrections" that could push companies into bankruptcy, Horstmeyer said.

"We need short interest in the markets to keep things rational and efficient and to correct prices," Horstmeyer said.

Editor's note: This Data Dispatch is updated on a regular basis; the last edition was published Nov. 8.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.