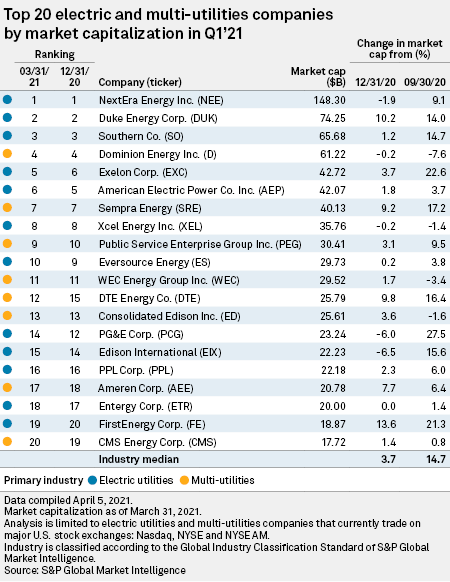

NextEra Energy Inc., Duke Energy Corp. and Southern Co. retained their first-, second- and third-place spots on the list of the top 20 S&P Global Market Intelligence-covered U.S. electric and multi-utilities by market capitalization at the end of the first quarter.

The total market capitalization of the 20 electric utility companies stood at $796.21 billion at the end of the first quarter, a 2.1% increase from $779.82 billion at the end of the fourth quarter of 2020. Of the total, 14 companies recorded quarter-over-quarter percentage gains, according to data compiled by S&P Global Market Intelligence.

NextEra, which remains the only power company on the list with a market capitalization topping $100 billion, saw a 1.9% quarter-over-quarter decrease in its market cap to $148.30 billion. In January, NextEra raised its projection for renewable energy development through 2022 and completed the merger of Gulf Power Co. into Florida Power & Light Co.

Duke Energy's market cap increased 10.2% to $74.25 billion as the company announced plans to divest a 19.9% interest in its Duke Energy Indiana LLC subsidiary to a Singaporean sovereign wealth fund in a move designed to strengthen the company's balance sheet and boost earnings.

Southern recorded a 1.2% quarter-over-quarter increase in its market cap to $65.68 billion. In February, the company disclosed an additional $176 million cost overrun at the Alvin W. Vogtle nuclear plant in Georgia due to the COVID-19 pandemic.

FirstEnergy Corp. posted the biggest percentage gain in market value of 13.6% to $18.87 billion as of March 31, improving its ranking to the 19th position, from the 20th spot in the fourth quarter of 2020. During the fourth-quarter 2020 earnings conference call, FirstEnergy management largely focused on the company's ongoing organizational transformation. FirstEnergy, which is in the middle of an internal investigation and criminal investigation related to its role in an alleged bribery scheme in Ohio, also disclosed that billionaire activist investor Carl Icahn has signaled his intent to acquire "voting securities" of the company.

Two of the California-based utilities, Edison International and PG&E Corp., saw the largest quarter-over-quarter percentage declines in the first quarter. Edison International saw its market cap drop 6.5% to $22.23 billion, slipping to the 15th place from the 14th. PG&E Corp. recorded a drop of 6% and slipped to the 14th position with a market cap of $23.24 billion.

On Feb. 11, California regulators extended a moratorium on service disconnections through June 30, 2021, and opened a proceeding to provide relief for mounting debt amid the ongoing economic hardship caused by the coronavirus pandemic.

Other notable companies retaining their positions among the top 10 utilities included Dominion Energy Inc. at the fourth spot with a market cap of $61.22 billion, Sempra Energy at the seventh spot with a market cap of $40.13 billion and Xcel Energy Inc. at the eight spot with a market cap of $35.76 billion.

Despite gains, the S&P 500 utility indexes underperformed the broader S&P 500 index for the first quarter, which posted a total return of 6.2%. Total returns were 4.2% for the S&P 500 Multi-Utilities index, 2.8% for the S&P 500 Utilities index and 2% for the S&P 500 Electric Utilities Sub Industry index.