Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2022

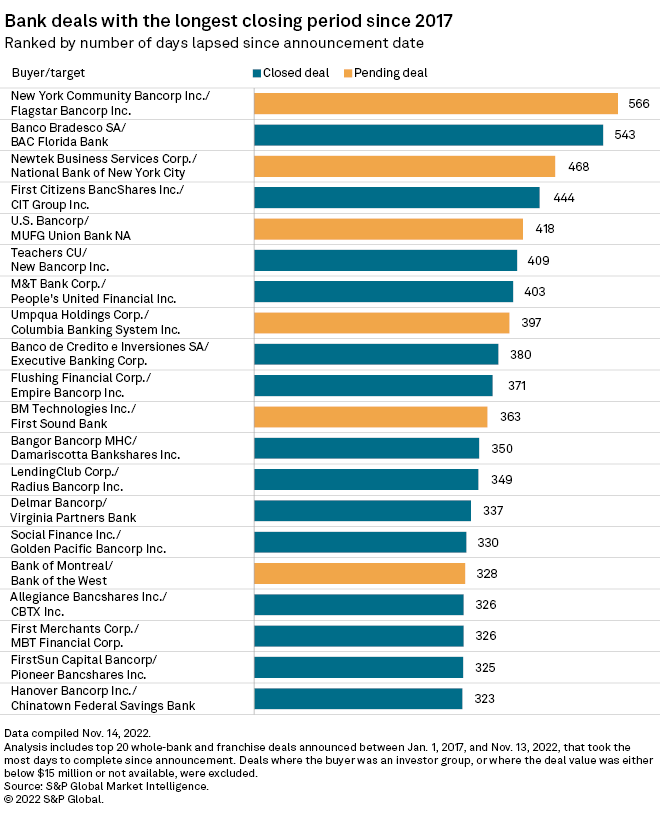

New York Community Bancorp Inc. can see the light at the end of the tunnel after securing regulatory approval for what is the longest closing period among all bank deals announced since 2017.

The Hicksville, N.Y.-based company announced that it secured long-awaited regulatory approval for its acquisition of Troy, Mich.-based Flagstar Bancorp Inc. from the Office of the Comptroller of the Currency on Oct. 28 and from the Federal Reserve less than two weeks later on Nov. 7.

The deal, which has been pending for more than 560 days, is now expected to close Dec. 1. When the companies announced the deal in April 2021, the original closing date estimate was 2021-end.

In that time frame, the companies extended the deal closing timeline multiple times and even changed the regulatory track of the deal in a way that eliminated the need for Federal Deposit Insurance Corp. approval.

Longest closing periods since 2017

Bank deals big and small have faced long closing timelines over the past two years as regulators ramped up scrutiny of bank M&A. In addition, some deals have faced opposition from community groups, leading some banks to strike community benefit agreements with these groups, including New York Community, which struck such an agreement in January.

Amid that backdrop of increased regulatory scrutiny and prolonged closing timelines for many banks in the past few years, New York Community and Flagstar's deal holds the longest closing period among all transactions announced since 2017.

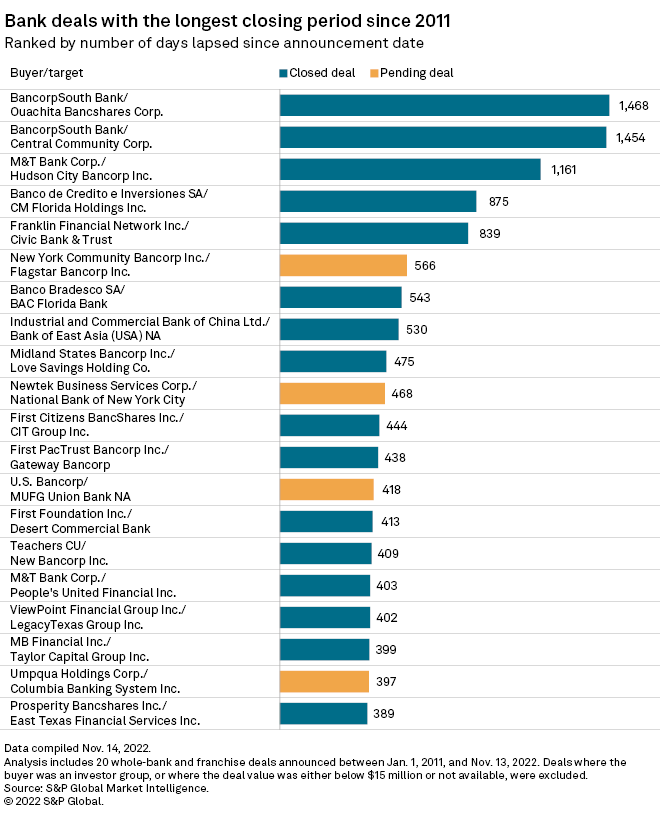

Longest closing periods since 2011

Looking back to 2011, some other deals took even longer to close.

Tupelo, Miss.-based BancorpSouth Bank holds the top two spots for the longest deal closing timelines since 2011 with its acquisition of Monroe, La.-based Ouachita Bancshares Corp., which took 1,468 days to close after it was announced, and its acquisition of Temple, Texas-based Central Community Corp., which took 1,454 days to close.

The two deals were delayed during the Consumer Financial Protection Bureau's investigation of mortgage lending discrimination allegations against BancorpSouth Bank, which paid more than $10 million in a settlement. BancorpSouth Bank later merged with Cadence Bancorp.

|

*Download a template to compare a bank's financials to industry aggregate totals. *View U.S. industry data for commercial banks, savings banks and savings and loan associations. *Download a template to generate a bank's regulatory profile. |

Buffalo, N.Y.-based M&T Bank Corp.'s acquisition of Paramus, N.J.-based Hudson City Bancorp Inc. had the third-longest bank deal closing period since 2011, with 1,161 days passing between announcement and closing. A key factor in the delay was that M&T received a consent order related to Bank Secrecy Act and anti-money laundering compliance.

New York Community's deal ranked sixth in the longest closing periods among bank deals announced since 2011.