Nintendo Co. Ltd. could soon turn on a new Switch video game console, in a move that analysts say would expand the device's target audience to include the rising number of consumers interested in purchasing more powerful gaming hardware. But there are some risks to the move.

Speculation about a new Switch model gained traction in August 2020 when multiple Asian media outlets first reported that Nintendo was planning to launch the device sometime this year. Although the company told its shareholders in February that new Switch versions would not be announced "any time soon," Bloomberg News reported in March that Nintendo plans to unveil the device, which would be equipped with a bigger OLED display from Samsung Display Co. Ltd., later this year. According to Bloomberg's sources, Samsung will start mass production of 7-inch OLED panels as early as June.

Although representatives from both Nintendo and Samsung declined to comment on the report, chatter surrounding a new Switch intensified after a follow-up report by Bloomberg suggested that the console would support technology from NVIDIA Corp. that would allow the console to reproduce game visuals at 4K quality when plugged into a TV.

Nintendo is no stranger to mid-generation console refreshes, so launching an overhauled version of the Switch would be an on-brand move for the company, analysts said. A handheld-only version of the console, the Switch Lite, already launched in 2019, while previous Nintendo portable systems including the Game Boy, Game Boy Advance, Nintendo DS and Nintendo 3DS all saw multiple iterations through their respective life cycles. However, launching a device that supports 4K ultra-HD resolution would be a first for the company, bringing it up to par with new consoles from Microsoft Corp. and Sony Group Corp.

"The target audience for a more powerful Switch will be core console gamers that are looking to get the most out of games both on the big screen and on the go," said Daniel Ahmad, a senior analyst at research firm Niko Partners.

More powerful hardware would also be beneficial to game developers, creating an environment where major titles designed for Sony's PlayStation 5 and Microsoft's Xbox Series X could be ported to Nintendo's device without too much hassle, Ahmad said.

The original Switch's $299.99 retail price has remained unchanged since it launched in March 2017. Bloomberg's internal analysts estimate that Nintendo could increase the price of the new console by as much as $100.

"Nintendo has always sold the Switch at a profit since its launch, unlike its competitors," Ahmad said. "We expect that Nintendo will attempt to launch its new SKU at the same price in order to reach a broad audience, but we could see a higher price if the power increase is significant."

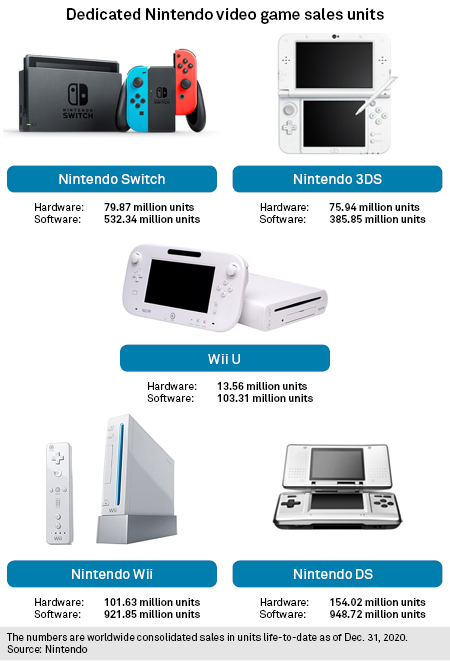

Neil Barbour, an analyst at Kagan, a media market research group within S&P Global Market Intelligence, noted that even Nintendo's least popular hardware, the Wii U, sold about 13 million units over a few years.

"Even if that's the basement, it's still probably enough for Nintendo to produce a high-end, high-margin Switch at $350 or $400," Barbour said. "It's also possible that more consumers see $400 as a value now that premium consoles cost $500."

Microsoft, Sony and Nintendo saw worldwide console unit shipments increase 13% year over year to 44.7 million in 2020 from 39.5 million in 2019, according to data from Kagan. The Switch alone racked up 27.4 million units, and Kagan believes the console could have enough momentum to overtake the Wii as Nintendo's most successful TV-connected console in terms of lifetime units shipped by 2022.

This year, worldwide console shipments are forecast to hit a record 54.7 million units, up 22.5% year over year. However, Kagan expects a new Switch model to be more of a stabilizing force in Nintendo's sales rather than a catalyst for additional growth.

"It's really unprecedented to see one console do two years of 27 million units shipped, and I'm not sure that a new Switch is necessarily going to drive the level of demand even higher," Barbour said. "If Nintendo really wants to drive sales, they need to tie a new Switch to one of their marquee franchises, like Zelda."

Niko's Ahmad added that the best way for Nintendo to replicate the original Switch's success with the new console is to continue focusing on the unique aspect of the product that caters to every type of gamer.

"Games and services will need to continue to be the main focus for the company going forward in order to attract more players to the platform," Ahmad said. "We believe there is opportunity for Nintendo to expand its library of games on Switch through additional backwards compatibility initiatives and cloud gaming."

Meanwhile, Chris Rogers — a global trade and logistics analyst at Panjiva, a business line of S&P Global Market Intelligence — cautioned that if Nintendo does plan to release a new console this year, it would face the same component shortages that are currently plaguing multiple industries.

"Nintendo may find that there is stiff competition for the available capacity at semiconductor manufacturers and for other components," Rogers said. "Building a new product that involves different parts means they will now be competing with not just other game console manufactures, but also laptop companies and even automakers."

Rogers said the argument could be made that the dearth of components could push Nintendo down to a second-tier customer for a lot of semiconductor providers.

"There are 17 million cars sold in the U.S. alone every year, and that's a lot more semiconductors needed," Rogers said. "So if Nintendo is putting together this new product, they're picking a tough time to do it."

Click here to listen to the latest episode of "MediaTalk," an S&P Global Market Intelligence podcast. In this edition, TMT reporter Anser Haider interviews Panjiva's Global Trade and Logistics Analyst Chris Rogers and Kagan analyst Neil Barbour, who tracks the technology and media sectors, about the current state of video game hardware, ongoing severe supply shortages and unprecedented demand for gaming.