The 2021-22 NFL season is officially underway, and the league's network partners say they are in strong positions with advertising sales.

Network executives at CBS (US), FOX (US) and NBC (US) all reported significant NFL pricing gains over last year and cited multiple reasons to be bullish on the 2021-22 season, including strong upfront and scatter pricing, an extended season and the growth of sports betting.

The optimism represents a stark contrast from the 2020-21 season, when COVID-19 concerns forced scheduling changes that moved some games to weekdays. NFL ratings declined 6.7% last season to 15.4 million viewers, from 16.5 million the prior season, according to data from Nielsen Holdings PLC.

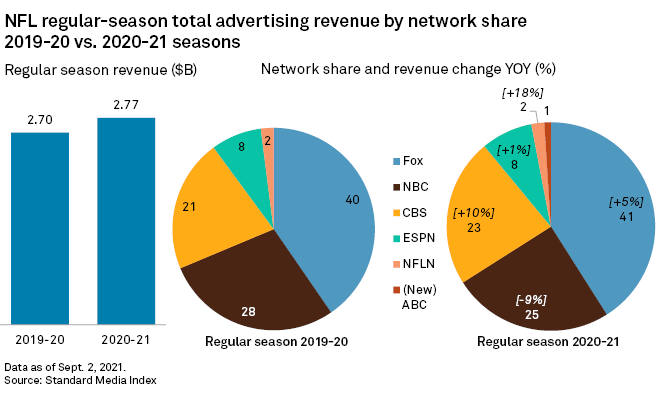

"We're all at the mercy of the ratings gods," Seth Winter, executive vice president of sport sales for FOX, said in an interview. FOX has commanded a lion's share of the regular season NFL ad revenue in the past two years, collecting 41% in 2020-21 as compared to 25% for NBC and 23% for CBS, according to data from Standard Media Index.

The NFL has taken several steps to expand its audience this year, striking new rights deals with additional streaming capabilities that stretch into the early part of next decade. Moreover, the networks' collective regular-season ad revenue take this season should improve from an additional week of sales, as NFL teams will now play a 17-game schedule.

Sports betting

The NFL ad market is further benefiting from the league allowing ads from seven sportsbooks companies to run inside game coverage. The networks also can include one ad per quarter, with an additional unit appearing in pre-game and halftime shows.

The ad sales executives all indicated they had struck deals with some of the sportsbook companies.

NBC's investment in one of these companies, PointsBet Holdings Ltd., "predicates a first look at our sportsbook inventory, but we've been able to work with all that have come to us to find some inventory for them across our portfolio of sports," NBC Sports Group Executive Vice President of Advertising Sales and Sponsorships Dan Lovinger, said during a Sept. 8 conference call with reporters.

Kagan analyst Scott Robson said sportsbook companies have "a lot of money to spend." He believes the national ads will help keep CPM (cost per thousand impressions) pricing high for the networks and is good for the marketplace overall, following the pandemic’s constraint of the restaurant and travel categories. Kagan is a media research group within S&P Global Market Intelligence.

CBS

Looking at the various networks, CBS registered more NFL money than usual during the upfront period, CBS Executive Vice President of Sports and Marketing John Bogusz said in an interview. During the upfront, content providers look to sell linear and digital schedules to media agencies and their clients ahead of the upcoming TV season.

Bogusz said CBS has registered double-digit NFL pricing growth over last season and is already sold out for a number of weeks and has limited inventory in other regular-season and post-season contests.

The insurance category continues to be a key driver for NFL ad sales. Bogusz said GEICO Corp., The Progressive Corp., State Farm Mutual Automobile Insurance Co. and The Allstate Corp. have all increased their ad outlays on the network's NFL telecasts. He also pointed to allocations from the FAANG companies, with Amazon.com Inc., Apple Inc., Netflix Inc. and Google LLC fueling CBS' NFL ad roster.

The network extended its halftime entitlement deal with Verizon Communications Inc., and other telcos are also on the books with significant spend, according to Bogusz.

As to the playoffs, Nickelodeon/Nick At Nite (US), ViacomCBS' kids network, will again offer an audience-dedicated NFL Wild Card game, as it did with New Orleans-Chicago last season.

For the most part, Bogusz said Nick's presentation will feature the same advertising roster as the CBS telecast, save for a few categories where they will be different copy from a marketer, or in a rare instance a promo will replace an ad that doesn’t align with the sensibilities of a younger audience.

NBC

With six months to go, NBC has under five spots to sell in Super Bowl LVI, slated for Feb. 13, and recent 30-second spots have commanded $6.5 million per unit, a record rate, Lovinger said.

In looking to maximize value for the remaining Super Bowl inventory, NBC has held back a couple of adjacent units in order to accommodate a marketer that might be interested in running a 60-second spot.

During last year's Super Bowl, CBS garnered $545 million of advertising from spots, according to data from Kantar Media Intelligences Inc.

As for the regular season, demand for "Sunday Night Football" is "incredibly strong," Lovinger said. Between its Super Bowl and regular-season coverage, the executive said NBC has scored business with auto and beverage marketers. He also pointed to the strength of the entertainment category, now a hybrid of studios running ads for theatrical releases and streaming services trumpeting their content offerings.

In addition to sports betting, "Digital wallets and cryptocurrency is a new category that's seen some interest," said Lovinger.

FOX

FOX's Winter said marketers began looking to the company's NFL, college football and MLB scatter inventory earlier than usual. During the scatter market, advertisers look to secure spots closer to a program's air date, usually at higher prices than negotiated during the upfront.

Winter said FOX's late Sunday-afternoon presentation is very well sold overall and neared its NFL ad sales projections before the season even kicked off. Insurance, automotive and telecom are top categories, with Winter also pointing to solid business with technology and retail marketers.

Sportsbooks aside, Winter said the cryptocurrency category is emergent on FOX's NFL, college football and MLB telecasts.

FOX has also scored a quartet of sponsorship deals for its recently launched NFL channel on free ad-supported service Tubi. At this point, Winter said Tubi is a relatively small contributor on the sports side, but it is an important asset for parent Fox Corp., which forecasts it will become a $1 billion business.

With NBC nearing the completion of its Super Bowl LVI ad lineup, Winter said FOX is poised to enter the ad market early for the 2023 NFL championship contest, as the company looks to capitalize on marketers looking to lock in spots amid the robust marketplace that could drive even higher prices a year from now.

The Walt Disney Co. officials did not respond to queries seeking the ad sales status for its "Monday Night Football" coverage.

The new season began Sept. 9 with NBC's coverage of defending champion Tampa hosting Dallas.