Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2022

By Joseph Williams and Darakhshan Nazir

While investors rewarded Netflix Inc. for its lower-than-expected subscriber losses in the second quarter, analysts remain concerned about the streaming company's long-term growth prospects.

Netflix reported a loss of 970,000 paid members globally during the quarter against guidance of a 2 million drop. More, it forecast membership growth of 1 million in the third quarter. Netflix hopes to reenergize growth by launching ad-based tiers to its platform in early 2023 and by monetizing accounts that are used across multiple households though password sharing. The company has also steadily raised prices in its most lucrative and mature markets to expand revenue, and its ad-supported tiers could create new pricing opportunities, Netflix executives said during a July 19 earnings webcast.

Investors celebrated the results, piling into the stock around the July 19 earnings release. Between July 14 through market close of July 20, Netflix shares were up 23.8%, a sharp reversal from the more than 70% drop the company endured through the first half of the year. While some analysts believe the company's efforts to reinvigorate subscriber growth will bear fruit, others say growth is coming from lower-revenue markets and ad-supported tiers could further erode revenues as legacy subscribers downgrade to cheaper options.

"Given the risk of elevated churn with every price hike from here, the realistic worry is that the company will be hard pressed to materially reaccelerate growth in [core] regions," MoffettNathanson analyst Michael Nathanson said in a July 20 note.

Hello, world

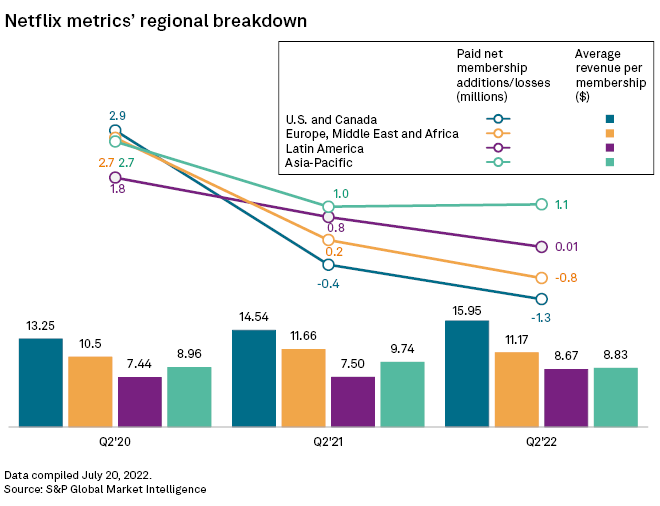

While Netflix lost 970,000 paid members globally, the company did not see losses across all its geographic segments. The Asia-Pacific region, which includes India, Korea and other Asia markets, reported the biggest gains, up about 1.1 million members and in line with prior-quarter growth.

However, monthly average revenue per member in the Asia-Pacific region declined to $8.83 from $9.74 a year prior. The decline in revenue per member was driven by price decreases in India and new plan options in the region, the company said.

The growth in low-revenue India memberships seems to be largely responsible for the company's beat against its global membership guidance, making the headline outperformance less savory, Pivotal Research Group analyst Jeffrey Wlodarczak said in a July 19 note on the results.

Unsubscribed

The company's largest reported market, the U.S. and Canada, tracked 73.3 million paid members who pay $15.95 per month on average for the service, the highest revenue per member among reported geographies. In that high-revenue market, the company shed 1.3 million members in the second quarter.

Its second-largest region, EMEA, which includes Europe and the Middle East, ended the quarter with 73.0 million members and average revenue per member of $11.17. The company saw memberships decline by about 767,000 in that geographic segment.

The U.S. and Canada may be fully penetrated by Netflix, and the addition of an ad-supported tier could result in flat paid memberships in those markets with lower revenue per member, Wlodarczak said.

The competitive landscape is also looking increasingly unfavorable to the Netflix thesis, Wlodarczak said. Where Netflix is as-yet a pure-play streaming company, streaming competitors such as Apple Inc., Amazon.com Inc. and Walt Disney Co. have high-margin businesses outside of streaming to support flexibility in their streaming strategy. Further, new upstart streaming platforms, like Paramount Global's Paramount+, are "incentivized to bid aggressively on content to drive subscriber growth," the analyst said, which could become a problem as Netflix halts content spending growth.

Guiding into the wind

Not all analysts are quite so bearish on the stock, however.

Despite the uncertainty around memberships, the company's financial strength and outlook merit a bullish thesis, Wedbush Securities analyst Michael Pachter said in a July 20 note, citing the company's guidance for 2022 free cash flow of roughly $1 billion.

"We are confident that Netflix is prudently positioning itself as an immensely and increasingly profitable company as long as its revenue growth remains relatively low," Pachter said.

Netflix's growth prospects and investment thesis remain firmly intact, executives said on the July 19 earnings webcast. Whatever the monthly cost of the service, it is far more affordable than seeing the same quality of content in a theater, CFO Spencer Neumann said, highlighting "Gray Man," a "big-budget action film" that will debut on the Netflix platform July 22. That value could make Netflix a strong entertainment option amid high inflation and a souring economy.

Further, all TV will be streaming TV soon enough, executives said.

"Streaming is working everywhere. Everyone is pouring in," CEO Reed Hastings said on the webcast. "It's definitely the end of linear TV over the next five, 10 years."