Netflix Inc. service in Russia has been suspended since March, which may complicate the company's efforts to reinvigorate subscriber growth around the world.

Estimates are somewhat mixed regarding Netflix's exposure to Russia, but the decline in Russian members and the inability to add new members in the country could hurt the company's ability to deliver the kind of growth numbers it saw in the past, analysts say. The company is set to report its first-quarter earnings results after market close April 19.

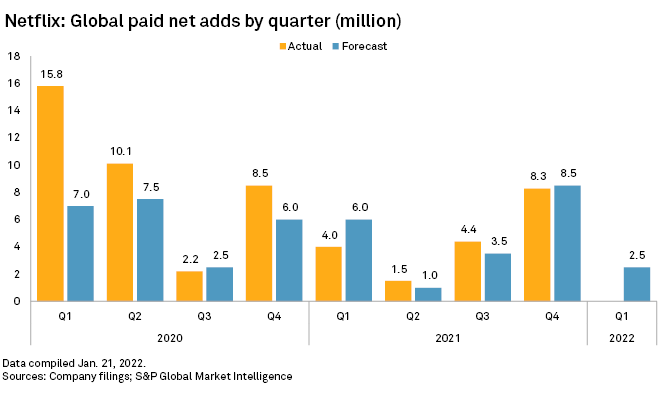

Netflix in January reported a membership miss for the fourth quarter of 2021 and issued guidance of a first-quarter 2022 membership gain of just 2.5 million, which would represent a year-over-year drop of about 36%. The muted forecast, and the fact that the Wall Street consensus puts first-quarter memberships in line with that guidance, could signal a shift in Netflix's scale of growth off the massive numbers posted through the pandemic, said Kagan analyst Seth Shafer.

"Everybody is looking at Netflix to see if last quarter's slightly disappointing guidance is going to be the new normal, or is Netflix going to manage to spring back like they have in the past," Shafer said. Kagan is a media research group within S&P Global Market Intelligence.

Further complicating Netflix's subscriber goals is the service's suspension in Russia. It is unclear if Netflix will count those suspended memberships in its total membership figures, but given that sanctions will likely hold until Russian President Vladimir Putin is removed from office, Netflix will not likely garner any growth in Russia at least through 2022, Wedbush Securities analyst Michael Pachter said.

"Even if Putin withdraws next week, as long as he's in power, I don't think we're lifting sanctions. We're looking for regime change," Pachter said. "It's probably going to hit their cash flow and their revenue."

Assuming Netflix has penetrated 10% of Russian households, that could account for as many as 5 million to 6 million memberships, which could be about $40 million in revenue, Pachter said.

Pachter's estimates land on the high end. Truist analyst Matthew Thornton estimates up to 1.5 million paid memberships in Russia. Shafer at Kagan estimates about 1.1 million as of the fourth quarter of 2021, but Kagan also pegs Russia as the highest growth country in Netflix's European segment, up 177.5% year over year in the fourth quarter.

Even without Russia, Netflix has had trouble sustaining growth, the pandemic period notwithstanding, and analysts and investors have pulled back the company's valuation to reflect this change. Year to date, Netflix has shed over 40% of its market capital, compared to an approximately 7% drop in the S&P 500.

So far, Netflix has managed to increase its revenue by increasing prices, especially in high-income markets like the U.S. and Canada, but there are natural constraints on how much the company can beneficially raise prices, said Alejandro Rojas, vice president at streaming media analysis firm Parrot Analytics. There are other levers the company can pull to generate some growth, but it is unclear if those will be enough to return the company to historic growth rates or if Netflix would even be willing to initiate some of those strategies.

"You hit a ceiling because people have limited attention, and they begin putting attention in other platforms, so pricing becomes less workable," Rojas said.

The company has been "reluctant" to consider advertising on its platform, which could generate additional revenue and allow Netflix to create lower-cost membership tiers and penetrate into untapped households, Rojas said. Its gaming strategy could drive some growth, but the scale and quality of growth are far from certain.

"The whole industry is going to get bigger than where we're at right now, and that's what we're seeing," Rojas said. "The big question for Netflix: Can they go to 900 million or 1 billion memberships? Can they get 5x where they are today?"