Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Sep, 2021

By Zoe Sagalow, Tayyeba Irum, and Zuhaib Gull

Nasdaq Inc.'s new diversity requirements could prompt hundreds of banks to select boards that better reflect the diverse customers they serve.

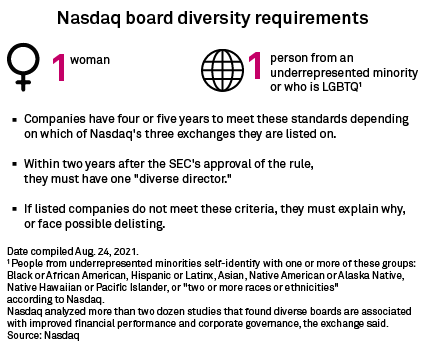

The rule requires companies to have at least one woman and one person from an underrepresented minority or from the LGBTQ community on their boards, or explain why they do not meet these criteria, to avoid being delisted.

Nearly 93% of Nasdaq-listed banks already have at least one woman on their boards, according to data from S&P Global Market Intelligence on 326 banks on the exchange, meaning they already meet half of the new requirement.

|

But most banks have not disclosed data beyond gender representation on their boards, so it is unclear how many have met the second requirement. They have two years to have either a woman or another "diverse" director on their boards, and four or five years to have both in place, depending on what Nasdaq exchange they are listed on.

Recruiting challenges

The new rule, which the U.S. Securities and Exchange Commission recently approved, poses fresh challenges to banks on the recruiting front, some stakeholders say.

Banks already have trouble finding suitable directors, as board members can face legal liability in the event of a bank failure, according to Bert Ely, principal of Ely & Co. Inc. The Federal Deposit Insurance Corp. usually sues a failed bank's senior management and directors to try to recover some of its losses for protecting depositors, said Ely, who has testified in failed bank cases as an expert witness on behalf of directors and officers of insurance companies.

"No director wants to go through that," Ely said. "Potential directors for banks have to give that a special consideration, versus serving on the board of directors of some local utility or manufacturing company or retail chain."

Meeting diversity standards can make the process even more challenging.

"And then when you start having to have categories of directors that meet certain social criteria, then that makes it even tougher," Ely said.

While larger banks have already made a push to diversify their boards in response to evolving public sentiment in recent years, smaller banks with more concentrated share ownership have been "less sensitive" to such public pressure, Ely said.

Meanwhile, John Sorensen, CEO of the Iowa Bankers Association, cautioned that top-down decrees on diversity may pose unintended consequences.

"The challenge becomes when you get a little too prescriptive on, in this case, the makeup of the board of directors of a bank, that often times can actually inhibit what you're trying to get done," he said. Flexibility and "giving financial institutions the ability to target markets" are important, he added. A "small subset" of banks that are members of his trade group are publicly traded, some of which are in rural markets, and there are at least six banks domiciled in Iowa that trade on the Nasdaq, he said.

"We think there are marketplace incentives that will drive the industry to do the right thing more often than not," Sorensen said, stating that enhanced diversity can give banks a competitive advantage.

|

Michael Hagedorn, CFO at New York-based Valley National Bancorp, said the new rule will make it harder to find board members, "but it's not impossible," and the effort will ultimately be worth it.

"Having people that are representative of the communities that we serve is going to help us achieve our goals," he said.

Hagedorn added that his company is currently above the minimums required by the rule, with two women and two men who identify as people of color on the bank's board.

James Angel, associate professor at Georgetown University's McDonough School of Business, said the diversity requirement will nudge companies to "think outside the box" when making board appointments. Perhaps a candidate lacks experience as a CEO but has been a CFO, a government official or worked in academia.

Moreover, while some board positions require narrowly defined qualifications, such as those for the audit committee financial expert, others do not, which could provide for a broader swath of candidates, Angel said.

Additionally, Craig Dwight, CEO of Michigan City, Ind.-based Horizon Bancorp Inc., said he believes banks are actually ahead of other industries when it comes to board diversity, thanks in part to regulatory oversight tied to the Community Reinvestment Act, a Civil Rights-era rule that seeks to ensure that low-income communities and people of color have access to financial services.

Although "boards have done a very good job," C-suites at banks are not as diverse as in other industries, he added.

Fixing the pipeline

One challenge to diverse board membership, according to multiple experts, is the aforementioned lack of diversity among C-suite executives at banks. Those individuals often comprise the pipeline of candidates to fill vacant board seats.

Changing the process of selecting board members could involve using different recruiting methods and altering how a company's pipeline of prospective board members is developed.

"There are plenty of women out there in business," said Georgetown's Angel. "There are plenty of people from previously underrepresented minorities out there. And it's just a question of searching for them, locating them and recruiting them."

Becky Heidesch, founder and CEO of WSS Executive Search, which offers recruiting services, said in an interview that it has been easier in the last few years to find candidates with the necessary experience and who meet diversity criteria because the pipeline has evolved to include women and people of color who have gained experience working in what has historically been a white male-dominated industry.

Sparse data

In establishing its new rule, Nasdaq partnered with Equilar Inc., which will help listed companies with board composition planning.

Kevin McManus, vice president and director of proxy services for investment research firm Egan-Jones Proxy Services, said data on ethnic and LGBTQ diversity have not been disclosed by companies historically. The company uses diversity information as part of its recommendations.

"In trying to buy such a database, we found that everyone had the same problem — diversity hasn't been disclosed in a meaningful and consistent way in the past," he said in an email. "Hopefully the Nasdaq rule will help change this."