Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Nov, 2022

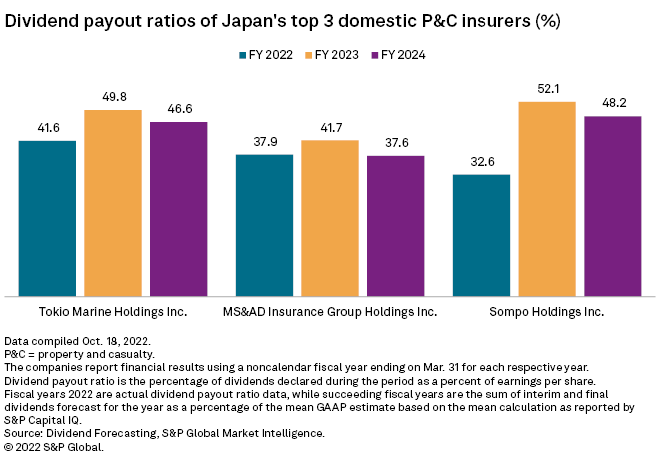

Japan's "Big Three" property and casualty insurers are expected to continue to increase their dividend payouts, even as they embark on an expansive international growth agenda.

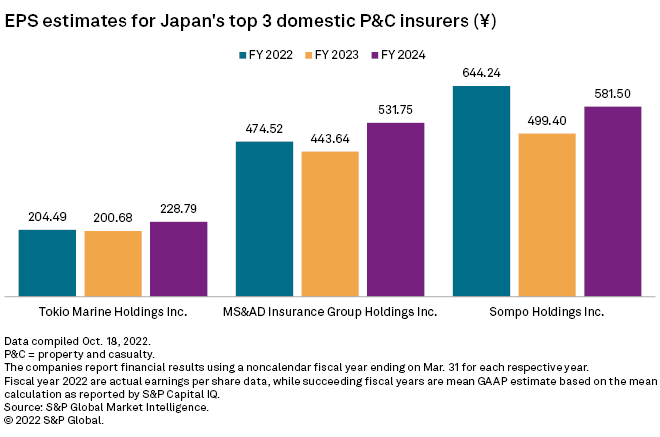

For the 2023 financial year, an S&P Global Market Intelligence analysis forecast that MS&AD Insurance Group Holdings Inc., Sompo Holdings Inc. and Tokio Marine Holdings Inc. will boost their dividend payout ratios even if they are foreseen to post lower EPS, underscoring their commitment to boosting dividends.

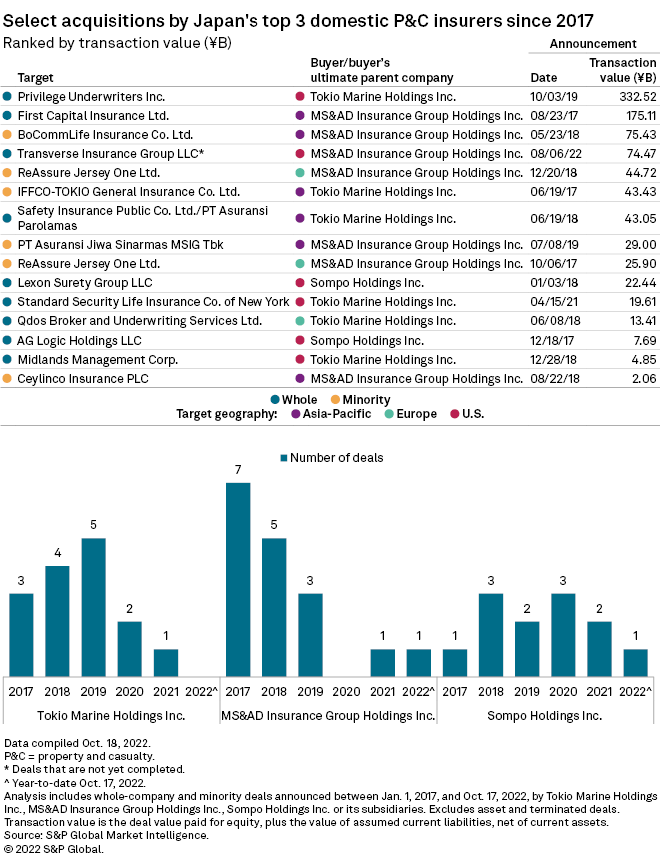

In its latest medium-term plan, covering 2022 to 2025 and discussed in May, MS&AD declared its intention to implement business and risk portfolio reforms. It would specifically shift toward international, life insurance and new businesses. The Japanese P&C giant was quick to act on the international front, confirming Aug. 10 that it is acquiring U.S.-based Transverse Insurance Group LLC for $400 million, or approximately ¥53.8 billion.

An MS&AD spokesman told S&P Global Market Intelligence the company does not expect the Transverse buyout to have a significant impact on its planned dividend payout because the deal is not that big in terms of overall size.

Irrespective of this appetite for overseas investment, S&P Global Ratings analyst Koshiro Emura agreed that MS&AD was on track to boost dividends. The company's dividend payout has a strong track record and it has consistently increased in absolute terms over the years, the analyst said in an interview.

Under the plan, the insurer is aiming to allocate 50% of group adjusted profit to shareholder dividends and share repurchases for the 2022 and 2023 fiscal years and 50% of return base profit for the 2024 and 2025 fiscal years.

MS&AD's dividend payout target is "not that difficult to achieve," Emura said.

MS&AD said during an investor relations meeting after announcing the acquisition of Transverse that it still has the risk appetite to invest overseas. MS&AD has a stronger risk appetite for U.S. specialty lines, Emura said, noting that international subsidiary MS Amlin Underwriting Ltd. has been posting "very poor" results.

MS Amlin's performance, which has been hit by climate change, partly encouraged the insurer to pursue the Transverse deal, the MS&AD spokesman said.

In terms of future M&A plans, MS&AD said it could look at Asian insurers as it plans to generate pretax profit of ¥18 billion from new business in the fiscal year starting April 2025, the last year of its midterm business plan, the company spokesman said.

Sompo's ageing domestic market

For the expansion of its overseas business, Sompo will explore an acquisition or investment in the U.S. or Europe in a push to shift away from a home market hit by an ageing and declining population, a company spokesman said.

The insurer is also "looking at startups with a technological edge" inside and outside of Japan for a potential acquisition, the spokesman added, as Japanese insurers are increasingly teaming up with auto-related partners to accelerate their auto insurance businesses.

In its three-year plan to March 2024, Sompo set a reserve of ¥600 billion for growth mainly through acquisition or investment. It also plans to raise the percentage of its profits that come from overseas markets to more than 30%, up from 14.8% for the fiscal year ending March 2021.

Sompo does not expect any acquisition to impact its planned dividend payout, the spokesman said, adding "that's what we promise[d] ... investors." The company is aiming for a 5.8% dividend yield in the fiscal year ending March 2024, up from 3.9% for the fiscal year ending March 2022.

|

* Access dividend projections on Eclipse by S&P Global. * Use this template to get an insight on insurance companies' dividend capacity. |

Tokio Marine eyes specialty expansion

Tokio Marine, whose U.S. businesses include Pure Group and HCC, is looking to grow annual profits by around 7%, while it intends to diversify its M&A risk in terms of products and regions, a company spokesman said. U.S. and European businesses providing specialty insurance, such as cyber cover, also remain attractive investment targets, the company added.

Like its Japanese peers, Tokio Marine said it will stick to its dividend payout plan regardless of its M&A strategy. It aims to increase its dividend payout ratio to 50% in the fiscal year ending March 2024, up from 48.5% in the previous year, a company statement said.

The three insurers "will continue to search actively for an investment into their peers outside Japan," said Tsuneo Watanabe, an executive at Nihon M&A Center, a Japanese M&A advisory firm.

Asia should be a critical region where the insurer's can extend their reach with a potential acquisition given the its growing population, Watanabe added.