Mainland Chinese banks will likely have insulation against the impact of the property sector slowdown due to their robust capital buffers.

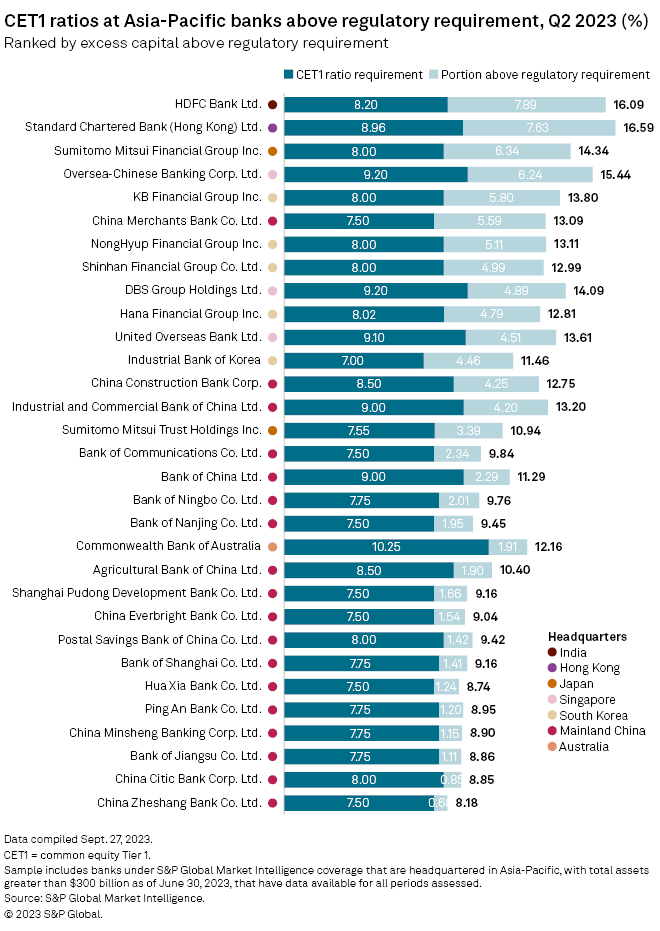

While some banks saw capital ratios decline likely due to write-offs of bad mortgages, the overall common equity tier 1 (CET1) capital ratios of 31 Asia-Pacific banks, each with assets exceeding $300 billion, surpassed the required minimum as of June 30, according to S&P Global Market Intelligence data.

Twenty of these banks posted enhanced CET1 ratios compared with the previous year, reinforcing their buffers.

Among the 18 mainland Chinese banks included in the sample, the performance varied. While eight lenders including Industrial and Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. saw a year-over-year decline in their CET1 ratios, the remaining banks showed improvements. Nevertheless, all lenders remained above the minimum regulatory requirement.

Property drag

Mainland Chinese banks "wrote off increasing nonperforming loans to the real estate industry," negatively impacting net profits and capital ratios, Kokichiro Mio, a senior economist at NLI Research, told Market Intelligence in an email. Mio, who covers the Chinese economy, believes the real estate-related problem would not be resolved in the near future, "but that won't lead to an infusion of public funds into banks." Banks' profitability may likely remain stable in the coming months.

China's property sector, which accounts for nearly a quarter of the country's GDP, will weigh on the economy's growth momentum in the second half, analysts estimated. Despite measures implemented by authorities, such as interest rate cuts and initiatives to boost housing demand, challenges persist for the world's second-largest economy. In September, S&P Global Ratings revised its real GDP growth forecast for China to 4.8% in 2023 and 4.4% in 2024, citing concerns over the "troubled property sector, uncertain local government finances and softer exports."

Meanwhile, mainland Chinese lenders face slower earnings growth, despite a strong second quarter. The banks are confronted with ongoing pressure on net interest margins and a subdued economic growth outlook, which pose potential obstacles to their progress, analysts told Market Intelligence in late September.

Many banks in the rest of Asia-Pacific continued to strengthen buffers, the data showed. Notably, South Korea's KB Financial Group Inc. experienced the most significant improvement in its CET1 ratio, rising 87 basis points to 13.80%.

Among the banks included in the sample, Standard Chartered Bank (Hong Kong) Ltd. posted the highest CET1 ratio at 16.59%. Following closely in the ranking of lenders with substantial buffers were India's HDFC Bank Ltd. with a CET1 ratio of 16.09% and Singapore's Oversea-Chinese Banking Corp. Ltd. with 15.44%.

However, Japan's Sumitomo Mitsui Trust Holdings Inc. saw a decline of 1.19 percentage points in its ratio, dropping to 10.94%. Similarly, both Singapore's DBS Group Holdings Ltd. and South Korea's Hana Financial Group Inc. reported year-over-year decreases in their CET1 ratios.