Natural gas utilities largely surpassed Wall Street's expectations during the latest earnings reporting period, though year-over-year profit growth remained elusive for many gas distributors.

Six out of nine gas utility operators selected by S&P Global Commodity Insights topped S&P Capital IQ consensus EPS forecasts in the quarter that ended March 31.

Spire Inc. posted the group's largest earnings beat, followed by Garden State gas distributors New Jersey Resources Corp. and South Jersey Industries Inc.

Southwest Gas Holdings Inc. fell short of expectations by the widest margin. One Gas Inc. and Northwest Natural Holding Co. also missed the mark.

However, few members of the group managed to grow EPS from the year-ago period. In each of the past three reporting periods, less than half of the group has posted year-over-year earnings growth.

Only three gas distributors topped year-ago EPS in the latest period: Chesapeake Utilities Corp., Atmos Energy Corp. and One Gas.

Chesapeake Utilities has posted nine straight quarters of year-over-year earnings growth, and it reported a decline just once since 2019. Atmos and One Gas have also boasted strong track records. Both posted year-over-year EPS declines just twice over the past four years.

New Jersey Resources posted the group's largest year-over-year EPS decline in the latest reporting period, partly due to an unfavorable comparison to unusually strong performance in the first quarter of 2021. Southwest Gas, which posted the second-largest EPS drop from a year ago, has now posted declines in four straight quarters.

Despite the string of declines, Southwest Gas now leads the group in share price gains for the year. Southwest Gas recently resolved a proxy battle with activist investor Carl Icahn, and executives are preparing a potential sale of the company.

Until recently, South Jersey Industries led the group in year-to-date stock price gains, bolstered by the announcement of its planned $8.1 billion buyout by an investment fund advised by JPMorgan Chase & Co.

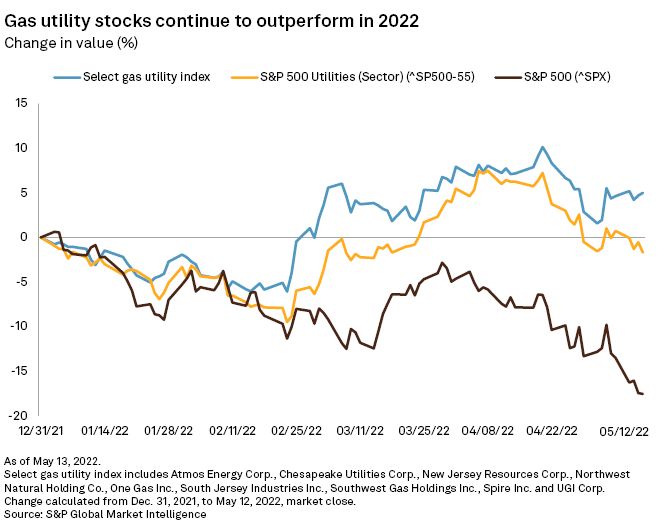

The select index of gas utilities as a whole has strongly outperformed the broader stock market, which approached bear market territory recently. In addition to recent dealmaking bolstering gas utility valuations, investors have pivoted to safe haven assets such as utility equities at a time when market conditions already supported gas distributor stocks, according to industry watchers.

Chesapeake Utilities and UGI Corp., two diversified gas utility operators that led peers in stock price gains in 2021, were the group's only constituents still trading in negative territory in 2022.

While many gas distributors reported that inflationary headwinds were not yet impacting their business, volatile commodity costs have buffeted UGI's European energy segment. Company executives said they will consider selling UGI International LLC's natural gas and electricity marketing business.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.