Sempra Energy's preliminary deal with Mitsui & Co. Ltd. for LNG volumes from expansion projects in Louisiana and Mexico marked another instance of an export partner supporting the company's push to become one of the top LNG exporters in North America. But the agreement was unlikely to bump up the timelines for those projects, as the company focuses on getting higher-priority LNG export ventures over the line.

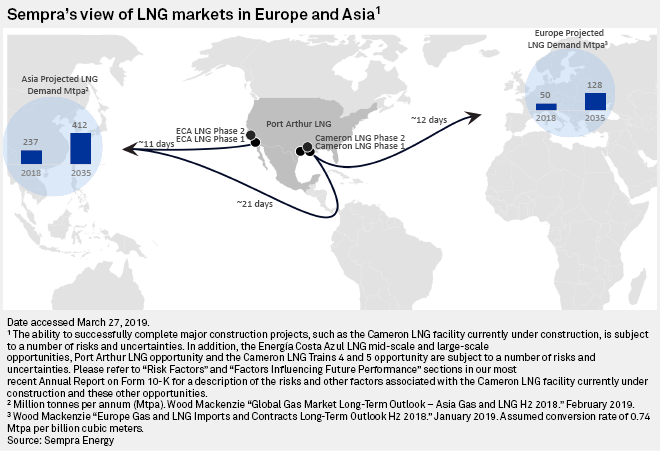

Mitsui and Sempra on Oct. 28 announced a non-binding memorandum of understanding that calls for the Japanese global trading and investment giant to buy up to one-third of the available capacity on a two-train expansion of the Cameron LNG terminal in Louisiana. Mitsui also agreed to purchase the potential offtake of about 1 million tonnes per annum and equity participation in the planned expansion of the Energía Costa Azul terminal, or ECA, in Baja California.

In doing so, Mitsui joined an early backer of the original $10 billion Cameron LNG facility in endorsing Sempra's expansion plans. France's Total SA struck a deal in 2018 that provided a framework to cooperate in the development of the ECA and Cameron LNG projects. Both Mitsui and Total are joint venture partners in Cameron LNG LLC through affiliates, along with units of Sempra and a company jointly owned by Mitsubishi Corp. and Nippon Yusen Kabushiki Kaisha.

"It's probably helpful longer term, but it wouldn't pull forward those timelines for me," said Michael Webber, managing partner of the export-focused investment research firm Webber Research & Advisory LLC, in an interview about the Sempra projects. "They have more than enough on their plate."

Sempra expects to start up the second and third trains of Cameron LNG by mid-2020, bringing the estimated total capacity to 12 mtpa and completing the original project. The first train started commercial operations in August.

In terms of additional projects, a top Sempra LNG executive said as recently as late September that the company's focus was to greenlight an earlier phase of the ECA project that would convert the facility from an import terminal to a bidirectional terminal with a planned export capacity of about 2.4 mtpa. Sempra's Infraestructura Energetica Nova SAB de CV unit said Oct. 24 that it would delay plans to commercially sanction this project until the first quarter of 2020 as it works to finalize commercial agreements, regulatory permitting, and engineering, procurement and construction arrangements.

Next in the queue would be a final investment decision on the Port Arthur LNG project in Texas, which Sempra hopes to do around the middle of 2020, according to Justin Bird, president of Sempra's LNG unit. Bird talked to S&P Global Market Intelligence and S&P Global Platts at the Gastech conference in Houston on Sept. 19.

In May, Sempra reached a preliminary deal with Saudi Arabian Oil Co., also known as Saudi Aramco, that calls for the state-run oil company to take a 25% stake in the Port Arthur project, which has a targeted export capacity of 11 mtpa from two liquefaction trains. The deal needs to be finalized, and Sempra is working to secure additional supply deals before commercially sanctioning the project.

"Then I think the timing gets a little bit less certain," Bird said about the projects further down the line.

There are three projects that fall into this category. The Cameron LNG expansion would add about 8 mtpa of LNG capacity. The second phase of the ECA project would amount to about 12 mtpa. As of September, Sempra was still determining what approach it wanted to take for this next phase, which could require a new marine berth and a significant pipeline project. And an expansion of Port Arthur LNG has been in the prefiling process with the Federal Energy Regulatory Commission since June. The Port Arthur expansion would double the nameplate production capacity of the terminal to 27 mtpa.

"They are not all going to get done in the next six to nine months," Webber said. "It's a question of which ones they are prioritizing."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.