Dozens of banks reported net losses in the first quarter, many because they opted to build their reserves by the millions ahead of any pandemic fallout.

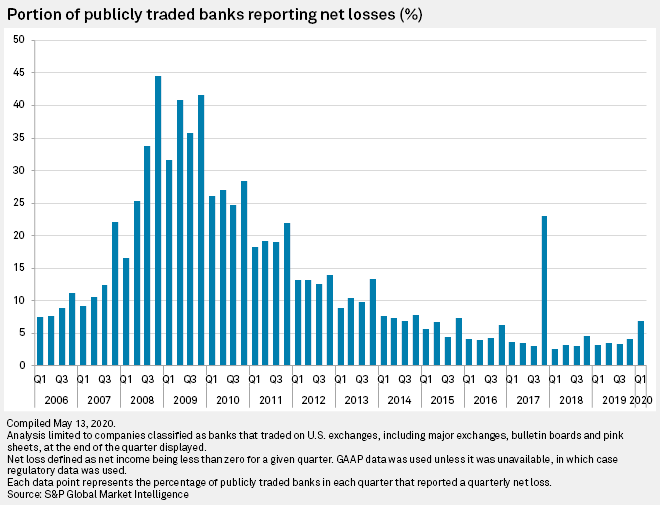

Forty-one publicly traded banks reported a net loss in the first quarter, representing 7.0% of banks. It was the highest percentage of money-losing banks since the 2017 fourth quarter when tax cut legislation forced the write-down of significant deferred tax assets.

Comerica Inc. was the largest bank to report a net loss in the first quarter. The $76.34 billion bank posted a net loss of $65.0 million, largely driven by a $411 million provision for credit losses, up from a reserve release of $13 million a year ago.

Other energy-exposed lenders also reported net losses, including Texas Capital Bancshares Inc., Hancock Whitney Corp. and Cadence Bancorp.

"Banks without energy exposure posted poor earnings in a lot of areas because of the required reserve build, so when you have energy exposure on top of the broad weakness in economic forecast, that drove even larger provisions," said Gary Tenner, an analyst for D.A. Davidson.

Oil markets have been hammered due to lockdown orders that have sapped energy demand. Combined with the implementation of a current expected credit loss standard that generally requires greater provisioning, the first-quarter spike was dramatic. Analysts said in interviews that it will not be the only reserve build this year.

"I don't want to call Q1 a non-event, but it's just the start," said Brett Rabatin, a consultant with The Travillian Group. "Given what's happened in the first quarter, it's pretty obvious you're going to see another quarter of pretty heavy provisioning."

While analysts expect loan loss provisioning to weigh on earnings for the first half of 2020, a potential second-half recovery could turn those reserves into profits.

Even under the incurred loss model, CECL's predecessor, the banking industry tends to release reserves after recessions. While the 2008 financial crisis caused losses great enough to fell hundreds of banks, the rest of the industry released millions of dollars of reserves from 2011 through 2016.

If the economy does start to recover in the third quarter as consensus forecasts predict, the banks taking lumps today could see earnings tailwinds by year-end. Investors, bankers and analysts have said they expect CECL to increase the volatility of earnings in recovery as well.

"It feels like we could see an earlier, more aggressive build, and then when there's an all-clear sign, the recovery in reserves happens more quickly," Tenner said, adding that economic projections will drive provisioning. "My expectation is that provision levels remain elevated in the second quarter. Beyond that, it's anyone's guess."

First-quarter loan losses remained broadly minimal even for energy-exposed banks. Oil has bounced back modestly from April lows but remains below many borrowers' break-even points. Whether banks experience losses will largely depend on how long oil prices remain depressed, said Brady Gailey, an analyst with Keefe Bruyette & Woods. If oil enjoys a second-half recovery, losses could be minimal.

"Banks did a good job of getting ahead of it and proactively building reserves," Gailey said in an interview. "I would not expect a lot of these banks to report full-year losses."

However, if the recovery fails to materialize in 2020, banks will need to continue building reserves just as charge-offs start accumulating.

Provisioning was not the only driver of net losses in the first quarter. Several banks reported significant goodwill impairments that dragged their bottom lines. Umpqua Holdings Corp. recorded the largest impairment at $1.78 billion, followed by PacWest Bancorp, which booked a $1.47 billion impairment. With stock valuations below tangible book value for many banks, the prospect of goodwill impairments could increase through year-end.

However, analysts said the goodwill impairments should not weigh on banks' stocks considering goodwill is recorded as an intangible asset and markets tend to focus on tangible book value.