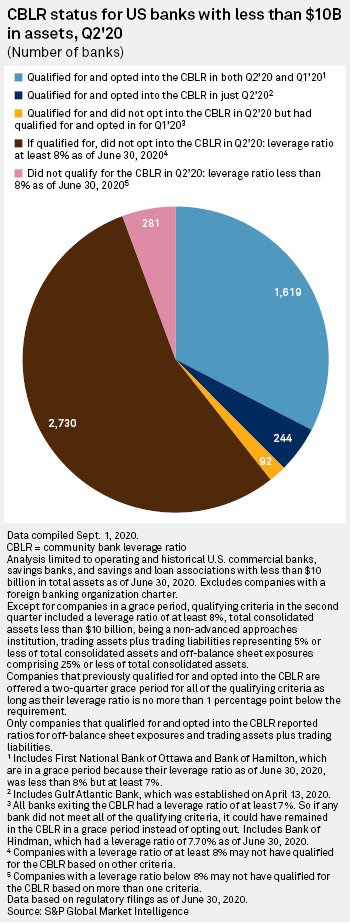

Most community banks qualified for the Community Bank Leverage Ratio based on reported leverage ratios, but a majority declined to take advantage of the single ratio designed to reduce reporting requirements.

Bankers said the regulatory relief has failed to gain traction due to a lack of significant time savings, difficulty comparing performance with peers and an influx of both deposits and loans stressing leverage ratios. Nearly 100 banks exited the CBLR after adopting it in the first quarter, and more than 2,700 community banks that qualified as of June 30, based on asset and leverage requirements, declined to adopt it.

The CBLR allows certain banks below $10 billion in total assets to report only one leverage ratio instead of the four capital ratios required under Basel III. In the first quarter, banks needed a leverage ratio of greater than 9% to take advantage, but that was reduced to 8% as part of the CARES Act. The minimum will move up to 8.5% in 2021 and return to 9% in 2022. Banks that adopt the CBLR and then report a leverage ratio no more than 1 percentage point below the minimum are allowed a two-quarter grace period.

|

Of the 4,966 banks that met the asset requirement as of June 30, excluding companies with a foreign banking organization, less than one-third opted into the program in both the first and second quarters of 2020. The number of banks using the CBLR increased in the second quarter with 244 banks entering, partially offset by 92 banks deciding to exit after adopting in the previous quarter.

"If we had a permanent CBLR of 8%, I think you wouldn't see these defections back to risk-based," said Christopher Cole, senior regulatory counsel at the Independent Community Bankers of America, which has lobbied for a permanent threshold of 8%. The impact of Paycheck Protection Program loans on balance sheets and capital ratios could also be a factor in returning to Basel III ratios, Cole said.

Zebulon, Ga.-based United Bank opted out of the CBLR after adopting the ratio in the first quarter. The bank easily qualified in the second quarter, as well, with a leverage ratio of 10.03%.

The decision to return to the four ratios was a result of the pandemic and the need to be flexible given the uncertain economic environment, said United CEO James Edwards Jr. in an interview.

"[The CBLR] wasn't that much time saving, and [switching back] did give us more options if the economy really deteriorated," said Edwards.

The rise in deposits, which creates additional assets and depresses the leverage ratio, also affected United's decision, Edwards said. "Deposit growth has just been phenomenal, and that obviously has the ability to stress capital levels."

While using the ratio saved some time, Edwards said it was not a significant amount, and it made it difficult to compare performance between United and its peers.

|

Edwards said the bank may reconsider entering the CBLR once the pandemic ends. "The time to be conservative is well before the high wind hits your boat, so to speak," he said.

Despite so many exits, two banks opted to stay in the CBLR framework even though their ratios dropped below the 8% threshold. Ottawa, Ill.-based First National Bank of Ottawa and Hamilton, N.D.-based Bank of Hamilton both dropped below the 8% minimum and entered the two-quarter grace period during which they either return to compliance or have to switch back to the Basel III ratios.

First National Bank of Ottawa President and CEO Steven Gonzalo said the Paycheck Protection Program was the reason the bank's ratio fell below 8%. The bank loaned $194.8 million as of June 30 through the PPP, which counted toward their CBLR. "In the call report for June 30, we were allowed to identify PPP loans, because of their unique structure and the guarantee, but they didn't change the leverage ratio calculations [to account for PPP]," Gonzalo said in an interview. He said the bank is "comfortably above" the 8% threshold without the PPP loans.

Once the PPP loans are forgiven, the bank will be able to continue using the CBLR. Gonzalo said the bank's holding company is also raising capital, which it can use to boost its leverage ratio if the PPP loans are not forgiven before the end of the third quarter.

|

First National Bank of Ottawa chose to use the CBLR because it is more straightforward when working with regulators, Gonzalo said. Although the bank still calculates the three other ratios for internal purposes, using the CBLR allows the bank to be clearer about its narrative.

"From a strategic perspective, and from a regulatory perspective, the additional narratives around the other leverage ratios don't need to come into question," he said. "We're above 8[%], therefore we're fine, we're done."