S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity is placing fewer bets in the financial technology sector, but those bets are getting larger as the investment focus shifts to late-stage funding rounds.

Private equity- and venture capital-backed fintech investments totaled $11.45 billion across 239 deals between Jan. 1 and Oct. 31, S&P Global Market Intelligence data shows. While the number of deals appears set for a third consecutive annual decline in 2024, deal value this year has already exceeded the 2023 full-year total of $7.97 billion.

Private equity poured nearly $40 billion into the fintech sector in 2021, with a significant portion of that capital flowing to startups that did not pan out. Chastened investors have stepped up their due diligence, and this year's investment activity has been more likely to target established fintechs and late-stage funding rounds, according to Sampath Sharma Nariyanuri, senior fintech analyst for 451 Research.

The uptick in private equity investment in fintech coincides with a brightening outlook for the sector, which got a boost from this year's interest rate cuts, Nariyanuri added.

Read more about rebounding private equity investment in the fintech sector.

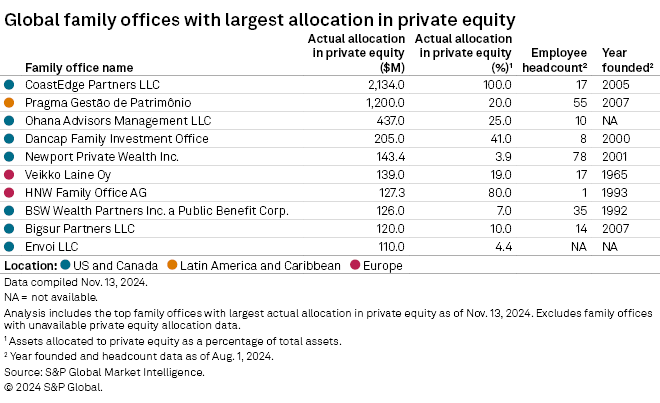

CHART OF THE WEEK: Ranking family offices with the largest private equity allocations

⮞ With $2.13 billion committed to the asset class as of Nov. 13, US-based CoastEdge Partners LLC tops the list of global family offices with the largest allocations to private equity, according to Market Intelligence data.

⮞ Brazil's Pragma Gestão de Patrimônio ranked second, with $1.2 billion allocated to private equity investments in its portfolio.

⮞ Private equity investments offer the potential of beating public market returns, but the lack of liquidity can be a risk for family offices, according to Hugo King-Oakley, head of private markets at Global Partnership Family Offices, an industry association.

TOP DEALS AND FUNDRAISING

– GTCR LLC agreed to invest $1.33 billion in testing and quality engineering company Tricentis GmbH. GTCR and Insight Venture Management LLC will have equal representation on the company's board.

– Fortress Investment Group LLC agreed to buy Loungers PLC in an all-cash deal that values the café, bar and restaurant chain at about £350.5 million.

– Kinderhook Industries LLC agreed to sell language solutions provider ZP Better Together LLC to Teleperformance SE. Teleperformance will merge ZP to Language Line Services Inc. as part of the deal.

– EQT Partners AB agreed to sell digital infrastructure owner and operator Melita Ltd. to Goldman Sachs Asset Management LP for an undisclosed amount.

– LeapFrog Investments raised $1.02 billion at the close of its fourth fund. The vehicle invests in healthcare and financial services companies in growth markets.

MIDDLE-MARKET HIGHLIGHTS

– Nautic Partners LLC agreed to buy Berry Global Group Inc.'s specialty tapes unit for about $540 million. The transaction is expected to complete in the first half of 2025.

– Kingswood Capital Management LP acquired cybersecurity company Identity Theft Guard Solutions Inc. from ZeroFox Holdings Inc. Terms of the deal were not disclosed.

– Argosy Capital Group Inc. exited its investment in frozen dessert company Rita's Franchise Co. LLC.

FOCUS ON: BIOTECHNOLOGY

– Biotech company Adcendo ApS raised $135 million in a series B funding round led by TCG Crossover Management LLC.

– Protein engineering company Cradle Bio BV secured $73 million in a series B round led by Institutional Venture Partners.

– Biopharmaceutical company 35Pharma Inc. secured $53 million in a series C financing round led by Frazier Life Sciences Management LP.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter