Commercial real estate loans continued to be a source of robust growth for banks in the first quarter, but the rest of the year will likely tell a different story.

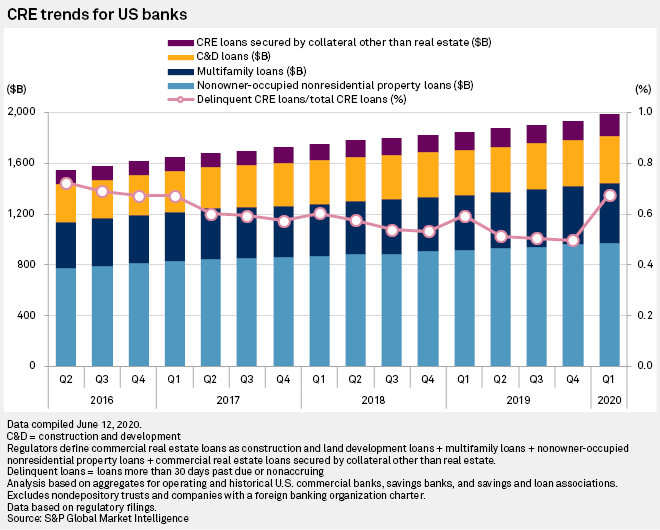

Total CRE loan balances owned by banks grew 7.7% year over year in the first quarter to an aggregate balance of $1.987 trillion across the industry. But bankers project a slowdown due to the COVID-19 pandemic, which has cast doubt on the valuation of all asset classes, particularly on certain types of commercial real estate, such as office buildings that face an uncertain future as companies experience the cost savings of widespread work-from-home arrangements. Several lenders have said the direction of valuations and the impact of the pandemic will be largely unknown until the third or fourth quarter.

"I do think you will see continued demand for office space, and you may see some changes in geographies over time. But it is a little early to call. You have a lot of competing factors out there, including a very low and supportive interest rate environment," Jonathan Pollack, global head of real estate debt for The Blackstone Group Inc., said at a recent conference.

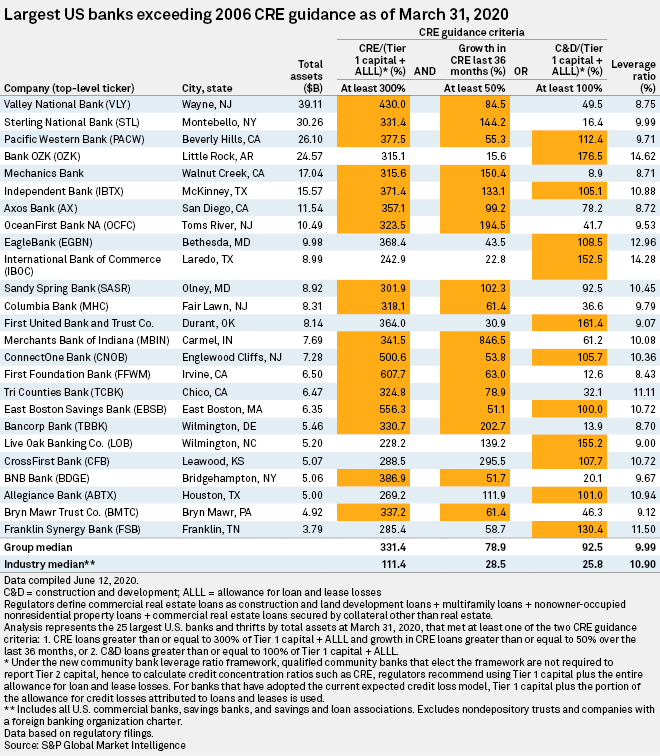

The number of banks considered to be "concentrated" in commercial real estate ticked up slightly in the first quarter to 390, compared with 387 in the linked quarter. But regulators changed the calculation in the first quarter, using Tier 1 capital and loan loss reserves instead of risk-based capital. There are two tests to qualify banks as concentrated in commercial real estate, which subjects banks to additional regulatory scrutiny. In one test, a bank is concentrated in CRE if its CRE loans account for 300% of capital and their CRE balance has grown 50% or more in the last three years. In the other test, banks are concentrated in CRE if construction-and-development CRE loans account for 100% of capital.

Bankers at companies considered concentrated in CRE have expressed comfort with their portfolios. With $39.1 billion in assets, Valley National Bancorp is the largest bank to meet the criteria for being concentrated in CRE. Valley National's chief banking officer, Tom Iadanza, said on the bank's earnings call that its restaurant and hotel loans, the portfolios arguably at greatest risk in the pandemic, were "pretty much 100% secured by real estate." He said hotel loans tend to have a loan-to-value ratio of 59% and restaurant loans in the 65% range.

"In each of these categories, we carry personal guarantees. We believe it's fairly well-protected, but there is still uncertainty as to when they come out," Iadanza said.

Even though the COVID-19 pandemic did not play much of a role in the first-quarter data, the delinquency rate for CRE loans still showed a noticeable bump. In aggregate, 0.68% of CRE loans held by banks were delinquent in the first quarter, an increase of 18 basis points from the previous quarter and 8 basis points higher than the year-ago quarter.

Ultimately, the performance of commercial real estate — and whether banks with concentrated exposures feel the pain — will depend on the virus, local markets and the ability for businesses to recover.

"Interestingly and encouragingly, we are seeing as the economy opens up and as hotels are allowed to be open, some early strength in occupancy that I think is beyond what expectations might have been," said Michael Wiebolt, senior managing director for Blackstone Group. "And so we are quite optimistic about that, obviously, subject to what happens with the progression of the virus."

Click here to download an Excel spreadsheet showing all banks with CRE concentrations above regulatory guidance.