Moderna Inc. expects to fall short of previous 2021 predictions for its COVID-19 vaccine Spikevax due to manufacturing delays and market over-saturation in wealthier countries.

The vaccine-maker — which has only one approved product — now anticipates between $15 billion and $18 billion in 2021 revenue from the delivery of 700 million to 800 million doses, executives said on Moderna's third-quarter earnings call Nov. 4. The company had predicted in August that it would see $20 billion from 800 million doses.

Looking ahead to 2022, Moderna expects to bring in between $17 billion and $22 billion, executives added.

The company has prioritized delivery to low-income countries through contracts with the World Health Organization's COVAX initiative and the African Union, Moderna CEO Stephane Bancel said, which has affected 2021 sales predominantly. The added complication of delivering doses to these regions has caused some of the expected revenue to be pushed into next year.

"In Q2, the challenge we had internally was all about filling vials, and the complexity of Q3 has really moved to the back end of the supply chain, which is releasing and shipping product," Bancel said.

The number of delivered doses is expected to rise dramatically next year, the CEO added, with Moderna supplying as many as 3 billion shots in 2022.

The 208 million doses delivered in the third quarter of 2021 brought in $5 billion in revenue, which was below analysts' consensus expectations of $6.2 billion.

"Overall, we would expect pressure on Moderna today given the lower-than-expected sales," Morgan Stanley analyst Matthew Harrison said in a Nov. 4 note. "However, we note that lower 2021 revenues make the comparison easier for 2022, a key dynamic for the stock."

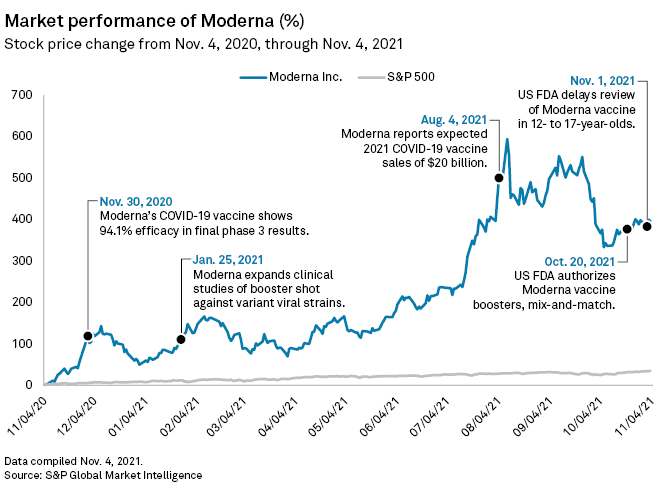

Moderna's stock was down 18.7% to $281.23 per share as of 12:44 p.m EDT on Nov. 4.

The company's share price had previously risen 1,952% from $23.61 on March 11, 2020 — the day WHO declared the COVID-19 outbreak an official pandemic — to a peak of $484.47 at market close Aug. 9, 2021, according to S&P Global Capital IQ Pro data.

The U.S. Food and Drug Administration said Nov. 1 that the agency's review of Moderna's vaccine in children aged 12 to 17 years would be delayed due to concerns about very rare side effects such as myocarditis, an inflammation of heart tissue. This could move the evaluation out to January 2022, Moderna president Stephen Hoge said on the call, while vaccine rival Pfizer Inc. has already received such an authorization.

"The most important thing to recognize is that the Pfizer adolescent vaccine was authorized prior to any substantial discussion about myocarditis as a risk," Hoge said. "In fact, the signal emerged a few weeks later just before we made our filing ... and it's in the face of those continuing and emerging questions that the FDA is being diligent and appropriately conservative in their approach."

Moderna's trials have shown no increased rate of myocarditis among the 12 to 17 years age group, Hoge said.

"Moderna has been a key player in the COVID-19 pandemic since the approval of their mRNA vaccine," Third Bridge senior analyst Mikaela Franceschina said in a Nov. 4 note. "In the third quarter, Moderna received authorization for their vaccine in India and Australia as well as a green light for booster shots for the immunocompromised which will further drive sales growth."

The outlook for the FDA's decision about pediatric shots is "likely to be positive," Franceschina added.

Next up: Flu

Moderna is also turning the mRNA technology that allowed it to become one of the first developers of a COVID-19 vaccine toward influenza and respiratory syncytial virus.

The company is expecting early-stage results for its flu vaccine soon and has begun developing a booster that would include both COVID and flu shots together — with ambitions to ultimately combine it with an allergy shot.

"We believe that combining flu and COVID in a single dose and then adding allergy is the critical central part of our strategy," Bancel said on the call. "We think it has tremendous value for compliance, for protection and strong value in convenience to the consumers."

Some of Moderna's work beyond vaccines could also become longer-lasting revenue pockets, Third Bridge's Franceschina said.

"Moderna has taken the plunge to further expand their efforts with its mRNA technology to develop better solutions for infectious and rare diseases," Franceschina added. "The company's main value driver will come from vaccines but the low-hanging fruit for mRNA technology is gene editing."