Mitsubishi UFJ Financial Group Inc. will likely continue to face higher credit risk than two other Japanese megabanks in the near term as the lender's larger international operations leave it more exposed to loan defaults in economies hit hard by the coronavirus pandemic.

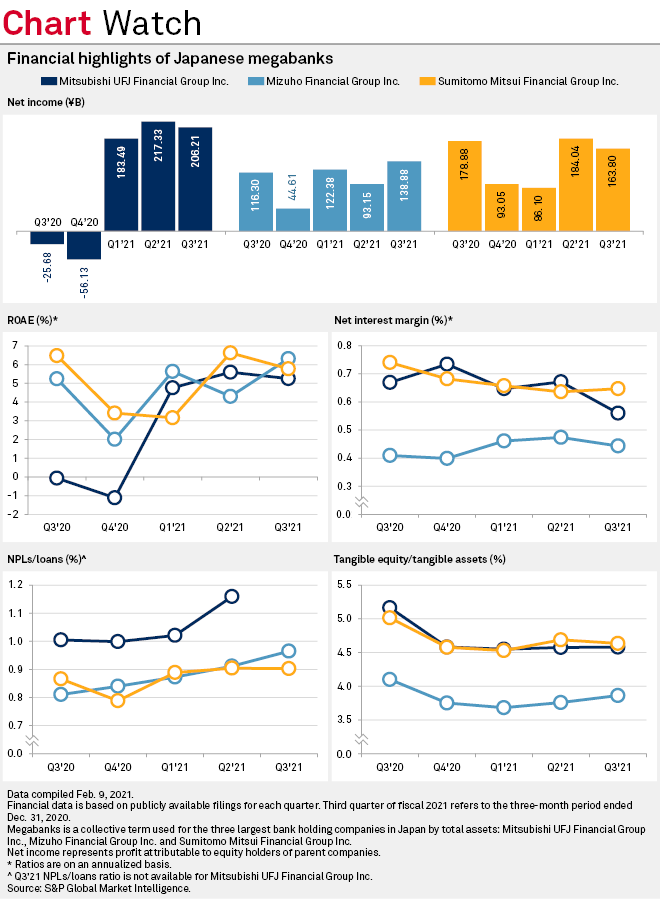

MUFG, which extends more loans overseas than Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc., has reported the highest nonperforming loan ratios and loan loss provisions among the trio for at least five consecutive quarters, according to data from S&P Global Market Intelligence.

In the fiscal third quarter ended Dec. 31, 2020, MUFG's NPL rose to 1.17%, the highest in three years. The amount of nonperforming loans rose to ¥575 billion, the highest quarter on record, or about 46% of the bank's total nonperforming loans in that quarter. Sumitomo and Mizuho reported NPL ratios of 0.90% and 0.97% in the fiscal third quarter, respectively.

During the first three fiscal quarters ended Dec. 31, 2020, 62% of MUFG's total loan loss provisions were set aside for its overseas lending, much higher than 24% at Sumitomo. Mizuho did not disclose such figures.

"Southeast Asia is the main reason for MUFG's higher NPL ratio," said Michael Makdad, an analyst at Morningstar. Among MUFG's overseas operations, the subsidiary in Thailand seems to be posing more challenges than others. "It's partly the impact of COVID-19 and lack of foreign tourists," he said.

MUFG, the largest bank in Japan by assets, sounded a note of caution when it released its latest earnings Feb. 4. "Hit by the spread of the pandemic, the credit risk is increasing globally," the bank said in a same-day statement.

As of 2020-end, MUFG extended ¥38.5 trillion of loans outside Japan, or 36% of its total loan book. That was higher than 29% at Sumitomo and 28% at Mizuho.

Risk in Southeast Asia

Well-heeled Japanese megabanks have been expanding outside their home market for more than a decade as they have sought new growth sources to offset sluggish loan demand and ultra-low interest rates in Japan. Among the three, MUFG, which has accumulated a 20.84% stake in Morgan Stanley since the 2008 global financial crisis, has been most aggressive in opening branches abroad and investing in non-Japanese banks, with a particular focus on emerging Southeast Asia.

"MUFG's exposure to overseas market is bigger" than that of its two rivals, so is its NPL ratio, said Toyoki Sameshima, a senior analyst at SBI Securities Co. MUFG "has made a strong commitment to enter the Thai and Malaysia markets" where higher risks are expected to lead to higher returns, he added.

MUFG Bank Ltd., a wholly owned banking unit of MUFG, has a 92.47% stake in Indonesia's PT Bank Danamon Indonesia Tbk, a 76.88% interest in Thailand's Bank of Ayudhya PCL, a 20% stake in the Philippines' Security Bank Corp. and a 19.73% ownership in Vietnam Joint Stock Commercial Bank for Industry & Trade. The Japanese bank also has extensive branch networks in Asia-Pacific, the Americas, Europe and the Middle East.

According to Bank of Ayudhya, its main businesses are personal loans, credit cards, auto hire‐purchase as well as microloans. Its expected credit cost increased 30% in 2020, with its loan loss coverage ratio at 175.1%, exceeding its target range of 140%-150%, although its NPL ratio remained at 2%. The Thai bank itself is also exposed to economic weakness in less developed economies as it owns 100% of Hattha Bank PLC in Cambodia, as well as various ventures in the Philippines, Vietnam, Myanmar and Laos.

The International Monetary Fund forecasts the so-called ASEAN-5 countries — Indonesia, Malaysia, the Philippines, Singapore, and Thailand — will likely register a collective economic growth of 5.2% in 2021, lower than the 6.3% expansion projected for all emerging markets and developing economies. The global economy will likely grow 5.5% in 2021 and 4.2% in 2022, after contracting 3.5% in 2020.

"Although recent vaccine approvals have raised hopes of a turnaround in the pandemic later this year, renewed waves and new variants of the virus pose concerns for the outlook," the IMF said in January.

As of Feb. 15, US$1 was equivalent to ¥105.35.