Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2024

By John Wu and Cheska Lozano

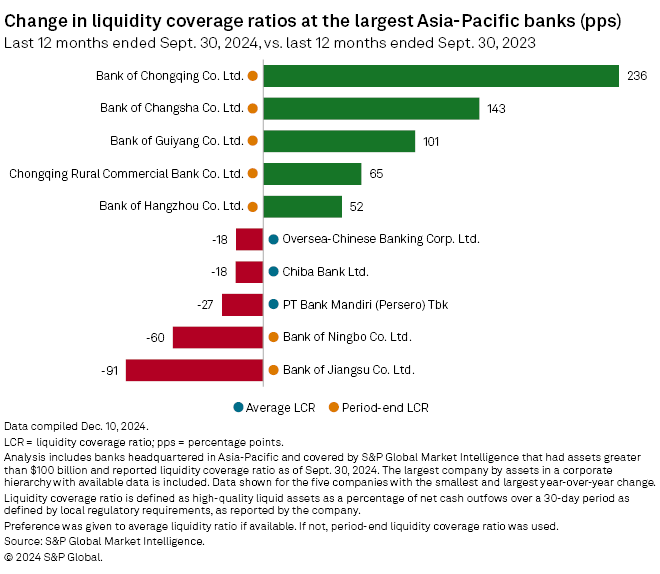

Most midsized Chinese banks improved their liquidity positions in the 12 months ended Sept. 30 amid a slowdown in loan growth due to weak demand.

As of the period, Bank of Chongqing Co. Ltd. had the highest liquidity coverage ratio (LCR) among lenders in the Asia-Pacific region, posting a year-over-year increase of 236 percentage points in its LCR to 511.75%, according to an S&P Global Market Intelligence analysis of lenders with assets over $100 billion. It was followed by Chongqing Rural Commercial Bank Co. Ltd., whose LCR rose 65 percentage points to 407.76%.

Eight other midsized Chinese lenders rounded out the top 10 banks in Asia-Pacific by LCR, which is calculated by dividing liquid assets by short-term debts and measures a bank's ability to meet its current debt obligations without raising external capital.

"Smaller Chinese banks may have more aggressive business practices, leading to a higher need for liquidity management and higher LCRs to maintain sufficient liquidity buffers" and "might face stricter regulatory oversight," said Iris Tan, senior equity analyst at Morningstar.

The increase in the LCRs of smaller Chinese banks could be explained by their higher dependence on interbank financing, which encourages them to manage liquidity positions more conservatively, Tan said.

Japan's The Norinchukin Bank ranked 11th with an average ratio of 200.40%, up 1 percentage point from a year ago. Mitsubishi UFJ Financial Group Inc. placed 15th at 163.00%, followed by Japanese peer Sumitomo Mitsui Trust Group Inc. and Indonesia's PT Bank Rakyat Indonesia (Persero) Tbk.

Bank stability

Loan growth at mainland Chinese banks has slowed despite rate cuts by the People's Bank of China and several stimulus measures announced by the government to support its 2024 GDP growth target of 5.0%. The measures included a reduction in the reserve requirement ratio and allowing homeowners to renegotiate with their banks to reduce interest rates. Following another interest rate cut in late October, benchmark interest rates are now at all-time lows.

Growth in the total assets of China's banking system decelerated in June to 6.6%, the lowest since 2018, before recovering somewhat to 7.5% in October, according to the National Financial Regulatory Administration.

China's four largest banks by assets maintained relatively conservative and stable liquidity positions, a reflection of their ability to lend to big corporates.

Industrial and Commercial Bank of China Ltd., the world's largest lender by assets, increased its LCR by 15 percentage points year over year to 138.20%. The LCR of China Construction Bank Corp. declined by 9 percentage points to 120.29%.

Some Chinese lenders posted sharp declines in their LCRs. Bank of Jiangsu Co. Ltd.'s LCR dropped 91 percentage points to 126.60%, while Bank of Ningbo Co. Ltd.'s decreased by 60 percentage points to 206.36%.

Among India-based lenders, Union Bank of India, which ranked 24th in the regional LCR table, had the highest ratio among its local peers at 144.12%, followed by Canara Bank at 137.43%, which marks an increase of 5 percentage points.

Five Korean banks continued to rank at the bottom of the league table with ratios barely above 100%.