Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog 29 Sep, 2022

By Kiran Shahid and Annie Sabater

Global private equity and venture capital firms have increasingly been targeting the Middle East and North Africa, or MENA, region as accelerating technology adoption and the shift from economic dependence on fossil fuels provide investment opportunities.

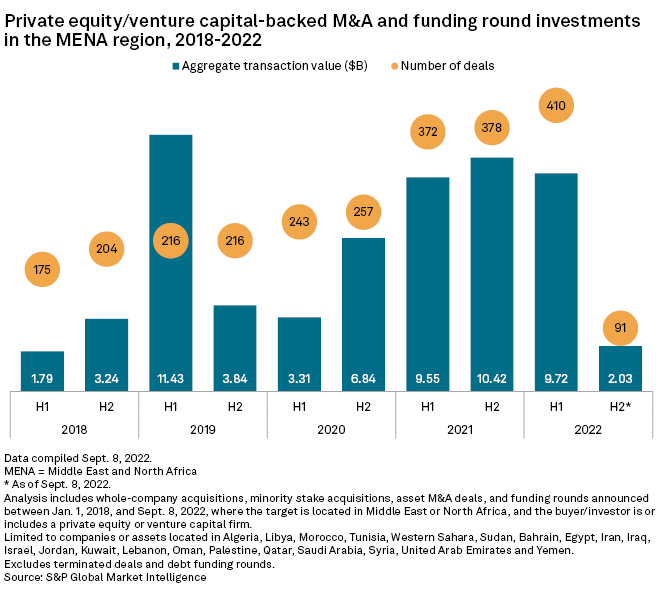

Deal value in the region reached $9.72 billion in the first half, up from $9.55 billion a year earlier, and 66% compared with the first half of 2020, according to S&P Global Market Intelligence data.

Technology driver

Attractive demographics and rising energy prices buoyed the market and supported a relatively stable economic backdrop for investment, Cameron Joyce, senior vice president and deputy head of research insights at Preqin, wrote in emailed comments to S&P Global Market Intelligence.

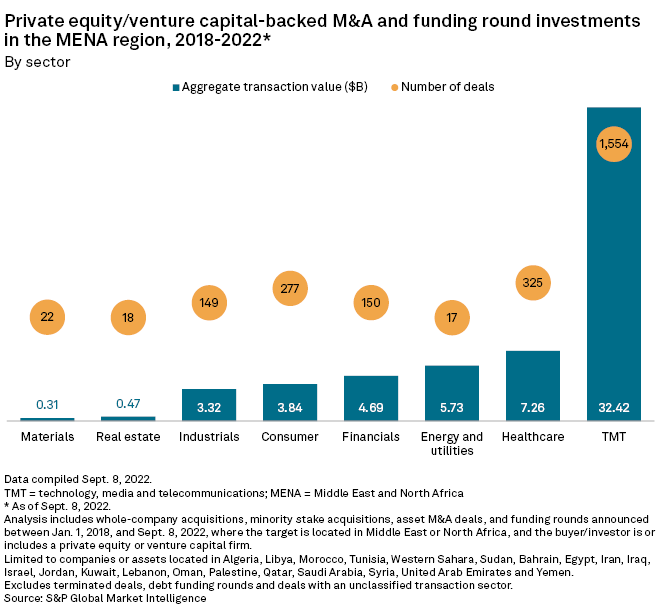

For the past four years, the technology, media and telecommunications sector recorded the largest number of M&A and funding rounds with private equity involvement at 1,554 deals worth a total of $32.42 billion, exceeding all the other sectors combined, according to Market Intelligence data.

Technology companies are taking advantage of untapped markets and rising consumer demand in the region. Financial technology, for example, a popular vertical within the sector, is providing routes for large unbanked populations to access financial services, according to Joyce.

"The outsized role of technology-focused deal flow reflects the significant potential that disruptive companies have when it comes to making an impact in the region's economy," Joyce said.

Governments in the region are subsidizing investment in the technology industry by monetizing legacy assets to invest in the local startup ecosystem and diversify their economies away from oil and gas, according to Global Private Capital Association's 2022 MENA Data Insight report.

Israel leads investment

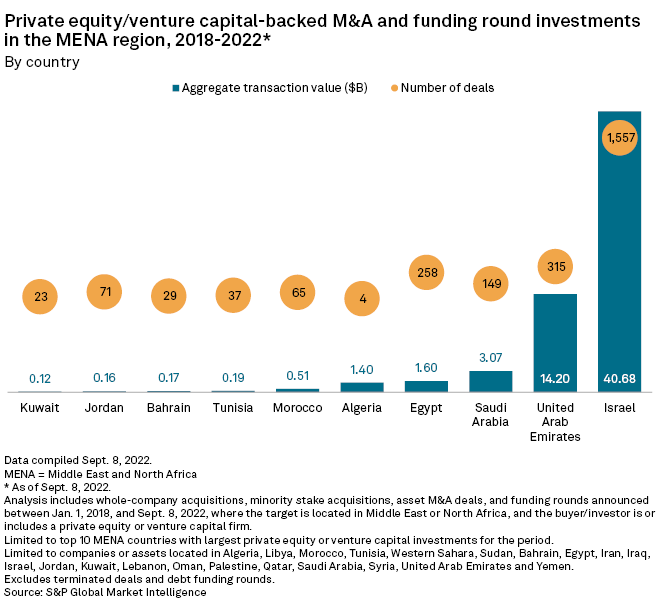

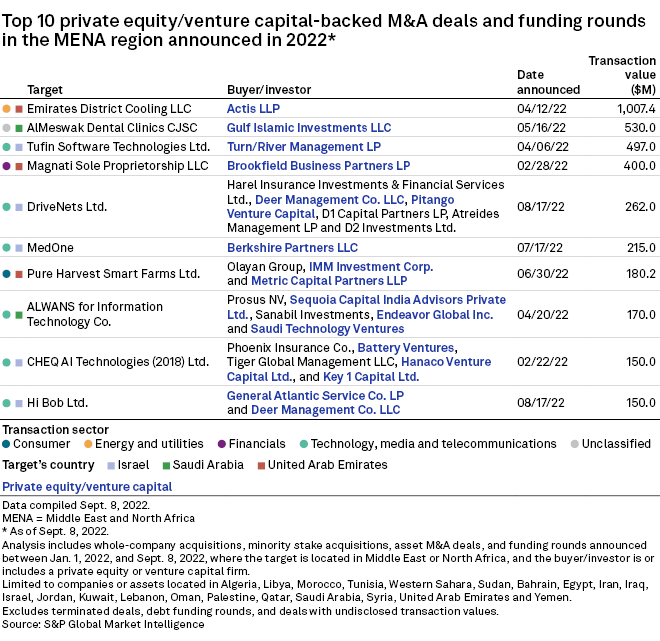

In the year to Sept. 8, five of the 10 largest private equity and venture capital deals in the region targeted Israel-based companies in the TMT sector. The largest of these deals was Turn/River Management LP's $497 million acquisition of Israeli cybersecurity company Tufin Software Technologies Ltd.

The largest deal announced in the region more broadly over the same period was Actis LLP's proposed acquisition of a 50% stake in United Arab Emirates-based cooling service provider Emirates District Cooling LLC from Dubai Investments PJSC for about $1 billion. Gulf Islamic Investments LLC's acquisition of a 51% stake in Saudi Arabian healthcare operator AlMeswak Dental Clinics CJSC for $530 million took the second spot.

On the road

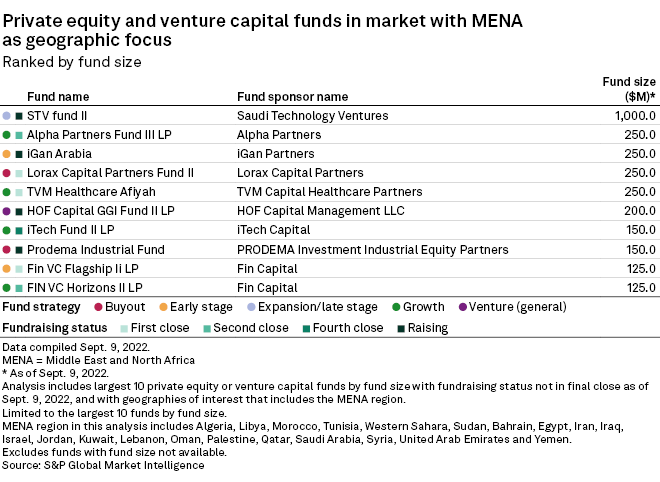

Saudi Technology Ventures' second Middle East technology investment fund STV fund II, which is targeting $1 billion, is the biggest venture capital fund in market. Other private equity and venture capital-backed funds currently raising include Lorax Capital Partners' fund Lorax Capital Partners Fund II, which is seeking $250 million for buyout investments in Egypt, and TVM Capital Healthcare Partners' fund TVM Healthcare Afiyah, which aims to raise $250 million for growth investments in sustainable healthcare companies.

Global headwinds

Private equity deal flow in the region during the second half has so far fallen behind the pace set a year ago, according to Market Intelligence data.

"Global macroeconomic trends are likely to weigh on activity in the near term as financial markets digest the impact of tightening monetary conditions around the world. The strengthening dollar is putting additional pressure on emerging economies at a time when investor risk appetite has been declining," Joyce said.

Theme

Products & Offerings

Segment