The merger between two of Indonesia's best-known unicorns will create a new financial technology giant that will seek to monetize relationships with its combined customer base. However, it will face competition from Chinese and regional fintech players seeking to carve a slice of the growing wealth in Southeast Asia.

PT Aplikasi Karya Anak Bangsa, which operates the popular ride-hailing business Gojek, announced its merger with e-commerce company PT Tokopedia on May 17. GoTo Group, as the combined company will be called, will become a platform providing e-commerce, financial services and ride-hailing services with a dominant share in its home market of Indonesia, Southeast Asia's most-populous nation. The combined valuation of the two companies adds to about $20 billion, according to S&P Global Market Intelligence data.

"The deal will present a variety of growth opportunities in financial services, including payments, consumer finance and merchant lending," said Sampath Sharma Nariyanuri, financial technology analyst at S&P Global Market Intelligence. "The combined entity's fintech business will deepen its ties into both online and offline commerce in the archipelago nation, gaining an edge over its competitors."

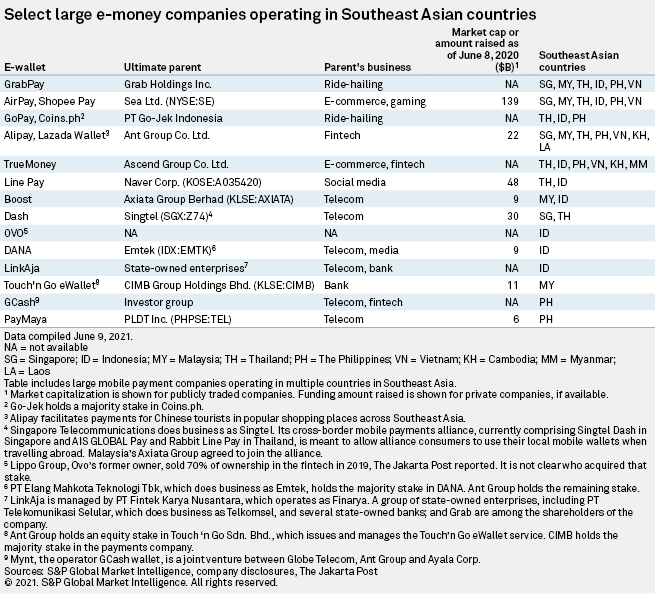

But that will also pit GoTo against Alibaba Group Holding Ltd.-owned Lazada South East Asia Pte. Ltd. and Sea Ltd.'s Shopee in the e-commerce space. And, its financial services business will compete with the fintech arm of Grab Holdings Inc., the ride-hailing app from Singapore that has similar ambitions to grow its fintech business across Southeast Asia.

Household Chinese fintech names such as Alibaba and Tencent Holdings Ltd. have narrowed on Southeast Asia, one of the fastest-growing economic regions in the world, for future expansion. Tencent announced a regional hub in Singapore, while Alibaba's affiliate Ant Group Co. Ltd. is seeking opportunities in payments and other fintech applications. Grab and GoTo plan to grow using the same playbook as the Chinese giants: tap into the financial lives of their users and utilize their combined platforms to sell financial services ranging from credit to insurance.

Regional disparities

The regional disparities in language, culture and even economic development create challenges that may be tough for a single company to overcome. It also sets the stage for partnerships and mergers. For example, GoTo counts Alibaba, Tencent and JD.com Inc. as its investors, while Grab was reported to have received an investment from Alibaba.

Regional diversities may result in some players becoming dominant in their home markets, with smaller chunks of business in others. In the aviation business, Indonesia's Lion Group and Malaysia's AirAsia Group Bhd. dominate their home markets, though they were less successful in their efforts to establish affiliate airlines in other countries.

Together, Gojek and Tokopedia recorded more than 1.8 billion transactions across their platforms in 2020 and had 100 million monthly active users. Prior to the merger, Gojek already offered a slew of financial services, such as a buy-now-pay-later feature via its digital payment arm, GoPay. It also acquired a 22.16% stake in digital lender PT Bank Jago Tbk. The merger with Tokopedia creates the potential to monetize relationships with individual customers and small-to-medium enterprises.

"GoTo will use its scale and offerings to accelerate financial inclusion in Indonesia and Southeast Asia, bringing millions of users into the formal financial system so they can actively take part in the digital economy," GoTo's spokesperson told Market Intelligence. "GoTo will further develop its payments and financial services offerings to address this gap and provide an enhanced financial experience for consumers, drivers and merchants."

Tokopedia currently operates in Indonesia only, though Gojek has operations in Vietnam, Singapore and Thailand. Meanwhile, Grab and Sea have already established themselves in many other markets.

"Grab is in many more countries and stronger in a few other countries. In Singapore, Grab is a few steps ahead relative to Gojek," said Oi Yee Choo, chief commercial officer at ADDX, a Singapore-based capital markets platform. Meanwhile, Shopee has a payments arm and operates in Indonesia, Malaysia, Philippines and Singapore, as well as AirPay, which operates in Thailand and Vietnam, according to Kagan, a media research group within S&P Global Market Intelligence.

Digital banking

S&P's Nariyanuri noted that Sea and Grab both have digital banking licenses in Singapore, which gives them an advantage over GoTo in the island nation. "Sea's e-commerce business presents the company with greater lending opportunities, as online shopping transaction values tend to be bigger than ride fares," he said. The average gross merchandise value per order accepted on Shopee across Southeast Asia was $14.31 in the third quarter of 2019. In comparison, the average transaction size on Gojek tends to be about $4.50.

"Higher average transaction value on e-commerce platforms creates greater consumer lending opportunities for digital banks," he said. "Both Sea and the Grab-led consortium could use their banking licenses to serve their current ecosystems."

But the reverse may be true in GoTo's home market. "Gojek and Tokopedia have been in and running Indonesia for a long, long time. And frankly, they're very entrenched," said Choo. "So to try and disrupt this combination, I think will take quite a lot of money and a lot of management effort."

According to Patrick Stokvis, vice president at research company Third Bridge, the merger would allow GoTo to move deeper into financial services, be it organically or inorganically.

"We'll see them moving into some of the other classic fintech battlegrounds, which are insurance, payments, wealth, investments, lending and remittances," he said. "Theoretically, this new huge access of data would allow them to build a really advanced cross-sell model, build better products, and perhaps would allow them to become stronger in performance marketing."