Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Mar, 2023

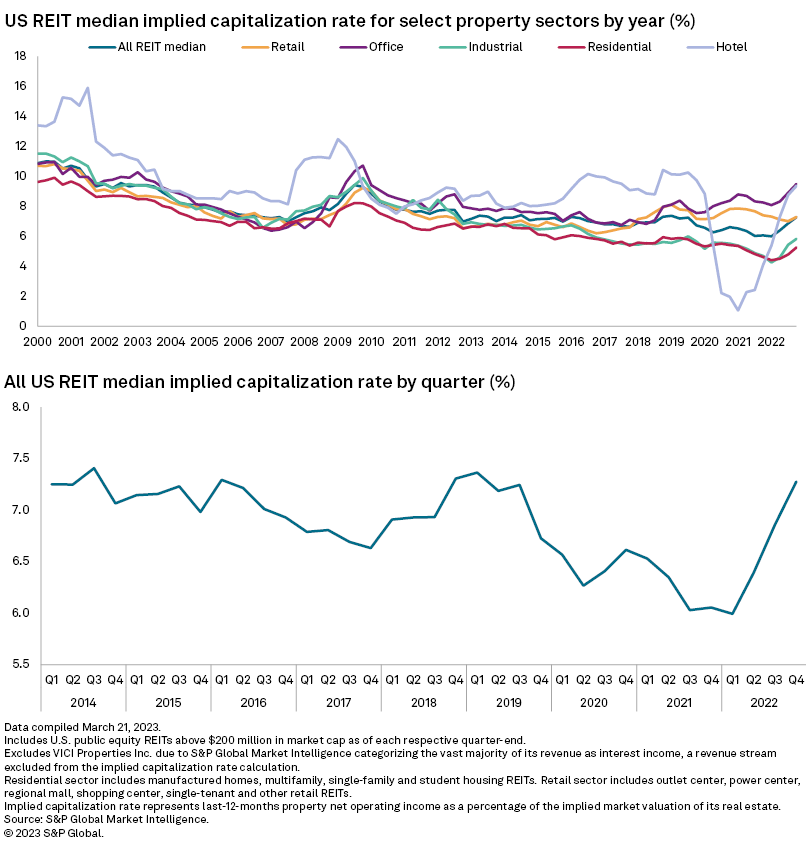

The median implied capitalization rate for US equity real estate investment trusts grew another 41 basis points in the fourth quarter of 2022, marking the third consecutive quarter of expanding implied capitalization rates, according to data compiled by S&P Global Market Intelligence.

US REITs closed the quarter with a median implied capitalization rate of 7.3%, the highest rate since the first quarter of 2019. The median implied capitalization rate increased 1.2 percentage points year over year.

The analysis included all US REITs that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of at least $200 million at each respective quarter-end.

Market Intelligence calculates the implied capitalization rate as property net operating income generated in the last 12 months divided by the REIT's implied real estate value — calculated as market capitalization, including operating partnership units, plus total debt, preferred equity, mezzanine items and noncontrolling interest, less non-real estate assets such as cash, securities or loans.

– Set email alerts for future Data Dispatch articles.

– Download the US Real Estate Field Calculations template that includes a line-by-line breakout of the implied capitalization rate calculation.

– For further capitalization rate analysis, try the US REIT Capitalization Rate Excel template.

Office, hotel sectors trade at highest median implied capitalization rate

The office sector traded at the highest median implied capitalization rate of 9.5% at the end of 2022. This marked a 59-basis-point expansion compared to the quarter prior, as well as a 1.2-percentage-point increase year over year. Within the office sector, Orion Office REIT Inc. traded at the highest implied capitalization rate at 16.1%, followed by Empire State Realty Trust Inc. and Office Properties Income Trust at 14.1% and 13.2%, respectively. Alexandria Real Estate Equities Inc., the largest office REIT by market capitalization, traded at the lowest implied capitalization rate of the group at 6.3%, while Boston Properties Inc. closed the year at 7.2%.

The hotel sector placed second with a median implied capitalization rate of 9.4%.

At the other end of the spectrum, the self-storage sector traded at the lowest median implied capitalization rate at 5.1%. The residential and industrial sectors followed with rates of 5.3% and 5.8%, respectively.

Highest implied capitalization rates

Advertising REIT OUTFRONT Media Inc. traded at the highest implied capitalization rate of all US equity REITs at quarter-end at 22.2%.

Regional mall-focused CBL & Associates Properties Inc. followed closely in the second spot at 21.3%, while timber REIT PotlatchDeltic Corp. rounded out the top three at 17.4%.

Lowest implied capitalization rates

On the flip side, two industrial REITs, Prologis Inc. and Rexford Industrial Realty Inc., traded at the lowest capitalization rates at 3.5% and 3.8%, respectively.

Manufactured home REIT Equity LifeStyle Properties Inc., industrial-focused Terreno Realty Corp. and farmland REIT Farmland Partners Inc. followed, each with a rate of 3.9%.