Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2021

By RJ Dumaual and Kris Elaine Figuracion

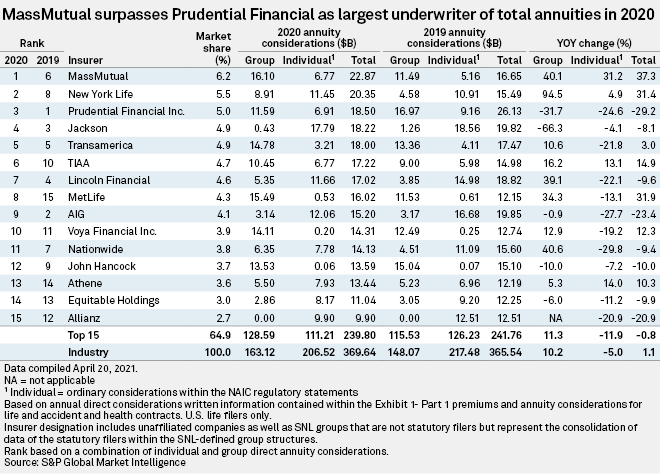

Massachusetts Mutual Life Insurance Co. became the largest writer of annuity products in 2020 amid Prudential Financial Inc.'s move to downsize its presence in the segment.

Prudential, which logged annuity considerations above $26 billion in 2019 and 2018, intends to halve its individual annuities business to 10% or less of earnings under a three-year plan designed to make the life insurer less market sensitive.

Piper Sandler analyst John Barnidge estimated that individual annuities currently account for 22% of Prudential's normalized earnings and said cutting individual annuities will likely happen via "in-force block run-off as well as through reinsurance [and] block sales." The individual annuities line of business has more than $175 billion in AUM, with more than 95% of that total in variable annuities.

Keefe Bruyette & Woods analyst Ryan Krueger said Prudential is confident in the performance of its variable annuity block, but management "concluded that the public market was unwilling to ascribe appropriate value." The company has stopped selling variable annuities with living benefits, Krueger noted.

Prudential logged $18.50 billion in total annuity premium and considerations in 2020, about 29.2% lower than the $26.13 billion recorded in 2019, following year-over-year declines of 31.7% and 24.6% in the group and individual lines of business, respectively.

MassMutual jumped to first from sixth in 2019 after it recorded $22.87 billion in total annuity premium and considerations in 2020, compared to $16.65 billion a year ago, owing to 40.1% and 31.2% gains in group and individual, respectively.

New York Life Insurance Co. surged to second from eighth with $20.35 billion of total annuity premium and considerations, partially attributable to a 94.5% year-over-year increase in group. Another big gainer was MetLife Inc., rising to eighth from 15th with total annuity premium and considerations of $16.02 billion.

American International Group Inc. plunged to ninth from second with $15.20 billion of total annuity premium and considerations following a 27.7% drop in the individual line of business.

In aggregate, the largest annuity underwriters' 2020 premiums and considerations slid to $239.80 billion from $241.76 billion the previous year, with 11.3% growth in group offset by an 11.9% drop in the individual line.

Individual annuities refer to fixed and variable annuities and is reported as ordinary within NAIC statutory statements. Group annuities include investment options typically available in tax-advantaged savings accounts and guaranteed investment contracts.

S&P Global Market Intelligence uses statutory total annuity premiums and considerations to determine market share. Total annuity consideration is a preferred indicator of market share as it not only reflects new business but also the persistence of a company's existing business in the form of renewal annuity considerations. Additionally, many policyholder acquisition costs are not recovered within one year. As such, total annuity premiums and considerations can also be a better indicator of profitability for life insurers, whereas new sales do not necessarily equate with profitability.