Rising U.S. equity markets were buoyed this week by continued optimism of an economic recovery, and brought along insurance stocks as well.

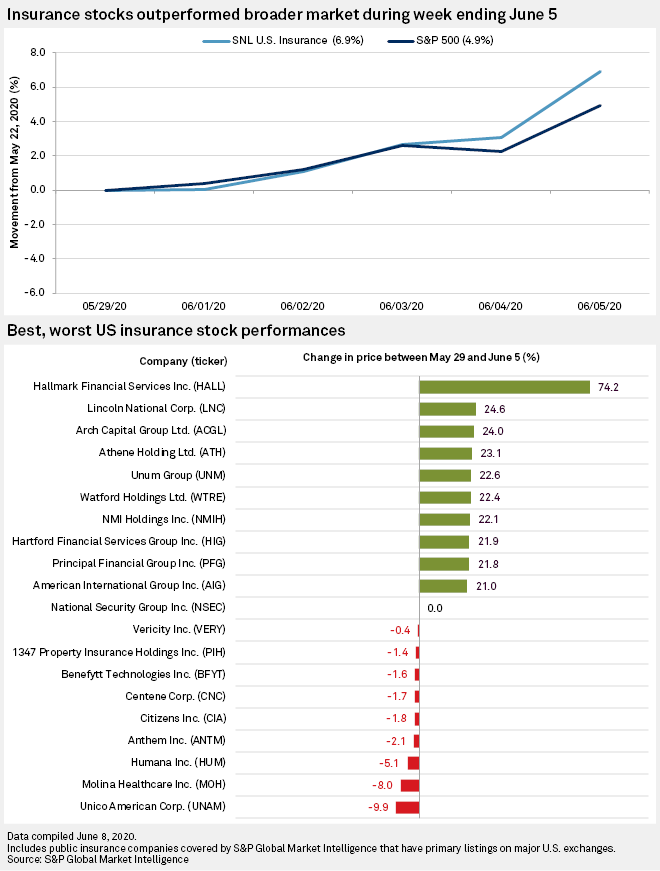

The S&P 500 climbed 4.91% to 3,193.93 for the week ending June 5, while the SNL US Insurance Index soared 6.90% to 1,084.52.

Nonfarm payroll numbers shocked the market prior to the Friday opening bell, as the Bureau of Labor Statistics said the U.S. added 2.5 million jobs in May. The unemployment rate also unexpectedly fell to 13.3% from 14.7% in April, which was the highest rate since records began in 1948. Consensus estimates predicted an unemployment rate of 19.8% in May, which would have been a fresh post-World War II high, and for the economy to have lost another 7 million jobs.

Tim Quinlan, managing director and senior economist for Wells Fargo Economics, said the report was an "undeniably jaw-dropping positive surprise." Markets roared higher on the final day of trading, though Quinlan did caution that the country would have to see seven consecutive months of similar reports to get employment back to March levels.

Assurant Inc. was in the headlines this week when Bloomberg News reported that investment bank Morgan Stanley may reach an agreement in the coming week to acquire the company's collateralized loan obligation assets. Assurant traded up 11.99%.

American International Group Inc., which was among the better performers of the week, was also in the spotlight due to dealmaking-related decisions. AIG said it would wind down Blackboard U.S. Holdings Inc.'s operations after it failed to reach a deal with potential investors. The company reportedly received an offer from a West Coast technology investor, but a formal process was not conducted.

Meanwhile, Carlyle Group and T&D Holdings completed their acquisition of a 76.6% interest in Fortitude Group Holdings from AIG.

AIG's stock rose 20.96%.

Despite being slapped by the SEC, Argo Group International Holdings Ltd. also traded up sharply, adding 20.50% for the week. The SEC found that Argo failed to disclose that it paid former President and CEO Mark Watson III more than $5.3 million between 2014 and 2018 in the form of perquisites and personal benefits. In order to settle the charges, the company agreed to pay a civil money penalty of $900,000.

The life insurance industry benefited significantly from the rising market, as shares across the sector soared. Athene Holding Ltd., Lincoln National Corp. and Arch Capital Group Ltd. put up the biggest gains this week, with increases of 23.12%, 24.62% and 23.95%, respectively. Multiline insurer Hartford Financial Services Group Inc. added 21.89%.

Managed care companies were among the few to fail to get caught up in the rally. Molina Healthcare Inc., Humana Inc. and Centene Corp. all ended the week in the red with declines of 7.96%, 5.06% and 1.72%, respectively.