Analysts remain cautious in their forecasts of Credit Suisse Group AG's performance in the near term as the collapses of Greensill Capital (UK) Ltd. and Archegos Capital earlier this year continue to weigh on the bank.

Despite the underlying strength of its franchise, Switzerland's second-largest lender by assets will need a few quarters to recover from the twin crises, the fallout of which exposes it to profitability, stock performance and reputational risks, according to market observers. Furthermore, the ongoing strategic review of new Chairman António Horta-Osório, which is focused on evaluating risk management, strategy and culture at Credit Suisse, creates added uncertainty about the future course of the bank.

Q2 earnings

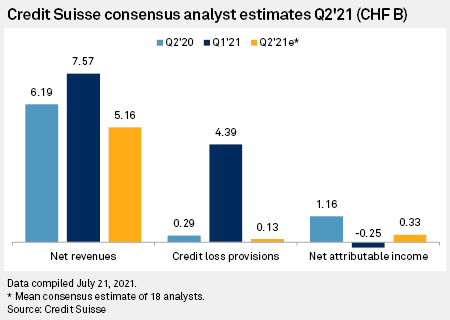

Consensus estimates ahead of Credit Suisse's July 29 earnings release show that both revenue and net profit are expected to be well below their prior-year levels, as analysts are factoring in a further CHF600 million loss resulting from the bank's exit of positions in U.S. family office Archegos and more potential losses stemming from the wind-down of four supply chain funds related to U.K. specialty finance firm Greensill.

Group earnings have also likely suffered from the continued normalization of trading activity to which Credit Suisse is more susceptible than some of its peers "given its comparatively high reliance on transaction-driven capital markets revenue and high exposure to the underwriting of leveraged lending and high-yield debt transactions," Moody's credit analysts said in a July 13 note.

The impact of lower trading activity in the second quarter may have been compounded further by Credit Suisse's self-imposed risk reduction on the heels of the Archegos sell-off, Zürcher Kantonalbank equity analyst Michael Kunz said in a July 22 note.

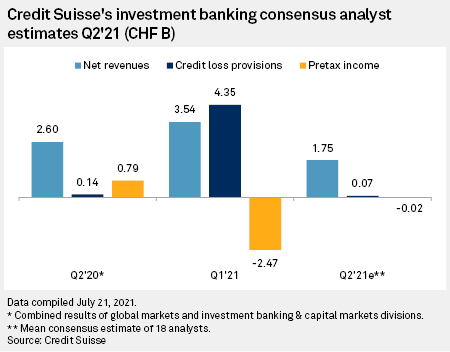

Second-quarter revenues at the investment bank are anticipated to amount to only a fraction of the prior-year result and the division is expected to book a pretax loss compared to a profit a year ago due to the Archegos collapse.

In April, the Swiss group said it will shrink its prime finance and brokerage business, and review the "overall size and look" of its investment bank as a result of the incident with the U.S. family office. The plan has made many investors question the future of Credit Suisse's investment bank and wonder whether a potential sale of the unit could unlock value for the group, Berenberg equity analysts said in a July 16 note. Although the analysts rejected a sale or a radical revamp of the investment bank as feasible options, they expect Credit Suisse to reduce its risk appetite and focus on growing its wealth management business.

I-bank questions

Moody's analysts are more critical of the investment bank, noting that it has been a weak spot in the franchise in recent years. Since Credit Suisse's latest large-scale restructuring in the 2015-2018 period, the unit has contributed about 20% to the group's pretax profitability, but its results have lagged the company's overall return on assets, they said.

Although this can partly be explained by the higher volatility of investment bank earnings compared to other, more stable, businesses in the franchise, "the segment's stubbornly high compensation expenses and inordinate consumption of resources also contribute to its comparatively low returns," Moody's said. Between 2016 and 2020, compensation and benefits expenses equaled 47% of the revenue base of Credit Suisse's investment bank, which was well above the peer group average of 31%, the rating agency said.

Nevertheless, a deeper restructuring of the investment bank would have potential trade-offs for Credit Suisse, it noted. "Further major disruptions or business model changes would strain [the bank's] profitability and credit strength," Moody's said. If Credit Suisse announces yet another large-scale restructuring, "revenue attrition and restructuring costs could put prolonged strain on the bank's ability to earn its cost of capital, in particular if [it] decides to make bigger cuts to its capital markets operations or materially lower its risk appetite in this segment," the credit analysts said.

Share price

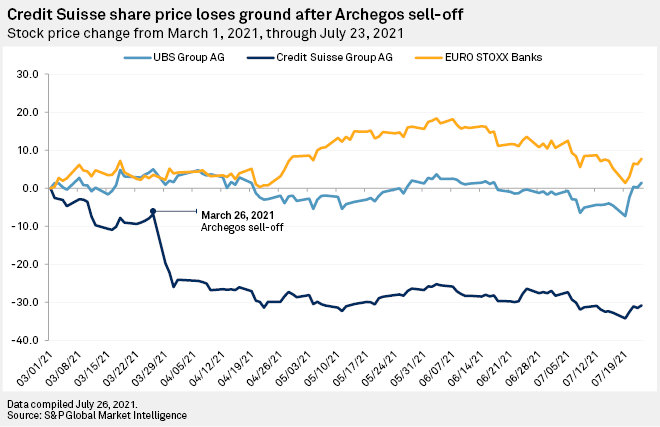

With the company's own unfinished review and ongoing regulatory investigations into the Archegos and Greensill matters, the next few quarters are likely to be challenging for Credit Suisse, and its stock price is expected to remain under pressure, analysts said.

"As long as it is not clear how the strategic course for the [group] will be set, we do not believe that the opportunity/risk ratio is favorable. That is why we do not see any compelling reason to invest in these stocks at the moment," Zürcher Kantonalbank's Kunz said.

Most investors who spoke with Berenberg were looking for "some tangible signs of progress before seriously considering adding Credit Suisse to their portfolio," the bank's analysts said.

Credit Suisse's share price has moved within a tight range of CHF9 apiece to CHF10 apiece in recent months, reflecting concerns over the Archegos and Greensill fallout and uncertainty about the outcome of a pending review by Swiss financial regulator FINMA and its effect on Credit Suisse's risk budget, Morgan Stanley analyst Magdalena Stoklosa wrote in a July 12 note.

The group's stock has not fully recovered since the Archegos sell-off in late March, when it lost roughly 20% of its value in less than a week, S&P Global Market Intelligence data shows.

Silver linings

However, the cautious consensus outlook for Credit Suisse's second-quarter figures could play into the bank's favor if the results turn out to be "less bad than feared," UBS equity analysts said in a July 12 note. Better-than-expected performance, especially in terms of revenue, could even give the share price a boost in the short term, they said.

Furthermore, Credit Suisse has enough capital to cope with the Archegos and Greensill hits, which has eased some of the investor concerns, according to Berenberg's analysts. The bank's common equity Tier 1 ratio is expected at 13% in 2021 and 12.8% in 2022, providing respective buffers of 240 basis points and 220 bps above the minimum CET1 requirement, their estimates show.

The analysts from Moody's marked Credit Suisse's "superior liquidity and sound funding" compared to peers as a key advantage in the current situation because they provide stability and protection for bondholders.

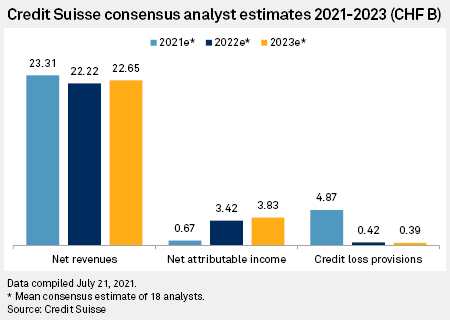

Although consensus estimates for the next three fiscal years show revenue falling, the group's net attributable income is expected to grow year over year in 2022 and 2023.

The impact of Archegos and Greensill has been a stumbling block on the way to the group's mid-term goal of return on tangible equity of 10% to 12%, but the mean consensus estimates for 2022 and 2023 put the ROTE at 8.1% and 8.3%, up from a projected 1.7% in 2021.