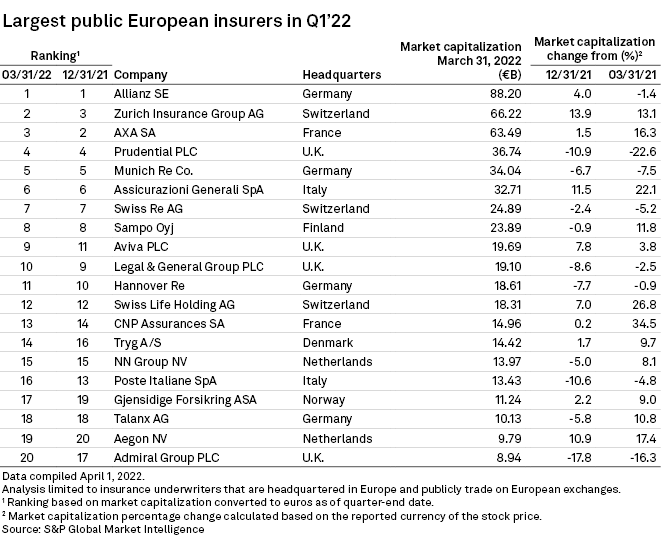

Half of the top 20 listed European insurers saw their market capitalizations slide sequentially in the first quarter, according to an S&P Global Market Intelligence analysis.

Prudential PLC's struggles

Asia-focused Prudential PLC, the fourth-largest insurer in the rankings, logged the second-largest quarter-over-quarter percentage point decline in market capitalization at 10.9% to €36.74 billion.

Jefferies analyst Philip Kett reset his sales forecasts for the life insurer to the "most prudent reasonable expectation," with pandemic-related restrictions still in place across Asia and case rates remaining high. The analyst also reassessed forecasts and shifted the potential reopening of Hong Kong back by another year to the end of 2023 from the second half of 2022, according to a March 11 note.

Allianz SE remained well ahead of its peers, as its market capitalization rose 4.0% quarter over quarter to €88.20 billion. Zurich Insurance Group AG and Axa SA were second and third with market capitalizations of €66.22 billion and €63.49 billion, respectively.

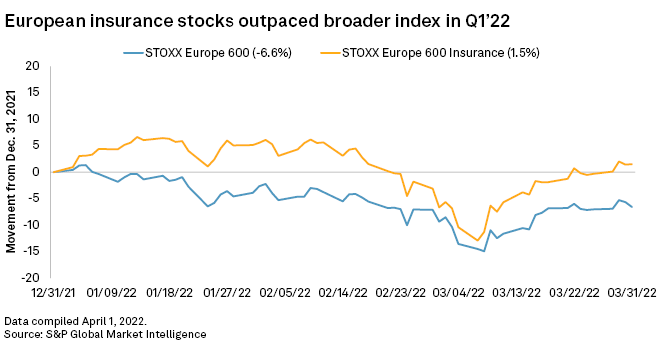

European insurance stocks perform better than broader index

The STOXX Europe 600 Insurance Index outperformed the broader index in the first quarter, growing 1.5% while the STOXX Europe 600 declined 6.6% compared with the end of the fourth quarter of 2021.

Assicurazioni Generali SpA, dealing with boardroom drama, saw its market capitalization grow 11.5% to €32.71 billion, while Zurich logged a rise of 13.9% to overtake Axa and claim second place. Reinsurers Munich Re, Swiss Re AG and Hannover Re posted declines of 6.7%, 2.4% and 7.7%, respectively.

The war between Russia and Ukraine has resulted in increased uncertainty for reinsurers, which face the prospect of much higher losses from the conflict than the rest of the insurance industry, according to UBS Investment Bank research.