Several of the highest-paid CEOs of big names in U.S. fossil fuel production, refining and transportation saw their compensation increase in 2020 despite the record-low crude prices and COVID-19 pandemic demand deficit that brought the industry to its knees.

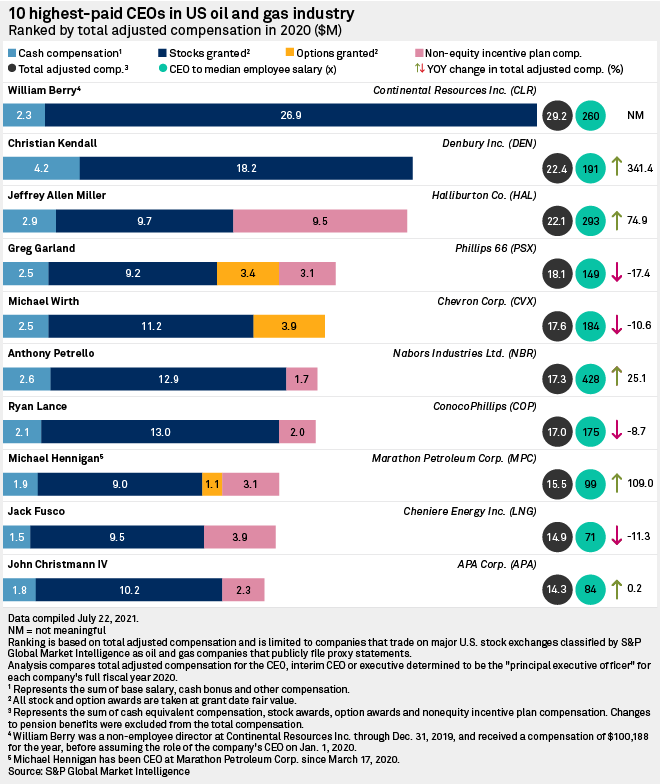

Independent producer Continental Resources Inc. occupied the top spot on a list of the 10 top-earning CEOs in the oil, gas and coal industries, S&P Global Market Intelligence data shows, with William Berry raking in $29.2 million even as the company's stock price plummeted over 50% during the period.

Berry assumed the CEO role Jan. 1, 2020.

S&P analyzed total adjusted compensation, which includes cash, stocks, options and nonequity incentive components, for that period, during which the S&P 500 Energy sector index tumbled 37%.

Denbury Inc., another independent producer, increased its top executive's pay 341% to $22.4 million in 2020 before filing for Chapter 11 bankruptcy protection July 30. Oilfield services giant Halliburton Co.'s Jeffrey Allen Miller was the third-highest paid CEO and saw his compensation rise nearly 75% to $22.1 million even as the firm furloughed some employees.

While the CEOs of supermajors ConocoPhillips and Chevron Corp., refiner Phillips 66 and LNG exporter Cheniere Energy Inc. remained on the list of highest-paid executives in the industry, their pay decreased.

Top executives at many exploration and production companies elected to reduce annual cash compensation as a commodity price crisis took shape, while others took action on bonus payouts and long-term incentive awards, such as stock options.

Prices for West Texas Intermediate crude started the year above $61 per barrel but plummeted into the teens, even briefly falling into negative territory in April, as the global effects of the coronavirus pandemic took hold.

"One of the most consistent criticisms of E&P compensation has been above target bonuses despite lagging shareholder returns," Meridian Compensation Partners LLC told clients in March. "We expect E&P bonuses for 2020 performance will average below target in the industry, with the vast majority of companies expected to pay at or below target for the first time in recent history, particularly those with oil-focused operations."

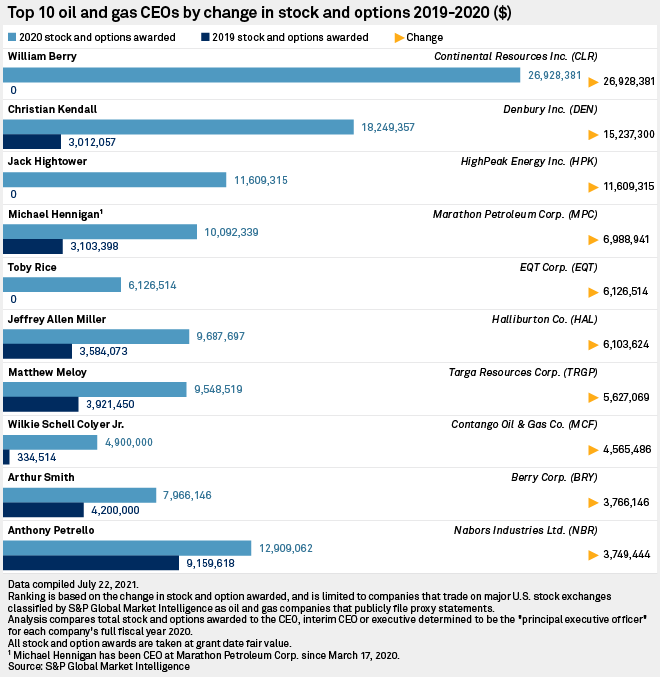

Meridian also predicted a "general pullback" in those long-term incentive awards, but Denbury's Christian Kendall still saw his increase by over $15 million in 2020.

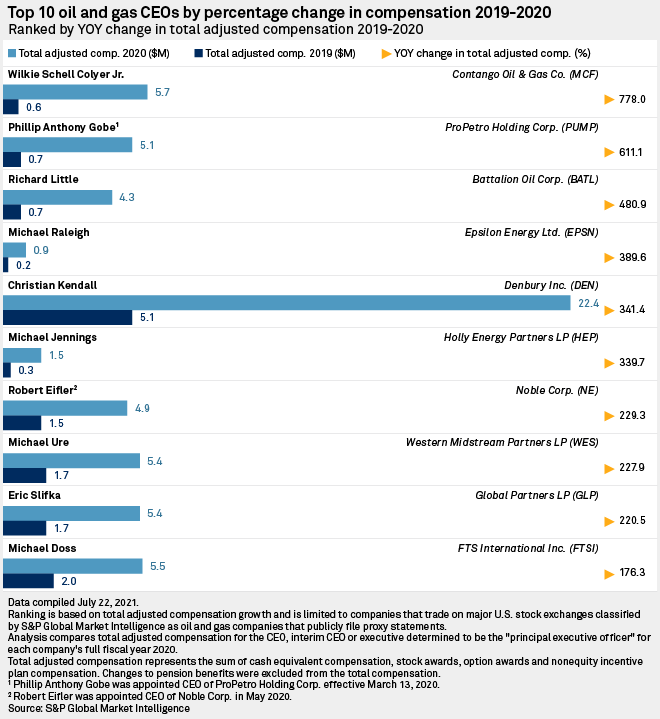

The largest percentage increase in compensation was for Contango Oil & Gas Co. CEO Wilkie Schell Colyer Jr., whose pay package grew 778% to $5.7 million. The driller acquired Mid-Con Energy Partners in January in an all-stock transaction.

The CEOs of oilfield services firms Noble Corp. and FTS International Inc. also saw some of the largest percentage increases in pay. Both companies filed for Chapter 11 bankruptcy in 2020 and have completed the restructuring process. Noble also plans to buy Pacific Drilling SA.

According to Kimmeridge Energy Management Co. LLC, a private equity firm with a history of shareholder activism, E&P compensation structures, in particular, suffer from inertia.

"There is this fundamental lack of accountability that we're seeing from the boards. ... Anything negative that happens is simply blamed on the commodity, and management teams were simply victims of their circumstances," Mark Viviano, Kimmeridge's head of public equities, said in a recent interview. "We saw that last year with the number of boards that changed performance metrics at the depths of the [oil price] crisis once it became clear companies would miss their operational and financial targets."

He added that real change will be hard to implement until boards bring in more "independent" representation from outside the oil and gas sector.