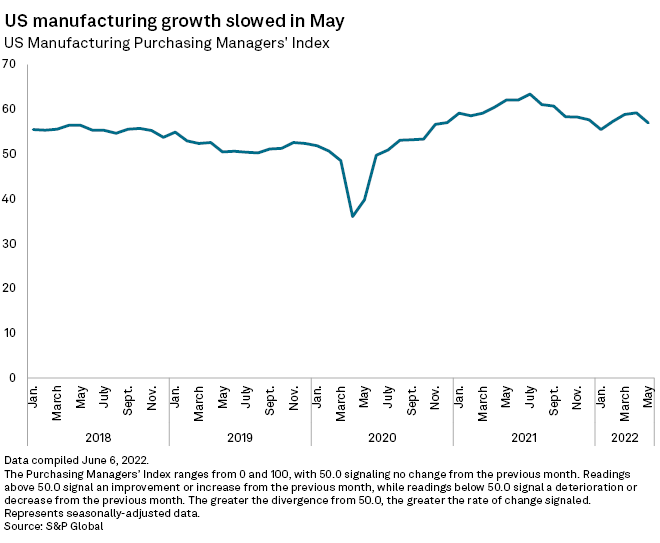

Growth in the U.S. manufacturing sector is slowing.

The S&P Global U.S. Manufacturing PMI was 57 in May, the lowest it has been in four months and down from the 59.2 posted in April. Regional surveys from Federal Reserve Banks in New York, Philadelphia and Richmond, Va., have also recently reported slowing growth in the sector.

The slowdown is largely due to the Fed's tightening of financial conditions. Supply chain issues, worsened by COVID-19 lockdowns in China, have also left manufacturers unable to obtain the raw materials needed to meet strong demand. The window to capitalize on that demand is closing as the Fed hikes interest rates to tame inflation by curbing demand.

"This is exactly what the Fed wants," Tom Essaye, president of Sevens Report Research, said of the slower momentum in manufacturing. "The question is, how quickly do we lose momentum and a slowing of growth becomes an outright contraction."

Supply, worker shortfalls

At the start of the pandemic in early 2020, manufacturers pulled back to wait out the uncertainty of the global shock. They eventually benefited from increased demand for goods as many consumers focused on home improvements during lockdowns and the federal government pumped stimulus into the economy.

This year, COVID-19 lockdowns in China and the Russia-Ukraine conflict have weighed on supply chains. Supply chain issues intensified in April but eased in May, according to the Federal Reserve Bank of New York's Global Supply Chain Pressure Index.

"They're getting hit from the macro consequences of Ukraine," said Robert Fry, chief economist for Robert Fry Economics LLC.

The struggle to find workers is also holding back production. Manufacturers in the U.S., Canada and Japan that want to expand factories, add more shifts or replace retiring workers are struggling to staff their operations, said Michael Hicks, who directs the Center for Business and Economic Research at Ball State University, Muncie, Ind. But the biggest factor weighing on the sector is the Fed's effort to fight inflation, which will make it more expensive to finance operations and will temper demand, Hicks said.

"Just as we think we were coming out of the supply chain problems, interest rates start rising," Hicks said.

Housing cooldown

The cooling housing market is more bad news for manufacturers, experts said.

If prospective buyers cannot find an affordable home, either because the asking price is too steep or interest rates climb too high, they may pull back on spending in other areas as they try to build their savings. If homebuilders take a hit from a softer housing market, the effects will be felt across the economy.

There have been five defaults in the homebuilders and real estate sector so far this year, according to S&P Global Ratings. Housing demand continued to slow in April with new home sales in the U.S. declining for the fourth straight month, according to Oxford Economics.

With the potential for a recession looming as the Fed aims for a so-called softish landing, more pain will be in store for manufacturers. A softish landing would mean a U.S. economy that continues to grow but very slowly as the manufacturing and new home construction sectors shrink, Hicks said.

"The complexity of any economy, not just ours today, makes engineering monetary policy for a soft landing just very difficult," Hicks said. "I don't think American consumers or producers ought to get their hopes up."