More branch consolidation is on the way for Truist Financial Corp., as the company has closed less than one-quarter of the locations it planned to shutter. The planned closures are mostly due to overlap created through the combination of BB&T Corp. and SunTrust Banks Inc.

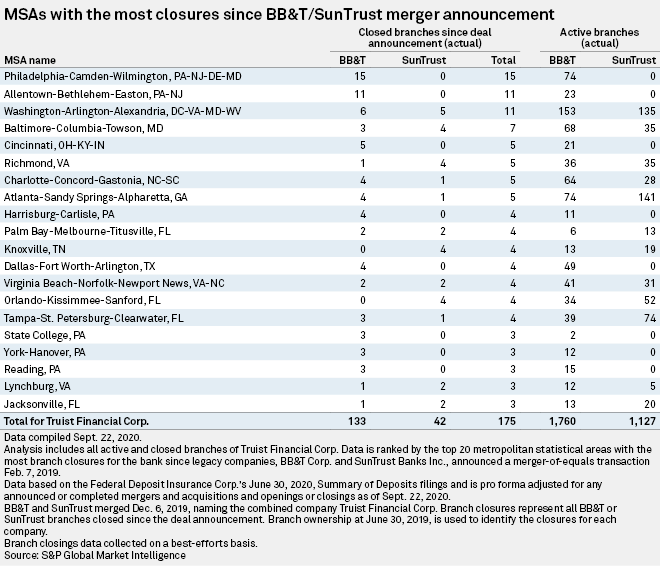

Since announcing their merger of equals on Feb. 7, 2019, BB&T and SunTrust have closed a combined 175 branches. That total represents about 22% of the 800 branches Truist estimates it will close, according to a presentation by the company at the Barclays Global Financial Services Conference on Sept. 15.

"With our merger of equals, there are a number of branches in close proximity which provide natural opportunities to consolidate and very little disruption for our clients," a spokesperson for the company wrote in an email.

But Truist agreed to not shut the branches right away. As part of the merger agreement with regulators, Truist committed to not closing the majority of overlapping branches until one year from closing, Chairman and CEO Kelly King said at an investor conference on Dec. 10, 2019. That date is approaching, as the MOE closed Dec. 6, 2019.

"You won't see a crescendo of branch closings right away," King said at the December 2019 event. "But we will be well-planned and ready so that there will be substantial opportunities to consolidate and reduce cost and improve service quality in that [one] year kind of time frame."

In an effort to smooth the transition of merging branches and minimize customer disruption, Truist is opening "blended branches" in November that will offer SunTrust and BB&T services, according to a company spokesperson. The spokesperson added that the transition to the full Truist client experience will not happen until 2022.

"These blended branches are located very close to other branches — often in the same parking lot or next door," the spokesperson said in the statement.

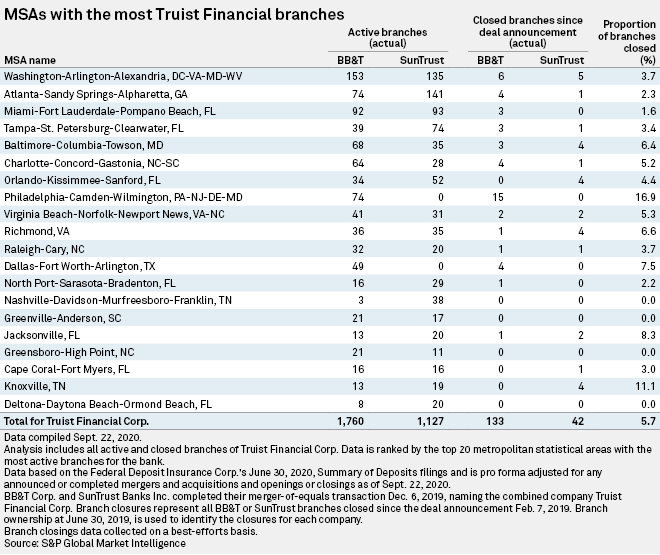

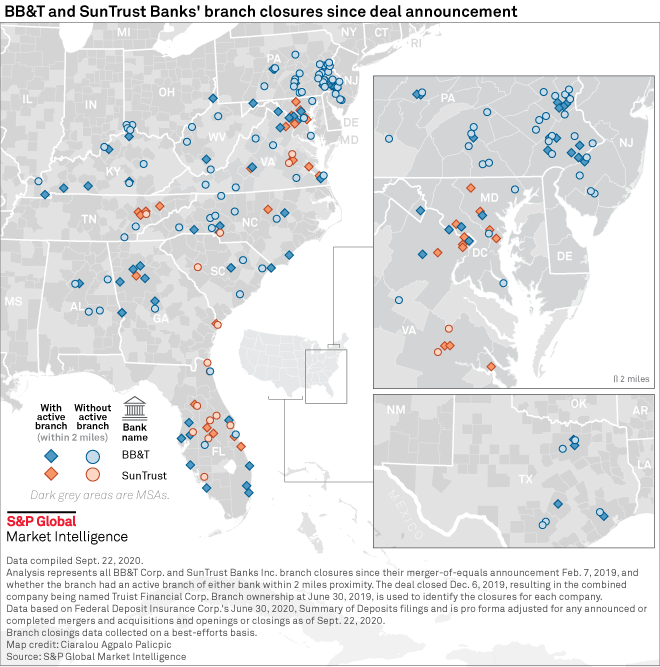

Of the closures that have taken place, BB&T branches made up 76%. Almost half of the closures had an active branch of either BB&T or SunTrust within two miles. Even after cutting 7.0% of its network following the deal announcement, BB&T still has more branches, with 1,760, than SunTrust, which has reduced its branch count by 3.6% to 1,127 locations as of Sept. 22.

In markets where both banks have a presence, the Washington, D.C., and Baltimore metro areas saw the highest number of closures with 11 and seven, respectively. Philadelphia is the metro area that has seen the most branch closures with 15, but SunTrust was not in that market. The Richmond-Berea, Ky., metro area is one market left with no Truist branch after the closure of the only BB&T branch.

For many banks, changing customer behaviors and digital transformation are having an impact on branch decisions, and King acknowledged that ongoing industry trend may affect his company. As Truist delivers more services digitally, it could reduce brick-and-mortar costs through branch and backroom support facility reductions, King said at the Barclays conference.

"When we laid out the net $1.6 billion, that was, of course, long before COVID, and so we feel good about that given the kind of steady state of what we were seeing," he said about the expected cost saves from the deal. "But to be honest, as you think about COVID and the changes that we expect coming out of that, there could easily be more changes."

Still, the Truist spokesperson noted that branches will remain an important part of the company's customer experience. Truist plans to enhance its digital and in-branch technology capabilities.

"As consumers and businesses rely more heavily on online and mobile channels, we are focused on ensuring our digital client experience complements the personal touch provided by the teammates in our branches," the spokesperson said.