Loan-to-deposit ratios at China's largest lenders climbed in the nine months ended Sept. 30, as interest rate cuts hit deposit growth.

Declining interest rates led to lenders' deposit growth trailing their loan growth, which drove a year-over-year increase in loan-to-deposit ratios (LDRs) at nine of the 13 largest Chinese banks by assets, S&P Global Market Intelligence data shows. All five of the largest Chinese banks logged year-over-year LDR increases, the data showed.

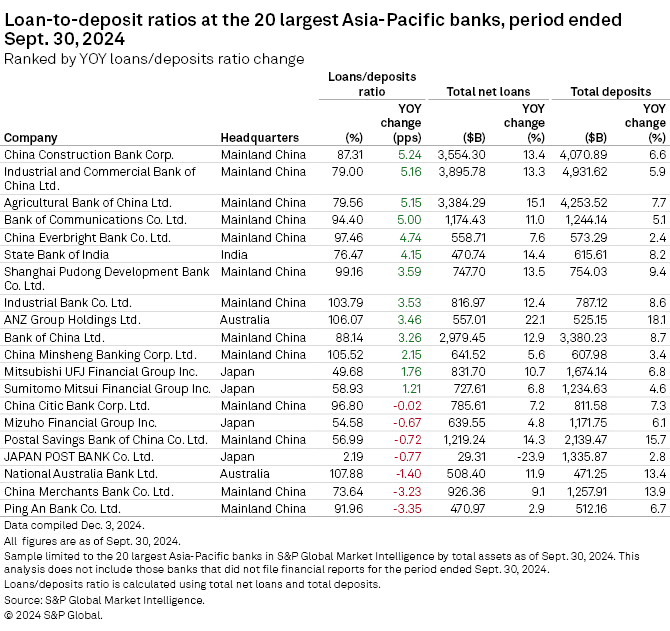

China Construction Bank Corp. posted the biggest yearly LDR increase, climbing 5.24 percentage points to 87.31% as of Sept. 30, the Market Intelligence data shows. The bank's total net loans increased 13.4% to $3.554 trillion from a year prior, while its total deposits grew 6.6% to $4.071 trillion in the same period.

Loan-to-deposit ratios, used to assess a bank's liquidity, are calculated by dividing lenders' total loans by their total deposits over the same period. A higher LDR indicates increased risk and lower liquidity.

"Deposit outlooks remain weak as China continues to cut rates, as deposits will migrate to alternative financial products, pending economic confidence recovery," said Iris Tan, a senior equity analyst at Morningstar.

Banks' loan growth remained weak in October, while deposit growth marginally improved, with a recovery in stock market confidence and an increase in nonbank financial instructions' deposits driving the improvement, Tan said.

Even credit growth in China has been relatively muted so far this year amid government economic growth stimulus measures, which include support to the housing sector. Preliminary data shows aggregate financing flow to the real economy was 25.66 trillion yuan in the first three quarters of the year, down 3.68 trillion yuan from the same period of 2023, the People's Bank of China said Oct. 14. Yuan loans increased 15.39 trillion yuan, though this was 4.13 trillion yuan smaller than the increase in the same period of 2023.

Deposits lag

Industrial and Commercial Bank of China Ltd. — the world's largest lender by assets — saw its LDR grow 5.16 pps year over year to 79% as of the end of September. China Minsheng Banking Corp. Ltd.'s LDR of 105.52% was the highest among the Chinese banks.

Despite the LDR increases, analysts expect interest rate cuts and government stimulus measures to filter down to banks' operating metrics.

"Combined with plans to recapitalize banks and expand the re-lending program designed to facilitate bank lending to [state-owned enterprises] for real estate acquisition, there is some positive news for Chinese banks which have been facing notable challenges from narrowing net interest margins," ING said in an Oct. 14 note.

ING expects the People's Bank of China to cut rates by 20 basis points to 30 bps in 2025 — and potentially more if US tariffs come in earlier or higher than anticipated.

Elsewhere in APAC

Two of the three Japanese megabanks — Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. — recorded modest year-over-year LDR increases during the period, with loans expanding faster than deposits, according to Market Intelligence data. Mitsubishi UFJ Financial's ratio rose 1.76 pps to 49.68%, while Sumitomo Mitsui Financial's climbed 1.21 pps to 58.93% as of Sept. 30.

Mizuho Financial Group Inc. — the third megabank in Japan — saw its LDR improve 0.67 pps to 54.58%, with its deposits growing 6.1% — higher than its 4.8% loan growth.

Australia-based ANZ Group Holdings Ltd.'s LDR increased 3.46 pps to 106.07%, while National Australia Bank Ltd.'s ratio dropped 1.40 pps to 107.88%. This was the highest LDR among the region's 20 largest banks by assets.

State Bank of India, the lone Indian bank in the Market Intelligence list, saw its ratio rise 4.15 pps to 76.47% as of Sept. 30. Its loans expanded 14.4% year over year, while deposits grew 8.2%.