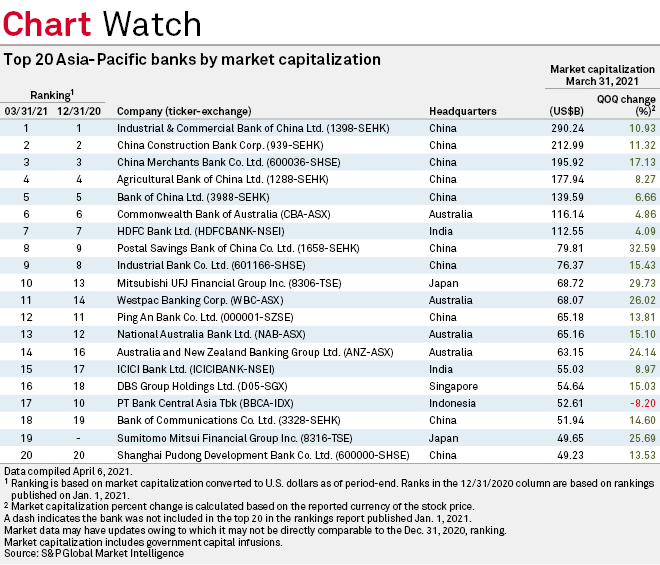

All but one of the 20 largest banks in Asia-Pacific saw growth in their market capitalization during the quarter ended March 31, continuing the momentum from the previous quarter, as economic recovery from the COVID-19 pandemic persisted across the region.

Industrial & Commercial Bank of China Ltd. retained its top slot on the ranking list in the quarter after recording a 10.93% quarter-over-quarter growth in market cap to $290.24 billion, according to data compiled by S&P Global Market Intelligence. China Construction Bank Corp., China Merchants Bank Co. Ltd., Agricultural Bank of China Ltd. and Bank of China Ltd. saw their market cap grow 11.32%, 17.13%, 8.27% and 6.66%, respectively, and kept their positions on the list.

Postal Savings Bank of China Co. Ltd. posted the highest gain with a 32.59% increase and climbed to eighth spot with a market cap of $79.81 billion.

The stock prices of Chinese banks rose during the quarter amid improving sentiments for the country's economic recovery, as well as bank earnings, margins and lending growth in 2021. Bank stocks in China struggled for most of 2020 amid an economic slowdown and uncertainties brought by the pandemic. Things started picking up later in the year as markets and businesses gradually started opening up after months in lockdown to contain the virus.

The increases in banks' stocks were broadly in line with the performance of their stock markets in the first quarter. The Hang Seng Index rose 4.21%, the S&P/ASX 200 grew 3.09% and Japan's TOPIX Index climbed 8.27% during the quarter. The SSE Composite Index, meanwhile, fell 0.90% to 3,441.91 as of the March 31 close from 3,473.07 at 2020-end.

"Banks' share prices have performed well, underpinned by rising bond yields and inflation expectations," said Rui Wen Lim, equity research analyst at DBS Bank. "We remain constructive on the longer term outlook for Asian bank stocks, as banks remain key proxies to a recovering economy, amidst a steepening yield curve."

Lim also expects better loan growth for Asian banks on resumption of economic activities and the ongoing investments to diversify supply chains. In the near term though, "we continue to be watchful on the extent of restructured loans that require extension and expect banks to continue to recognize weak credits as nonperforming loans," the analyst added.

Japan's Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. recorded 29.73% and 25.69% growth in their market cap, respectively, while Australia's Westpac Banking Corp. and Australia and New Zealand Banking Group Ltd. were among banks that logged over 20% quarter-over-quarter increases in their market cap during the quarter.

Indonesia's PT Bank Central Asia Tbk, meanwhile, was the only lender on the list that saw a decline in its market cap, falling 8.20% to $52.61 billion.