A bill that would require the pension program for Maine state employees to divest itself of the stocks of fossil fuel producers, coal utilities and infrastructure builders over the next five years is waiting for the governor's signature before becoming law.

As of June 10, Democratic Gov. Janet Mills had not said whether she will sign the bill or veto it. The measure passed the Democratic-controlled House and Senate on largely party-line votes.

|

The executive director of the Maine Public Employees Retirement System, or MainePERS, opposed the measure, saying it would violate the fund's purpose — to earn money for current and future retirees — while doing little to affect climate change.

"Divestment does not change the climate," MainePERS Executive Director Sandra Matheson told the state Senate in written testimony in February. "The only real impact making a statement of principle might have is to create a newspaper headline which in turn might further elevate the discussion around climate change. Using the trust fund to make a headline for a cause, however, violates both our fiduciary duty and the Constitution."

Environmentalists said the statement could make a difference. "Divesting sends a truly powerful message, and to have Augusta join in adds real weight," Bill McKibben, founder of environmental group 350.org, said in a statement. "This action is a gift to the planet — and also to the pensioners of the Pine Tree State, freeing them from the money-losing investments in gas and oil."

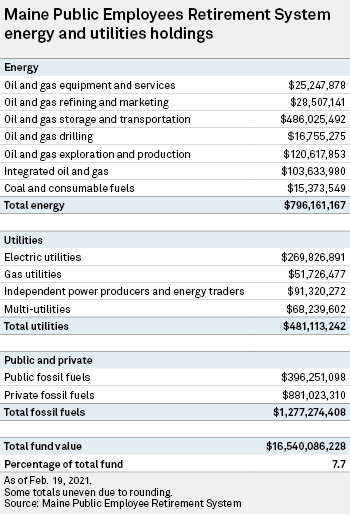

According to fund data, nearly $1.3 billion, or about 7.7%, of its $16.5 billion in assets at the end of 2020 were invested in fossil fuel producers and utilities. State retirement managers are not actively picking stocks, Matheson said in written testimony. Instead, part of the fund's assets are invested in directly-owned shares reflecting the Russell 3000 Index, while the rest — the majority of the assets — are invested with private fund managers that are judged on performance.

The bill would require the state retirement program to sell stocks in the largest 200 publicly traded fossil fuel companies as judged by the size of their reserves as well as any stock in the 30 largest utilities using coal for power. The bill also directs the fund to divest itself of any companies that build or operate fossil fuel infrastructure.

That money could be reinvested in renewable resources with a better return, according to Sierra Club Maine Executive Committee member David Gibson. "With the freed-up funds, the pension fund can invest in climate solutions, doing double duty of earning profits for the fund while safeguarding our future," Gibson said in a statement.

If the state sheds its shares in fossil fuel companies, it would lose the ability to direct them to reduce carbon emissions, Matheson testified. "As stock owners, we can use our voice to further advocate for corporate transparency and responsibility on climate," Matheson said. "This type of advocacy, called engagement, is in the best interest of everyone, including our members and retirees."