NEXTracker Inc. has begun integrating flow batteries into solar arrays, including this one in northern China. |

After numerous false starts, bankruptcies and billions of dollars invested, developers of alternatives to lithium-ion batteries for electricity storage believe that a new window of opportunity is opening. This renewed optimism is fueled by maturing battery and nonbattery technologies, some limited commercial successes, demand for longer-duration storage, and growing concerns around the safety and supply chain risks of the incumbent chemistry.

Pointing to a recent major fire at a 2-MW lithium-ion battery system in Arizona, the state's second such incident, Arizona Corporation Commission member Sandra Kennedy said in an Aug. 2 regulatory filing that the technology carried "unacceptable hazards and risks." Kennedy urged the state to explore available alternatives "that are far more sustainable and do not have these risks."

Project owner Arizona Public Service Co., utility subsidiary of Pinnacle West Capital Corp., disclosed Aug. 8 that it would delay its ambitious battery expansion plans to incorporate lessons from the accident. But the utility remains committed to adding energy storage resources, Pinnacle West's CEO said, perhaps creating an opening for competitors.

"Lithium's not the only game in town," said Philippe Bouchard, senior vice president of startup Eos Energy Storage LLC. The New Jersey-headquartered developer of zinc-based batteries has raised nearly $100 million to commercialize its technology, culminating in recent installations in California and North Carolina.

The next step for the company is raising capital for a flagship manufacturing facility. "We have been preparing this scale-up for quite some time," Bouchard said.

Eos is among dozens of aspiring companies, from upstarts to industrial powerhouses, that are courting investors, utilities, project developers and others to catapult them into competition with lithium-ion leaders LG Chem Ltd., Samsung SDI Co. Ltd., Panasonic Corp. and Tesla Inc. While a few of these efforts have separated from the pack, experts remain skeptical of their near-term chances.

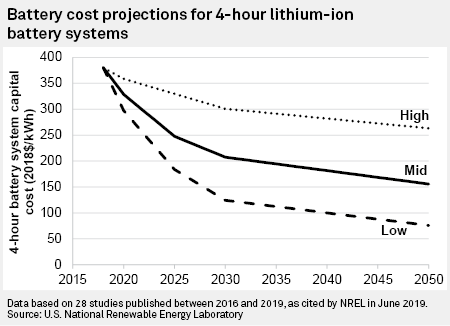

"There are a number of contenders to lithium-ion technology for power storage applications," said Felix Maire, a senior analyst at S&P Global Platts Analytics. "However, lithium-ion benefits from the massive scale of the electric vehicle market."

As lithium-ion battery-makers rapidly expand to meet rising demand for EVs, prices are plummeting and project developers are taking advantage. Platts Analytics expects an additional 40% drop in lithium-ion battery prices by 2025, making it harder for alternative technologies to compete.

The U.S. is on pace to add almost 10,000 MW of utility-scale battery storage by 2023, according to Platts Analytics' latest outlook, and Maire expects lithium-ion to remain dominant. Undeterred, developers of competing technologies are stepping up efforts to differentiate themselves with added capabilities including longer-lasting storage, which is widely seen as critical for deep decarbonization of power grids.

'The future of electrical storage'

Haresh Kamath, an energy storage expert at the Electric Power Research Institute, the primary research organization for U.S. utilities, agrees that the alternatives face long odds, noting the incumbent's high energy density, low cost and supply from "reputable companies who we know will be here tomorrow."

But Maire and Kamath do see potential for other technologies. Flow batteries, which charge and discharge using an electrolyte stored in large external tanks, offer greater operational flexibility, reduced degradation, lower safety risks and improved economics for some applications than lithium-ion systems, according to developers.

"We are going to be competitive right out of the box," said Richard Brody, director of energy storage sales and marketing at U.S. aerospace giant Lockheed Martin Corp., which plans to launch a flow battery commercially by 2021.

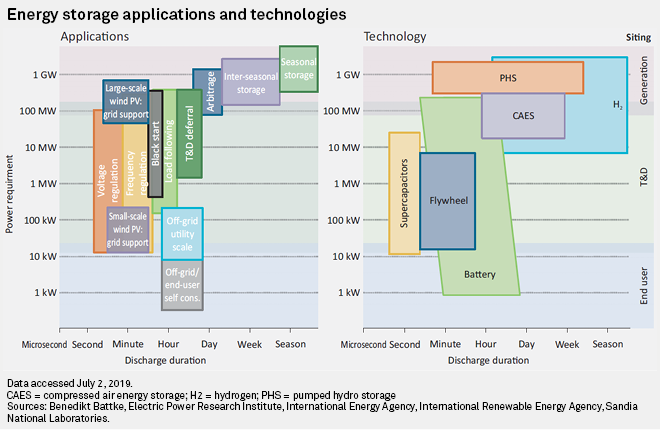

Lockheed is already in the storage market with third-party lithium-ion batteries but sees limitations. "The economics [of lithium-ion] start to break down when you get beyond applications requiring more than five hours of storage," Brody said in an interview. Lockheed plans to showcase the technology in pilot projects demonstrating eight to 10 hours of discharge ahead of its commercial debut.

The National Renewable Energy Laboratory recently identified 34,000 MW of U.S. market potential for eight-hour storage systems, a level that could grow with more variable wind and solar on the grid.

Germany's Schmid Group, Japan's Sumitomo Corp., and Oregon-based ESS Inc., a startup funded by chemicals company BASF SE, are also developing various types of flow batteries. Sumitomo worked with Sempra Energy to install a 2-MW system near San Diego that recently became the first big flow battery to participate in the California ISO's power markets. One grid official called it "the future of electrical storage."

NEXTracker Inc., a California subsidiary of Singapore-based manufacturing company Flex Ltd., has integrated so-called vanadium redox flow batteries from Avalon Battery Corp. into solar farms in Iowa and China. "If you are cycling on a daily basis, there is a really strong financial case for flow batteries," said David Stripling, NEXTracker's director of energy storage products.

RedT energy PLC, a vanadium flow startup traded on the London Stock Exchange's AIM index, in late July disclosed a series of steps that include qualifying for frequency response services in the U.K., advancing a planned 50-MW combined flow and lithium-ion battery project, and proposing to acquire Avalon Battery. The two companies said they have preliminary support from "a strong new strategic investor" and existing investors to inject at least $30 million into the merged business.

Lithium-ion variants

In some experts' view, the most likely alternative batteries to succeed in the next decade are not entirely new chemistries but variants of lithium-ion, such as lithium sulfur, that are "riding on developments" in consumer electronics and electric vehicles, according to Kamath.

Sodium-sulfur batteries, though more expensive than lithium-ion, are already commercially available, Kamath noted. Japan's NGK Insulators Ltd., a key technology developer, secured a global sales agreement with BASF SE in June after completing a 108-MW project in Abu Dhabi in January.

The technology "fits ideally to the requirements of the emerging market for long-duration energy storage systems," Frank Prechtl, a director at BASF New Business GmbH, said in a news release.

NGK, which said its batteries can discharge for six to seven hours, has delivered roughly 560 MW across more than 200 locations, mostly in Japan but also in the U.S.

Beyond batteries

As a growing number of U.S. states target very high levels of renewable energy, their grids may require days, weeks or months of energy storage, far surpassing the capabilities of conventional lithium-ion and other competing batteries.

Pumped hydroelectric storage is the most established long-duration technology, accounting for the vast majority of storage installed globally. New U.S. projects are advancing, including in Montana and Oregon. But environmental concerns and other development hurdles remain formidable barriers for most new pumped hydro proposals.

One "terribly underestimated" technology is compressed air, which relies on off-peak power to store air under high pressure in a reservoir, Kamath said. PowerSouth Energy Cooperative has operated the 110-MW McIntosh CAES facility in Alabama since 1991. But the only U.S. compressed air energy storage project built since then is the 1.5-MW Seabrook ICAES System Project in New Hampshire, according to S&P Global Market Intelligence data.

Another option is hydrogen, though "it's probably at least 15 to 20 years from commercial use as energy storage," Kamath said.

An ambitious project in Utah led by Mitsubishi Hitachi Power Systems Ltd. and Magnum Development LLC seeks to harness excess renewable energy in the West for a 1,000-MW energy storage project, relying on compressed air, hydrogen, flow batteries and solid-oxide fuel cells. Touted as the "world's largest renewable energy storage project," it has the backing of Utah Gov. Gary Herbert and a target completion date of around 2030.

The Utah project may never reach full build-out. But there is no question that utilities are seeking a diverse portfolio of systems for grid-scale storage.

Picking the right energy storage technology "depends on what your ultimate use case is," said Miguel Romero, director of growth and technology integration at San Diego Gas & Electric Co., a Sempra utility. Eventually, lithium-ion and its emerging competitors "will complement each other," Romero said.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.